COVID Relief Checks Helped Needy the Most

In the pandemic’s early days, the unraveling of economic life was breathtaking. Some 3.3 million Americans filed for jobless benefits in the second week of March 2020. A record 6.6 million joined them the following week.

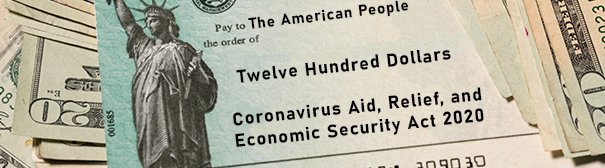

By April, government checks were starting to land in workers’ bank accounts, bringing the urgent relief Congress intended. The unemployed used the often-substantial assistance – up to $3,400 for a family of four – to cover basic expenses, and the people who were holding on to their jobs saved for possibly difficult days ahead.

New research shows that the benefits of this assistance disproportionately went to those who needed it most: low-income workers and people who had financial problems before COVID hit.

The relief checks “have been more of a lifeline for individuals who were struggling,” the study concluded. “Rather than simply help prevent widening inequality,” the relief “may have helped close the gap.”

Consider the workers who either had great difficulty paying their debts in 2019 or had been spending more than they earned. Thanks to the first round of relief distributed in 2020, both groups saw improvement in three major areas, according to the Dornsife Center for Economic and Social Research at the University of Southern California.

The disadvantaged workers experienced the largest reductions in financial stress and felt more satisfied with their finances. They also felt less financially fragile, reporting that it was easier to come up with $400 in cash for an emergency like a car repair. And their ability to save increased.

The researchers said they couldn’t directly credit the relief checks for these improvements. Another important factor – the enhanced unemployment benefit of $600 per week – was also simultaneously at play. But one analysis in this study did find that the people who had received the checks saw more gains than the workers who were still waiting for their checks when they participated in the Internet survey in April 2020 that the researchers used.

As was widely acknowledged at the time, lower-paid hourly workers suffered the brunt of the pandemic-related layoffs. The researchers found that $60,000 in yearly income was a sort of dividing line: households that earned less benefited more from the government assistance than households that earned over $60,000. The lower-income households were more likely to build up their checking and savings account balances.

Women and female-headed households were also very vulnerable in the pandemic because so many prioritized taking care of children who weren’t in school over their jobs. But after the relief checks went out, women had more improvements in their financial well-being and stress levels than men. The pandemic spurred more of the women to save money too.

The benefits of the government checks in early 2020 are now clear. But it’s possible they have dissipated over the past two years, the researchers said, requiring a new investigation of the long-term impact as well as the effects of subsequent rounds of relief checks.

To read this study, authored by Marco Angrisani, Jeremy Burke, and Arie Kapteyn, see “The Early Impacts of the Coronavirus Pandemic on Americans’ Economic Security.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.