Our Financial Status: Race Really Matters

Racial differences in workers’ finances are nothing less than shocking: whites have roughly six times more wealth than Latinos and black-Americans and double the income.

These age-old disparities will be as familiar to readers as they are to economists. But a clear and updated picture of their magnitude was presented in a recent study.

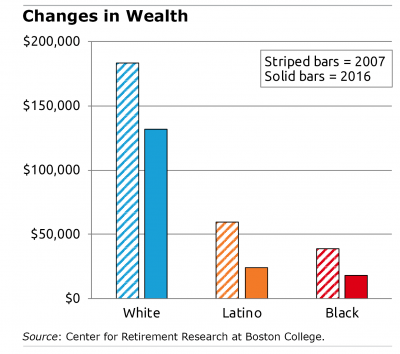

In 2016, U.S. household wealth, regardless of race, still had not rebounded to 2007 levels. But whites made a lot more progress climbing out of the hole created by the plunging stock market and housing crash that ushered in the 2008 recession.

The researchers examined changes in each group’s net worth over a decade. Pre-recession, white households had five times more wealth than blacks; this ratio grew to 7-to-1 in 2016. The white-Latino wealth ratio doubled from 3-to-1 to nearly 6-to-1.

The 2016 data are the most recent from the Federal Reserve’s triennial survey of American households’ personal finances.

The 2016 data are the most recent from the Federal Reserve’s triennial survey of American households’ personal finances.

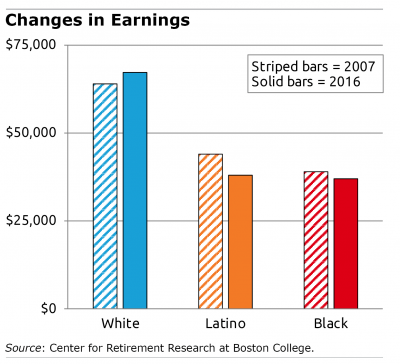

The earnings picture isn’t as dire but the gap is still large. White households are earning slightly more than they did in 2007, and blacks and Latinos are not. In 2016, white Americans had two times more income than either minority group.

Many factors, notably education, influence how well someone does. But, clearly, race does matter.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Is it race that matters or socio-economic status? Other studies have documented the shrinking middle-class and the widening gap between the haves and have-nots. I don’t want us to put our heads in the sand about race, but I do feel that solutions to help all the middle-class grow will have the best chances of acceptance.

There are many factors that contribute to this issue, and maybe race is one of them, but let’s not forget that 70% + of black children are born out of wedlock, that a very large percentage of black men have been, or are, incarcerated, and the education level attained by black Americans lags that of other racial groups.

If folks of any racial group want to grow their wealth the best way to begin is: (1) get an education, (2) get a job, (3) get married and stay married.

I don’t think that getting into a discussion about race and racism is appropriate here but I would humbly suggest that you watch the PBS series “Race: The Power of an Illusion” and read the book The New Jim Crow by Michelle Alexander to get a better understanding of the why behind the statistics you quote and why telling black Americans to just shape up is so inappropriate.

While socio-economic status matters, race is a key factor because minorities of color clearly have more obstacles to overcome such as student loan debt, lower starting salaries and less opportunity. Minorities have more ground to make up. It’s not that it can’t be done. It’s just harder. The playing field is not level but getting better. Other troubling factors are food deserts and health care delivery in majority minority communities. Sadly, gentrification cures this.

Lots of thoughtful comment here.

Though some are hesitant to discuss these racial topics, what a few have cited is right on target. What we typically refer to as the “success sequence” is critical to individual financial success.

We all know about the “success sequence” – the idea that the ticket to success is to keep things in order: graduate high school, don’t commit crimes, stay off drugs, don’t get pregnant early, have kids only after getting post-secondary education, get a job, and then get married.

Nothing in life is guaranteed of course, but following these sequential concepts will drive success and help address the root causes of individuals’ attainment wealth, income, net worth, etc. – no matter the race.

As a black man (and former mayor of my city), I see these concepts not being embraced by communities, not being embraced by those in power (either elected or community leaders), and not written about much by writers (perhaps because it wouldn’t sell).

But, when I look at the clusters of minorities in communities around the country who (perhaps by chance, rather than intent) have done these things that lead to success – like with blacks in my community as just one example – I see fantastic results: high school graduation rate – 98.7%, bachelors degree or higher – 58.9%, etc…

One significant outcome of these “success sequence” of factors is that the black population in my community has a higher level of household income than any other demographic (scroll down to the section titled “median household income by race): http://www.usa.com/beavercreek-oh-income-and-careers.htm

These desirable outcomes can be accomplished nationwide if the narrative regarding “race does matter” changes and is considered being more of a correlation due to individual choices that are made (or not made), rather than a causation implying “due to race.”

Success is within the reach of all of us; no exceptions.

A most insightful and powerful comment. It’s quite unfortunate that, as you said, these concepts not being embraced by communities, not being embraced by those in power (either elected or community leaders), and not written about much by writers.

As you noted, individual choices, both made and not made, often have significant and lasting consequences when it comes to long term financial well being. It’s a shame that this fact isn’t recognized and discussed more frequently.

Promoting and modeling that message has the potential to dramatically improve the financial outcomes of individuals who hear it and are motivated to make better choices.

In the long run it can mean the difference between financial success or financial failure. As such, it’s really critical that more people understand the importance of their daily decisions and are encouraged to choose wisely as they live out their lives.

We want as many people as possible to be financially successful, and to have happy and personally satisfying lives.

The problems of poverty and discrimination require a variety of solutions.

Yes, it is wise to get a good education, get a good job, seek to advance in that job or seek a better one, get married, love and inspire your children, save your money, participate in civic matters, etc.

But we still have a racism problem. For example: Did you see Sec. Mnuchin in a hearing chaired by Cong. Walters? He could be paraphrased as saying, “You are black and female, so I do not have to listen to you. I must instruct you.”

His problem seems to have been that — although she had excused him because of a conflicting appointment — he wanted the entire hearing to be dismissed, apparently because he thought he was so important that the hearing could not go on without him.

Is this a fair comparison? The one issue that is often overlooked is the access to these services. Segregation legally ended in 1968, so blacks only had the ability to access professional financial services over the past 51 years. I think it’s safe to say that the generation coming up through the early and mid-1900s would have never sought out professional financial services so that realistically leaves a generation, maybe two, that have truly had the ability to use professional financial services.

To Brian comments: How, and why, did “these “success sequence of factors” become paramount/commonplace in your city and could it be duplicated in most cities? This was/is not a common situation and just talking about race and “success factors” will entail a long journey. I have seen racism up close, and poverty as well. No easy solutions.

To Gene’s comments: just getting access to professional services or using professional services does not bring financial success. Examples abound. Your use of “ability to use” must include teaching and safeguards under gird with values training. A lot implied. Again, not a “get rich quick” scheme but doable.

I have a draft proposal to try to do that but I’m now too old to implement it, and earlier no one wanted to listen. Well, one woman did who saw the potential and broke down crying, but the others did not want to run it as it would take commitment and connections. One man said he would raise $500,000 – if I could find that leader. Didn’t.

Too bad as it would work…in time. As Brian said,”success is within the reach of all of us; no exceptions.” He’s right, but…