Filter

Age Discrimination Affects Women More

Some people might plan to work well into their 60s if they can’t afford to retire, or if they just think they’ll be around a long time. But this strategy is more difficult for women to execute than for men. A study of employer discrimination in hiring found “strong and robust” evidence that female job applicants in their mid-60s were much less likely to be called in for interviews for low-skill jobs than were younger women. Evidence of age discrimination among older men was more mixed, or even non-existent in one occupation. “It seems there was age discrimination for women – no matter what,” said Patrick Button, an economist at Tulane University. To conduct their meticulously designed study, the researchers…

December 8, 2015

Is Betting on Fantasy Sports Addicting?

“The best adrenaline rush ever,” says one of the barrage of fantasy sports commercials broadcast into living rooms this football season. An adrenaline rush is known to be a hallmark of addiction to other types of gambling, which can trigger the brain’s pleasure center much like the triggers in a drug addict’s brain, according to University of Cambridge psychologists. Hundreds of thousands, perhaps millions, of Americans are playing fantasy football and other sports online for money. The Internet has made this so accessible that it could facilitate the rapid-fire betting associated with problematic gambling. Playing fantasy sports is “as easy as ordering a pizza online … [or] texting your friends,” a relapsed gambler told the New York Times. He said…

December 3, 2015

What Derails a Planned Retirement Date

Workers are feeling very ambitious these days: one in three plans to retire after age 65. In the 1990s, just one in 10 did. In reality, though, many older Americans today are retiring before they’d planned, resulting in lower monthly Social Security checks, slimmer 401(k) accounts, and more golden years to pay for. There’s no shortage of research looking into what derails these plans. But, for the first time, a new study ran a statistical horse race among the various reasons known to impact older workers’ decisions. Health issues finished first in the race, followed by layoffs, and a spouse’s early retirement. In an ideal world, eliminating these major shocks, along with a few less prevalent shocks that were also analyzed,…

December 1, 2015

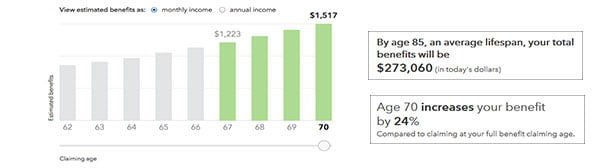

Social Security Delay: the Value to You

What matters most in retirement is how much money comes in the door every single month. That’s why this blog – and its sponsor, the Center for Retirement Research – hammers away at the wisdom of delaying when you sign up for Social Security in order to increase the size of your monthly checks. So here’s a very quick project for the long Thanksgiving weekend: insert your birthday and earnings into this new online tool to get an anonymous, back-of-the-envelope estimate of how much a delay is worth to you. The age you claim your benefits is crucial, because two out of three households rely on Social Security benefits for more than half of their retirement income. Yet the majority…

November 24, 2015

Listen to Your Elders Please

People do not like to hear advice from their “elders.” But shouldn’t retirement be an obvious exception? The options for what most workers can do to salvage their retirement finances rapidly narrow as they get closer to retiring. After 50 or so, it’s also tough to find a better job, and only so much can be saved in short bursts – retirement saving requires years of diligence. If you’re still listening, the following is sage advice drawn from two recent New York Life surveys of older workers on the cusp of retirement and octogenarians. Workers in their 50s and early 60s said they started saving too late for retirement. They put the “magic age” at around 26. Automatic savings vehicles…

November 19, 2015

Long-term Care Policyholders Who Lapse

In an upside-down aspect of long-term care insurance, about one in four older people with a policy who eventually go into a nursing home had let that policy lapse sometime in the previous four years, forfeiting coverage that would’ve paid for their care. The questions are who does this and why. New research by the Center for Retirement Research (CRR) finds two explanations for why: a scarcity of financial resources and cognitive impairment, which limits the elderly’s ability to properly manage their finances, including their long-term care policies. The researchers found no support for what they call “strategic lapsing” – a deliberate decision to quit paying the premiums by healthy older individuals who, upon reconsideration, conclude that their risk of…

November 17, 2015

Mortgage Payoff? Freedom vs the Math

Financial planner Diahann Lassus views as misguided the “obsession” some baby boomers have with paying off their mortgage before they retire. But Jane Rose, who has done just that with the loan on her home in Cherry Hill, New Jersey, has discovered how liberating it is. “I’m such a happy camper,” she said. The math versus the emotion, the rational versus the irrational, head versus heart – that’s a simple way of framing a complex issue. Many boomers looking ahead to their retirement years are grappling with whether to pay off their mortgage before they retire or shovel any spare funds into their employer’s 401(k). Both arguments have merit for very different reasons. First, the math. The alternative to paying…

November 12, 2015

Men Save More – Women Save Better

This will not surprise you: men have more money saved for retirement than women. Men averaged $123,262 in their defined contribution plans, compared with $79,572 for women, according to a new report by Vanguard based on its 2014 recordkeeping data. But these figures hide a larger truth: women are actually better at saving for retirement. “Overall, women are better at this but men earn more money so they have higher wealth accumulation,” says Vanguard researcher Jean Young, author of the new report, “Women versus Men in DC Plans.” Young’s research found that women are 14 percent more likely to enroll in a voluntary workplace retirement savings plan. Women save 7 percent of pay, compared with 6.8 percent for men, controlling…

November 10, 2015

Meaningful Work Improves Health

Older workers with jobs that give them a high degree of control and influence or a sense of achievement and independence tend to be healthier, new research finds. The specific benefits of these “psychosocial” aspects of work include lower blood pressure, musculoskeletal agility, better cognitive functioning and improved mental health. They’re equivalent to the health benefits associated with vigorous exercise three times a week, the study found. Researchers long ago established a strong connection between poor health and jobs requiring strenuous physical activity in harsh conditions. This new study looks at a wide array of psychosocial job characteristics increasingly relevant in the New Economy, as well as revisiting the grueling physical characteristics prevalent in the manufacturing-driven economy of the past…

November 5, 2015

5 Financial Goals for Teens, Young Adults

The above video qualifies as Personal Finance 101 – one critic dismissed it as nothing more than “common sense.” But that’s appropriate for the audience and worth sharing with teenagers and young adults in your life who are just starting on a financial path. The speaker, Alexa von Tobel (three years before she agreed to sell her online advisory company to a major insurance company for millions of dollars) provided common sense goals for people who get their money the old-fashioned way – one paycheck at a time. She proposed these five financial priorities (with minor alterations by Squared Away): Follow a budget. Have an emergency savings account. Strive to become debt-free. Pay credit cards in full. Negotiate your salary. Save for retirement to secure employer’s…

November 3, 2015

Fewer Boomers Get Social Security at 62

The best way for most individuals to increase their retirement income is by delaying Social Security – each year they wait significantly boosts their monthly benefit check. It seems that baby boomers are getting the message. The share of people who claim their Social Security benefits at age 62 – as soon as they’re eligible – is falling, and falling more rapidly than previously thought. The share of 62-year-old men who claimed immediately dropped from 56 percent in 1996 to 36 percent in 2013, according to the Center for Retirement Research, which supports this blog. For women with the same birth years, the share of 62-year-old claimers declined from 63 percent to 40 percent. The Center also confirmed that mor…

October 29, 2015

Health Insurance Costs Squeeze 401ks?

U.S. workers’ wages, adjusted for inflation, are stagnating, but their share of health care costs keeps going up. “Something has got to give, right? That something could very well be the 401(k) or 403(b) plan,” said Mark Zoril, a personal financial planner and benefits adviser to small companies. Six in 10 workers agreed: the rising cost of their health insurance “directly affects” how much they set aside in their retirement savings plan at work, according to a new survey gauging the “financial stress” of more than 2,000 full-time employees with health coverage. The random survey was conducted by LIMRA, a financial services research organization. Despite a slowdown in medical inflation, employees are paying a growing share of the tab for…