Retiring with Debt

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Rising reliance on debt among pre-retirees and retirees may be cause for concern

With a contracting retirement income system, rapidly rising health care costs, and the prospect of long-term care expenses, one would have thought that people approaching retirement would be paying off their credit card debt and closing out their mortgages. But surveys suggest that people are entering retirement with more debt than ever before and relying on borrowing to cover expenses in retirement.

According to the Federal Reserve’s Survey of Consumer Finances, in 2010 54 percent of pre-retirees and 41 percent of those 65-74 had a mortgage on their home. And the median amounts of these mortgages were not trivial – $97,000 for pre-retirees and $70,000 for new retirees. About 41 percent of pre-retirees and 32 percent of new retirees also had outstanding credit card balances (median balance about $2,200) and installment loans (median balance about $11,000). About 9 percent of pre-retirees and retirees faced debt payments that exceeded 40 percent of family income.

The high levels of debt were driven by housing. During the housing bubble, financial institutions encouraged homeowners to think of their house as a cash machine. In response, they took on more housing debt during their working years and approached retirement with considerable housing debt.

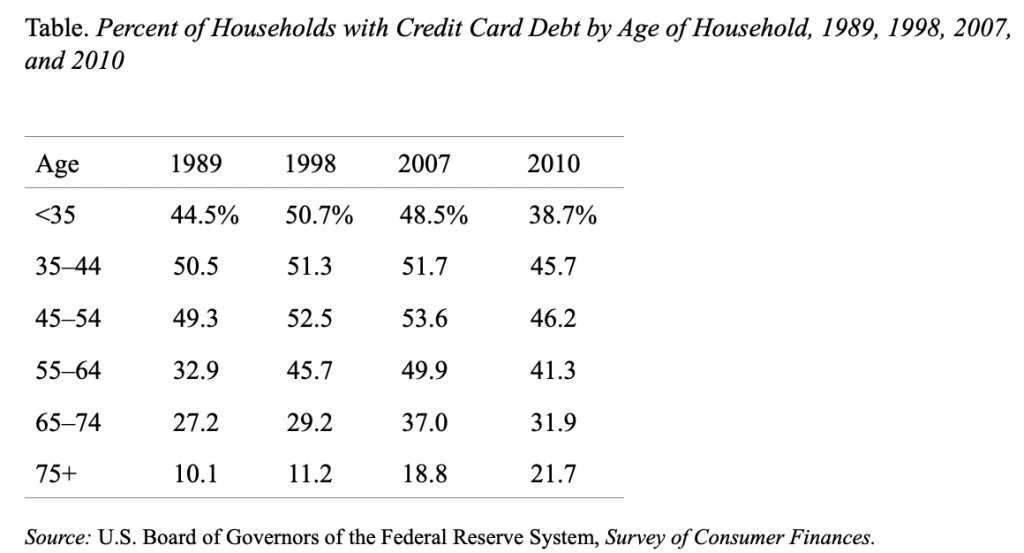

But credit card debt is also increasingly a problem for older Americans. The table shows the percent of households with credit card debt by age from the Survey of Consumer Finances for 1989, 1998, 2007 and 2010. Over the entire period, the percent of older households with such debt has increased, while the percent of indebted younger households has declined.

Interestingly, the biggest increases have occurred among households with heads 75 and older.

The changes since the financial collapse have been particularly interesting. Generally, this period has been one of deleveraging. Outstanding credit card debt declined between the third quarter of 2008 and the first quarter of 2012. The deleveraging reflected changing behavior of consumers who were charging less on their cards and/or paying off more, tighter lending standards on the part of the companies, and the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act of 2009, which increased the transparency and fairness of the credit card industry. But as the table shows, the deleveraging between 2007 and 2010 was much greater among younger households than older ones. In fact, the percent of households 75 and over with debt continued to increase.

The policy think tank Demos undertook surveys in 2008 and 2012 that highlight the changing pattern of indebtedness between those over and under age 50. Of households with debt, those over 50 saw their average balances decline by 16 percent compared to a 37-percent decline for those under 50. Older households frequently used their credit cards to manage daily living expenses and to cover contingencies such as car and home repairs as well as medical expenses.

In short, as we think about the adequacy of our national retirement system, we should keep an eye on the extent to which older people are entering retirement with debt and using debt to cover basic expenses.