SECURE 2.0 Offers Perks for the Rich to Make Progress for the Middle-Class

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New pension bill totally neglects low-paid workers.

Saving for retirement is a good thing and apparently one of the few issues that can garner bipartisan support in a fractured Congress. Most recently, the House passed the “Securing a Strong Retirement Act of 2022” – affectionately known as SECURE 2.0 because it builds on SECURE legislation enacted in 2019.

Even though a CNN headline says “Big Changes Are Coming to Your 401(k),” I would characterize SECURE 2.0 as a modest endeavor that provides goodies for high earners, some helpful changes for middle earners, and shamefully neglects the lack of coverage and inadequate balances of low earners.

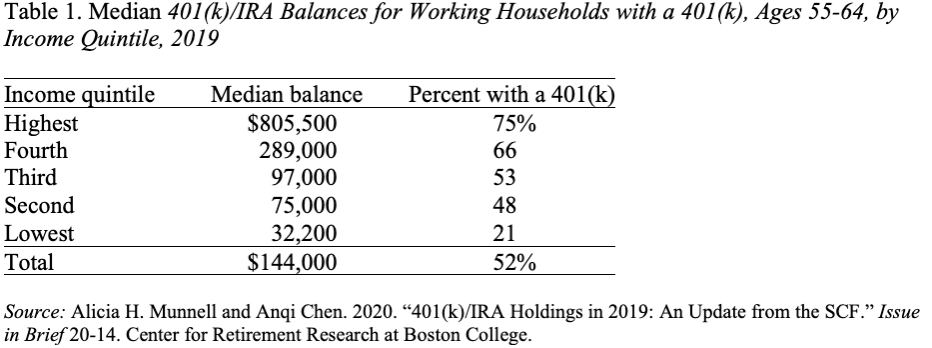

As background, let’s look at the retirement holdings of today’s working households approaching retirement (ages 55-64) with data from the Federal Reserve’s Survey of Consumer Finances, which provides information not only on 401(k) balances but also on household holdings in IRAs. Table 1 shows that 401(k) plans work well for the highest earners – 75 percent of these working households have a 401(k) with median balances of $805,500 – and not so well for low earners – only 21 percent have a 401(k) and the median balances were only $32,200.

So, what does SECURE 2.0 do?

Goodies for high earners:

- Increases the age for required minimum distributions from 72 to 75. Only the wealthy can afford to not tap their 401(k) savings until their mid-70s. The tax incentives for retirement saving are supposed to help people accumulate resources to support themselves in retirement, not help the wealthy build up their estates.

- Increases catch-up contribution limits to $10,000 for workers ages 62, 63, or 64. Only about 10 percent of 401(k) participants are constrained by the current limits, so this change benefits only this privileged group.

- Increases the limits of qualified charitable distributions from retirement plans. Introducing a one-time $50,000 tax-free distribution to charitable trusts and indexing the annual distribution limit of $100,000 means that the wealthy will never pay taxes on substantial amounts of distributions.

Meaningful improvements for middle earners:

- Requires new 401(k) plans, with some exceptions, to auto-enroll eligible employees; employees can opt out. Auto-enrollment is an effective way to increase participation for middle earners who may not sign up on their own.

- Permits employers to treat student loan payments as if they were contributions to the 401(k) and contribute a match to the plan based on those amounts.

- Creates a national online lost-and-found effort for retirement plans, which will help workers find stranded accounts. This initiative is long overdue as the United States is one of the few developed countries without a pension registry.

Shameful neglect of low earners:

- No effort to provide a vehicle for retirement saving to the 50 percent of private sector workers currently not offered a retirement plan at work. Without continuous coverage, workers end up either totally reliant on Social Security or, as a result of moving in and out of coverage, with inadequate balances. Some states (California, Illinois, Oregon, and most recently Connecticut) have stepped into the breach with Auto-IRA programs, but we need a national program.

- Minimum movement on the Savers Credit. Matching the contributions of low-paid workers could enhance their retirement holdings, but the current Saver’s Credit is complex and not refundable for those with no tax liability. Secure 2.0 would provide a uniform 50-percent credit for all who are eligible, but not until 2027, and does not make the credit refundable.

I hate to end on such a negative note, because any form of bipartisan legislation is a wondrous thing. And I guess horse-trading requires that the industry gets some goodies for their well-heeled clients in order to make some progress for the middle class. But I really do wish we could have a national Auto-IRA program with a substantial refundable Saver’s Credit for the low paid.