Filter

Walk? Yes! But Not 10,000 Steps a Day

A few of my friends who’ve recently retired decided to start walking more, sometimes for an hour or more a day. Becoming sedentary seems to be a danger in retirement, when life can slow down, and medical research has documented the myriad health benefits of physical activity. To enjoy the benefits from walking – weight loss, heart health, more independence in old age, and even a longer life – medical experts and fitness gurus often recommend that people shoot for 10,000 steps per day. But what’s the point of a goal if it’s unrealistic? A Centers for Disease Control study that gave middle-aged people a pedometer to record their activity found that “the 10,000-step recommendation for daily exercise was considered…

August 15, 2019

Fewer Contingent Workers Seek SSDI

The vast majority of so-called contingent workers – think Lyft drivers, AirBnB hosts, independent contractors, consultants, and freelancers – have built up the work history necessary to apply for federal disability benefits if they become injured. The 86 percent coverage rate for contingent workers in their 50s and early 60s is less than the 92 percent for regular workers – but not by much. Despite their relatively high rates of eligibility, however, older contingent workers are significantly less likely to end up on Social Security Disability Insurance (SSDI) than similar workers in traditional jobs, according to a new study by the Center for Retirement Research. This finding is mainly driven by contingent workers’ lower application rates for SSDI. Applications ar…

August 13, 2019

For Family, Caregiving is a Choice

Francey Jesson’s life took a dramatic turn in 2014 when she lost her job at Santa Fe, New Mexico’s airport after a dispute with the city. In 2015, she relocated to Sarasota, Florida to be close to her family. One day, her mother, who has dementia, started crying over the telephone. Jesson had always known she would be her mother’s caregiver, and that time had arrived. She and her brother combined resources and bought a house in Sarasota, and Jesson and her mother moved in. “It wasn’t difficult to decide. What was difficult was everything that came with it,” she said. One reason for the rocky adjustment was that Jesson, who is single, had been preparing herself mentally to tak…

August 8, 2019

People in their Prime are Working Less

The decline in Americans’ labor force activity started around the year 2000 and accelerated after the 2008-2009 recession. Labor force participation is now at its lowest level since the 1970s. The main reason for the drop is our aging population. But the news in a systematic review of current research in this area is a more troubling trend that’s also driving it: people in their prime working years – ages 25 through 54 – are falling out of the labor force. Prime-age men are the most active members of the labor force. Yet in 2017, only 89.1 percent of them were either working or seeking a job, down from 91.5 percent in 2000, according to the review by University of…

August 6, 2019

A Proposal to Fill Your Retirement Gap

David and Debra S. both had successful careers. In analyzing their retirement finances, the couple agreed that he should wait until age 70 to start his Social Security in order to get the largest monthly benefit. But he wanted to sell his business at age 69 and retire then, so the North Carolina couple used their savings to cover some expenses over the next year. Waiting until 70 – the latest claiming age under Social Security’s rules – accomplished two things. In addition to ensuring David gets the maximum benefit, waiting guaranteed that Debra, who retired a few years ago, at 62, would receive the maximum survivor benefit if David were to die first. Other baby boomers might want to…

August 1, 2019

Why are White Americans’ Deaths Rising?

Rarely does academic research make a splash with the general public like this did. A grim 2015 study, prominently displayed in The New York Times, showed death rates increasing among middle-aged white Americans and blamed so-called “deaths of despair” like opioid addiction, suicide, and liver disease. Rising mortality, especially for white people with low levels of education, ran counter to the falling death rates the researchers found for Hispanic and black Americans. The husband and wife team who did the study proposed that “economic insecurity” might be an avenue for research into the root cause of white Americans’ deaths of despair. A 2018 study took up where they left off and found a connection between economic conditions and some types…

July 30, 2019

1 of 3 in Bankruptcy Have College Debt

One thing bankruptcy won’t fix is college debt, which – in contrast to credit cards – can’t usually be discharged by the courts. One in three low-income people who have filed for bankruptcy protection from their creditors have student loans and face this predicament, according to LendEdu, a financial website. The debt relief they can get from the courts is very limited, because the aggregate value of their non-dischargeable college loans is almost equal in value to all of their other debts combined, including credit cards, medical bills, and car loans. Under these circumstances, a bankruptcy filing “does not sound like a financial restart,” said Mike Brown, a LendEdu blogger. Although LendEdu analyzed data for low-income bankruptcy filers, the court’s…

July 25, 2019

Expect Widows’ Poverty to Keep Falling

The poverty rate for widows has gone down over the past 20 years. This trend will probably continue for the foreseeable future. Women face the risk of slipping into poverty when a husband’s death triggers a drop in retirement income from Social Security and a pension (if he had one). But beginning in the 1970s and 1980s, women moved into the nation’s workplaces at an unprecedented pace. Women now make up nearly half of the labor force and are more educated, which means better jobs – and better odds of having their own employer retirement plan. As a result, they have become increasingly financially independent. This trend of greater independence is now showing up among older women. Widows between ages…

July 23, 2019

Why Americans Can’t Come Up with $400

In Beavercreek, Ohio, the cleanup from a recent tornado has begun. But debris is still piled high on many residents’ lawns. “What we’re seeing following this tornado is people not having enough cash to pay upfront for house debris removal even though insurance companies will reimburse them,” former mayor Brian Jarvis said on Twitter. The debris cleanup comes on top of other costs like temporary housing in this city east of Dayton. Much was made recently of a survey in which four of every 10 American families said they could not cover an unexpected $400 expense. But no one explained why. New research has some answers. Even when people have $400 in their checking or savings accounts, they don’t always…

July 18, 2019

Spotlight on Our Research, Aug. 1-2

Topics for this year’s Retirement and Disability Research Consortium meeting include the opioid crisis, retirement wealth inequality over several decades, trends in Social Security’s disability program, and the impacts of payday loans, college debt, and mortgages on household finances. Researchers from around the country will present their findings at the annual meeting in Washington, D.C. Anyone with an interest in retirement and disability policy is welcome. Registration will be open through Monday, July 29. For those unable to attend, the event will be live-streamed. The agenda lists all of the studies. Here are a few: Why are 401(k)/IRA Balances Substantially Below Potential? The Impacts of Payday Loan Use on the Financial Well-being of OASDI and SSI Beneficiaries The Causes and Consequences…

July 16, 2019

Video: Retirement Prep 101

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably. This 17-minute video might be just the ticket for them. Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing. While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc. Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But…

July 11, 2019

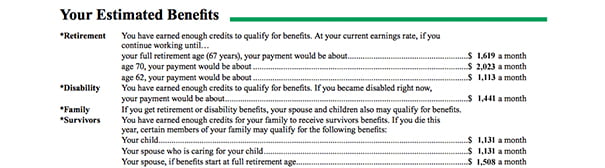

Social Security Statement Has Impact

When a Social Security statement comes in the mail, most people do not, as one might suspect, throw it on the pile of envelopes. They actually open it up and read it. But are they absorbing the statements’ detailed estimates of how much money they’ll get from Social Security? RAND researcher Philip Armour tested this and found that the statement does, in fact, prompt people to stop and think about retirement: workers said their behavior and perceptions of the program changed after seeing the statement of their benefits. The study was made possible after Social Security introduced a new system for mailing out statements. Workers used to get them in the mail every year. In 2011, the government took a…