Retirement Index Shows Many Still At Risk

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

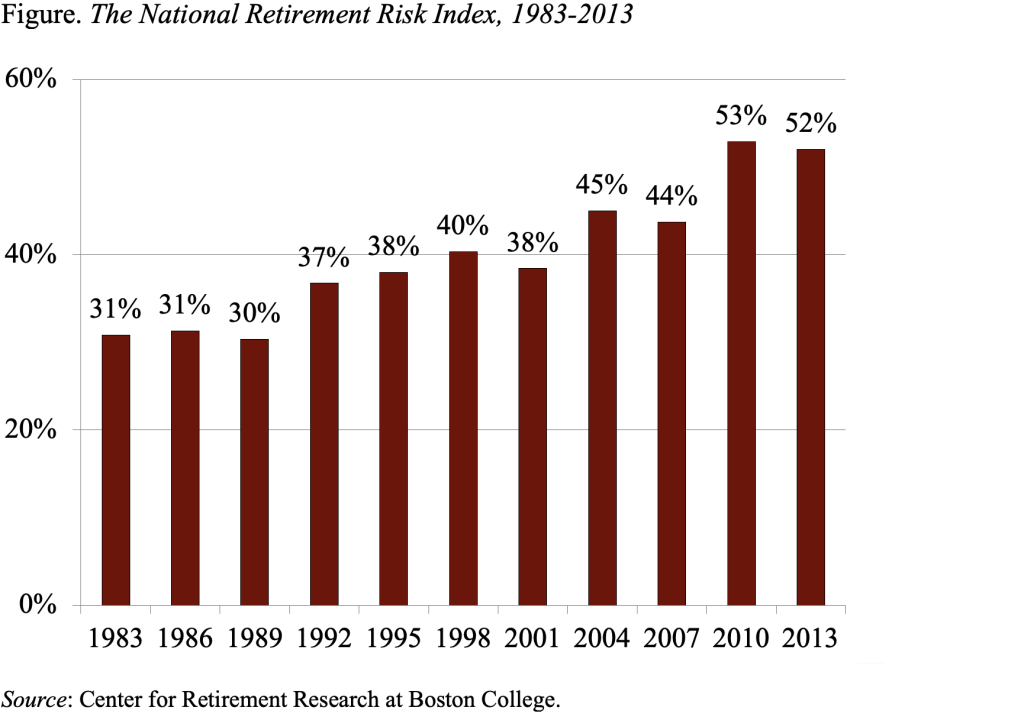

The National Retirement Risk Index documents the retirement savings shortfall.

Every three years, with the release of the Federal Reserve’s 2013 Survey of Consumer Finances (SCF), we update our National Retirement Risk Index (NRRI). The NRRI shows the share of working-age households who are “at risk” of being unable to maintain their pre-retirement standard of living in retirement.

Constructing the NRRI involves three steps: 1) projecting a replacement rate – retirement income as a share of pre-retirement income – for each member of the SCF’s nationally representative sample of U.S. households; 2) constructing a target replacement rate that would allow each household to maintain its pre-retirement standard of living in retirement; and 3) comparing the projected and target replacement rates to find the percentage of households “at risk.” The NRRI was originally created using the 2004 SCF and has been updated with the release of each subsequent survey.

Our expectation was that the NRRI would improve sharply in 2013; it certainly felt like a better year than 2010. The stock market was up, and housing values were beginning to recover. But the ratio of wealth to income had not bounced back from the financial crisis, more households would face a higher Social Security Full Retirement Age, and the government had tightened up on the percentage of housing equity that borrowers could extract through a reverse mortgage. On balance, then, the Index level for 2013 was 52 percent, only slightly better than the 53 percent reported for 2010 (see Figure).

This result means that more than half of today’s households will not have enough retirement income to maintain their pre-retirement standard of living, even if they work to age 65 – which is above the current average retirement age – and annuitize all their financial assets, including the receipts from a reverse mortgage on their homes. The NRRI clearly indicates that many Americans need to save more and/or work longer.