Filter

Retirement Saving: Excuses and Regrets

U.S. workers have a long list of reasons, many of them legitimate, for why they can’t come up with the money for a retirement savings plan. But here’s the rub: we live in a 401(k) world. Workers who aren’t convinced of the urgency of saving should listen to people who have already retired. Even though many current retirees have defined-benefit pensions, they have become largely unavailable to most people still working today. And these retirees say they’ve learned the hard way that saving is key. Excuses now and regrets later – these two takeaways came out of a nationally representative survey of workers and retirees by HSBC, a global financial institution. Saving for retirement is not a major priority for…

January 29, 2015

Inequality Fuels Drop-Out Rate

Education is the holy grail of success. But too many young men in this country don’t graduate high school, much less aspire to a college degree. It’s clear that completing high school improves one’s chances of moving up the economic ladder. So why doesn’t this incentive always work? At a time of greater attention to the nation’s widening inequality, new research supports the argument that income inequality may actually discourage disadvantaged low-income teenagers from finishing high school. The study examined whether there is a relationship between inequality and the drop-out rate, measuring inequality as the ratio of the lowest incomes in each state – the bottom 10 percent – to incomes in the middle. The study found that drop-out rates…

January 27, 2015

Winging It in Retirement?

Saving should be the centerpiece of any retirement plan today. But a new survey indicates that many Americans on the cusp of retiring have given little thought to the other key issues they’ll face in retirement. A majority of older Americans recently surveyed by the American College of Financial Services, an educational organization for financial professionals, said they have set a goal for how much money to save to “live comfortably” as retirees. And, when asked to assess their own progress, they feel they’re doing a good job of it. Granted, the survey was limited to a select group of about 1,000 people over age 60, all of whom have at least $100,000 in investable assets. But the financial risks…

January 22, 2015

Errors in Medical Bills Are Rife

Ever try to make sense of a medical bill, with its co-payments, cost-sharing, and government or insurance-company reimbursements that haven’t been paid yet? Hospital stays with multiple doctors and lab tests make billing even messier. These layers of complexity contribute to errors and confusion that can damage Americans’ credit ratings. Consumers “incur medical debts in collection without certainty about what they owe, to whom, when, or for what,” the federal Consumer Financial Protection Bureau (CFPB) reports. When a hospital or physician hasn’t been paid, they may, after trying to resolve the issue in-house, pass the unpaid bill to one or a series of collection agencies. Yet nearly one in four of the complaints consumers have made to CFPB about medica…

January 20, 2015

The Psychology of Fraud

What makes this AARP video about fraud compelling is that a few brave seniors were willing to discuss how they were cheated out of a few thousand dollars, $20,000, even $300,000. With the baby boom population aging at the same time that the Internet has become a haven for hackers, scammers, and invasions of privacy, experts predict that the incidence of online and other fraud against the elderly will continue to increase in coming years. Some researchers have begun to explore the topic of fraud and aging, with one recent study showing that people become more vulnerable to fraud as they age and experience natural cognitive decline. The seniors’ testimonials in the video, produced by the AARP Fraud Watch Network,…

January 15, 2015

Americans Cope with Income Swings

A full-time job that delivers a steady paycheck, week in and week out, is a luxury for many working people. Low- and middle-income adults are instead often whipsawed by wild swings in their incomes, finds a U.S. Financial Diaries project, based on detailed biweekly or monthly financial interviews with 235 urban and rural U.S. households nationwide. During the course of the year these interviews were conducted, the average household experienced four spikes or dips, defined as a change of at least 25 percent in their incomes. The Bloomberg video above explains that even when workers’ annual incomes are sufficient to cover annual expenses, these month-to-month fluctuations complicate how – or whether – they can save for their future. The incom…

January 13, 2015

Many in Dark About Their College Debt

A recent Brookings Institution report confirms for the first time how severely uninformed many college freshman are about the impact of the debts they’re taking on to fund their education. This isn’t entirely surprising. But with tuitions continually rising and students now often forced to borrow the equivalent of a house down payment by the time they graduate, the Brookings findings should serve as a wake-up call: Half of the full-time freshmen surveyed “seriously underestimated” how much they were borrowing. Among students known to have federal college loans, four out of 10 either said they didn’t have any federal loans or didn’t have any debt at all. According to the report, “Students who do not have a good idea of…

January 8, 2015

Fewer Need Long-term Care Insurance

Years of confinement to a nursing home is everyone’s worst fear for old age. With a semi-private room now costing about $81,000 annually, the prospect of a lengthy stay is also a popular reason for buying a long-term care insurance policy to cover it. Undercutting this rationale is a new study led by senior economist Anthony Webb of the Center for Retirement Research, which sponsors this blog. He finds that U.S. nursing home stays are relatively short: 11 months for the typical single man and 17 months for a single woman. There’s some unpleasant news in the study, too, because the risk that an older person may one day need nursing home care is 44 percent for men and 58…

January 6, 2015

What Readers Liked in 2014

Since you are the best judges of what financial information is most useful, it’s a holiday tradition to feature readers’ favorite articles published during the year. Please spread the word among family and friends about the most popular 2014 blogs, listed below, by “liking” Squared Away’s Facebook page. Readers can also sign up for emails of each week’s headlines. The articles are ranked in the order of their total page views: Retirees Live on Less. People who’ve already retired say adjustments are required to live on a smaller income. Retirement Delayed to Pay the Mortgage. Paying off the house tilts many baby boomers’ decisions. Retirement: a Good State of Mind. New research tries to resolve the conflicting evidence about whether…

December 23, 2014

Hunger: Unspoken Among the Elderly

Retirees in one Orlando-area community sustain a lively conversation about every topic under the Florida sun, a conversation that threads through their rounds of horseshoes, dinner dances at the club house, and senior yoga. But one subject must be handled with great discretion: hunger. Judy Cipra knows this, because she and her late husband, Fran Cipra, started, and she continues to operate, Fran’s Pantry to collect money and buy groceries for 18 seniors who struggle financially in the Palm Valley retirement community, where my mother also lives. “If you call me and you tell me that you need food, I don’t ask any questions,” Cipra said. “You just get it.” Cipra said people reliant solely on Social Security are often…

December 18, 2014

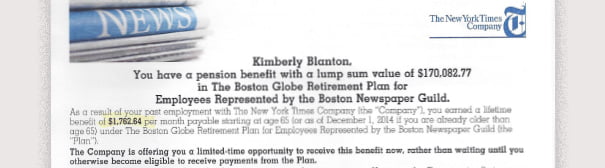

Evaluating a Pension Buyout Offer

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.” My 17-year employment as a Boston Globe reporter entitles me to a $1,762 monthly pension for life, starting at age 65. I’m 57 now. But a few weeks ago, the company put two alternatives on the table: take a smaller pension that starts now or trade my pension for a lump sum of $170,000 in cash. The deadline for accepting the new offer: the day after Christmas. The New York Times Co., which used to own t…

December 16, 2014

Widows Face More Financial Adversity

Two times more widows than widowers say their spouse’s death carried significant negative financial consequences during the first year after their loss. This sharp contrast recurred in numerous financial questions recently posed to widows and widowers by New York Life. The contrast also seemed to persist across various income levels, in questions revolving around both essential needs and luxuries. Here’s a sampling of answers given by nearly 900 Americans whose spouses have died sometime in the past decade: Their answers beg the question: Why the divergence? One reason is certainly that two-thirds of the widows surveyed reported their income was under $35,000, while a majority of the widowers earned more than that. Adults over age 18 were canvassed, so working…