Retirees say ‘Ugh’ to Medicare Shopping

In terms of popularity, reviewing Medicare plans during the open enrollment, going on now, ranks right up there with doing taxes.

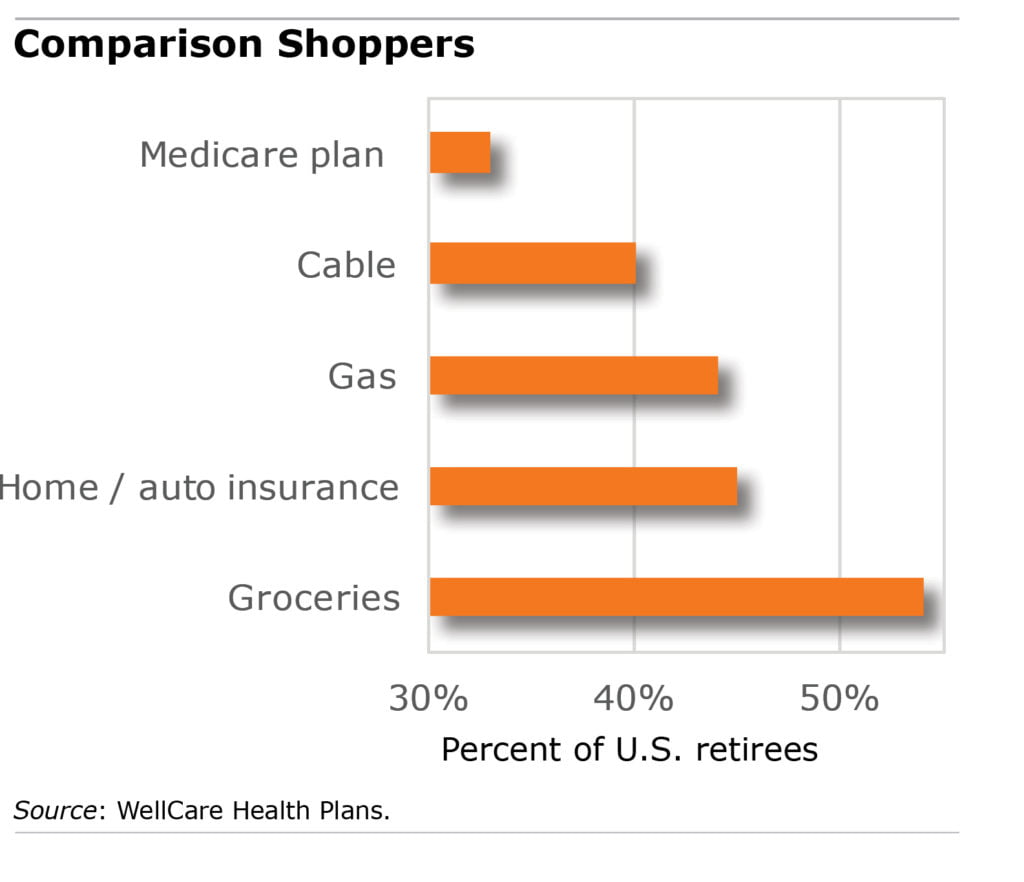

Retirees on Medicare view healthcare as their most burdensome expense. But they are less likely to comparison shop for Medicare plans than for their groceries and gas, even though plan shopping would probably save more money.

Deciding on a Medicare Advantage plan or deciding to switch to traditional Medicare, with or without a Medigap supplement, is “overwhelming, scary, and has consequences, so we put it off,” said Bart Astor, a spokesman for the insurer WellCare Health Plans, whose nationally representative survey quantified just how much retirees dread Medicare enrollment.

Selecting one path over another also necessitates predicting the impossible: their future health and how much coverage they will need.

Squared Away can’t predict your medical needs in 2018 either. But perhaps one of these blogs will help you decide which path to take:

- Free help navigating Medicare’s maze

- 10 rules for Medicare Advantage shopping

- Know the pitfalls of spotty hospital coverage in Advantage plans

- Advantage premiums reflect physician networks

- Fewer, clearer Medicare Part D choices

- Avoid initial Medicare enrollment mistakes

- Medicare primer: Advantage or Medigap?

If you haven’t shopped yet, why not get started on Black Friday?

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

There’s so much information online, it’s easy to get confused or read incorrect information. Sometimes it’s easier to simply call a Medicare agent to discuss your options. Great resources listed here though, thank you!

I can relate. After my first year using Plan D for precriptions, I automatically renewed with the provider I had chosen for the initial year. I figured if my provider was the cheapest for me the first year, it would continue to be the cheapest.

I was wrong. My annual cost for my one prescription increased $400 or more. So this year when open enrollment came around, I searched on Medicare.gov and found a Part D provider that is higher rated and costs me $600 less a year.

I’m 75 years old so when I never I need a pick me up to get through the typical 75 year old aches and pains, I head over here to the Boston College “seniors are stupid” blog. Never disappoints me. This time Boston College claims:

“Retirees on Medicare view healthcare as their most burdensome expense. But they are less likely to comparison shop for Medicare plans than for their groceries and gas, even though plan shopping would probably save more money.”

Duh, that’s because there is very little comparing to do or price differences to consider. Whereas gas and food prices change all the time and there are… you know… actual selections to shop for (compare).

— Part A costs what it costs (usually “free”)

— Part B costs what it costs (varies whether you are poor, middle class or rich but you don’t get to decide anything)

— If you want networked managed care, Part C prices vary but once you find out what brand Part C your doctor takes, that almost always ends the shopping (if your doctor takes Part C, you can usually make the low-premium/high-deductible vs. high-premium/low-deductible decision we seniors have been making for 60 years in all insurance decisions within that one brand)

— If like most doctors, your doctor does not take Part C, you need Medigap. All the plans are alike by letter. Take the cheapest of the letter you want (same low-premium/high-deductible vs. high-premium/low-deductible decision as above) or stick with Blue Cross because you always had Blue Cross or pick AARP because they love we seniors

Wow, that was hard.

Oh by the way, did you screw up? If so, you can change every year, and even much more often depending on where you live and your income.