Older Americans Increasingly Vulnerable to Rising Rents

As the nation was emerging from the pandemic, rents exploded. Two years later, the pressure on rents is starting to ease in response to an increase in multifamily construction, including apartment buildings.

But the COVID-era surge continues to haunt renters, who are paying about 20 percent more than they did in 2019, though healthy wage increases in recent years offset some of that.

The nation is in the grips of “an unprecedented affordability crisis,” Harvard’s Joint Center for Housing Studies concludes in its new report. The center estimates that about half of U.S. renters – some 22 million households – spent at least 30 percent of their income on rental housing in 2022. That’s the highest share in over a decade. About 12 million of them spent more than half their income on housing.

A related trend detected by Harvard’s housing center last year is concerning for future retirees: declining homeownership among older workers that will expose growing numbers of them to rising rents when they retire.

Any homeowner will tell you a big advantage they have over renters is that the payments on a fixed-rate mortgage don’t increase. Rents do and, as we’ve seen recently, sometimes by a lot. Rising rents are particularly a strain on retirees since they have less income than when they were working.

Another bonus of homeownership is that it’s a form of forced retirement saving. Every mortgage payment adds a little bit to home equity, which is money retirees can use to supplement their income. They have so far been reluctant to tap that money. But it is, nevertheless, a source of wealth that’s available to them.

To the extent that homeownership is a form of retirement wealth, things seem to be heading in the wrong direction.

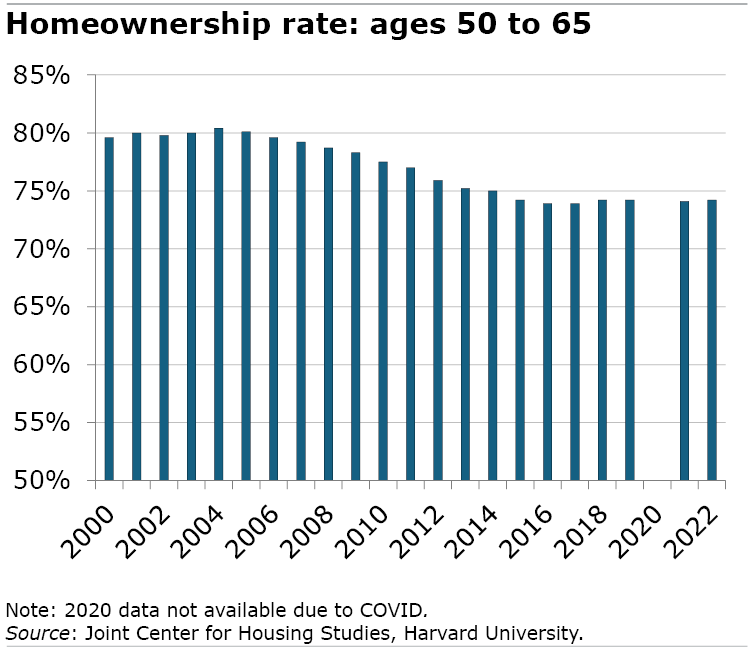

Two decades ago, homeownership among 50- to 65-year-olds – mostly boomers – hit an all-time high of 80 percent, the housing center reports. And then the Great Recession happened, and homeownership started dropping. Today, 74 percent of older workers own their homes.

That downward trend “likely foreshadows lower homeownership rates for older adults in the future,” the center predicted.

If that prediction is right, the absence of this major source of wealth can only mean the need for affordable rental housing for retirees that the center has warned about for years will continue to grow.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

I certainly agree with the concern about declining rates of home ownership and particularly as it relates to longevity risk. At the same time, the cost of homeowner (and auto) insurance has increased significantly since 2022. And more homeowners are finding themselves in areas that were not considered to be in flood prone areas. CT and NC recently had 1-1000 year storms which resulted in significant property damage (and loss of life). This reality involves more than coastal states. Wildfire is another peril that is broader than just the west/southwest resulting in higher insurance premiums.

I’m delighted to see you are still creating outstanding work. Suggest you might “review” the value of website http://www.investor.gov

Or investor.gov and recommend it to your readers.

I like the site because you can determine results after subtracting fees or both fees and inflation. I continue to be amazed at how ignorant folks are regarding the impact of fees over their investing lifetime. It may seem just a tiny bit in the first few years, but in a lifetime—fees could wipe out up to 70%….In the words of John Bogle.

Site. Provides Nifty calculator among many other useful hotlinks.

Sincerely,