Recession’s Hit to Cities Varies Widely

The COVID-19 recession is unlike anything this country has seen.

If the second-quarter contraction were to continue at the same pace for a full year, the economy would shrink by a third! This is the deepest downturn since the Great Depression, and low-income Americans are feeling the brunt of it.

What makes this recession unique, however, is that the low-income people living in the most affluent metropolitan areas are worse off than low-income residents of less affluent cities, Harvard economist Raj Chetty explained during a recent interview on Boston’s public radio station, WBUR.

What makes this recession unique, however, is that the low-income people living in the most affluent metropolitan areas are worse off than low-income residents of less affluent cities, Harvard economist Raj Chetty explained during a recent interview on Boston’s public radio station, WBUR.

“What’s going on is that affluent folks have the capacity to self-isolate, to work remotely, to not go on vacation,” he said. “So in affluent areas, you see enormous drops in consumer spending and business revenue.” In these areas, more than half of the lowest-income workers have lost their jobs, and many of them worked in small businesses, he said.

In less affluent cities, people have to go to work and “are out and about more, and business revenue hasn’t fallen nearly as much,” he told his radio host. “In previous recessions, we haven’t seen those sort of patterns.”

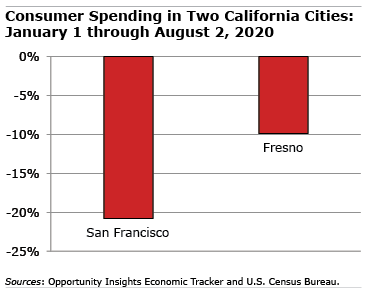

Chetty’s point is demonstrated by comparing what happened to consumer spending this year in San Francisco and Fresno, California, on the tracktherecovery.org website he and other economists have created. (Visitors can sort the spending data by state, industry, and consumer income levels, as well as by city.)

The typical family living in San Francisco, one of the richest U.S. cities, earns more than $100,000 – or double Fresno’s income. And consumer spending in San Francisco – based on credit card data – has fallen by 20 percent since January. Spending in Fresno, on the other hand, is 10 percent below January levels.

This pattern holds across the country. Spending this year has declined 11.5 percent in high-income neighborhoods, but only 4.2 percent in low-income neighborhoods, according to the data.

This distinct pattern underscores the importance of the right policies at this critical time.

When the full force of the economic shutdown hit in March, spending fell off a cliff as states tried to suppress the coronavirus. But once workers started receiving the federal government’s $1,200 relief checks and the extra $600 in weekly unemployment benefits, they started buying again – especially in lower-income cities, where people needed the money for rent and groceries.

Chetty said this tells him two things about policy. First, to restore the economy requires getting control of COVID-19 so high-income people will feel comfortable spending money again.

Second, continuing a federal supplement to unemployment benefits is the most effective type of support, “because lower-income people will spend it.”

Read more blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.