Small Business Retirement Plans: How Firms Perceive Benefits & Costs

The brief’s key findings are:

- Our 2023 Small Business Retirement Survey looks at why some small firms offer a retirement savings plan and others do not.

- Factors that affect whether small firms offer a plan include firm size, wages, and industry, as well as beliefs on whether it will help attract workers.

- The main barriers to offering a plan are concerns about the stability/size of the firm and the perceived costs of a plan.

- Concerns about costs are driven by misperceptions; many firms are unaware of lower-cost options for employers and tax credits.

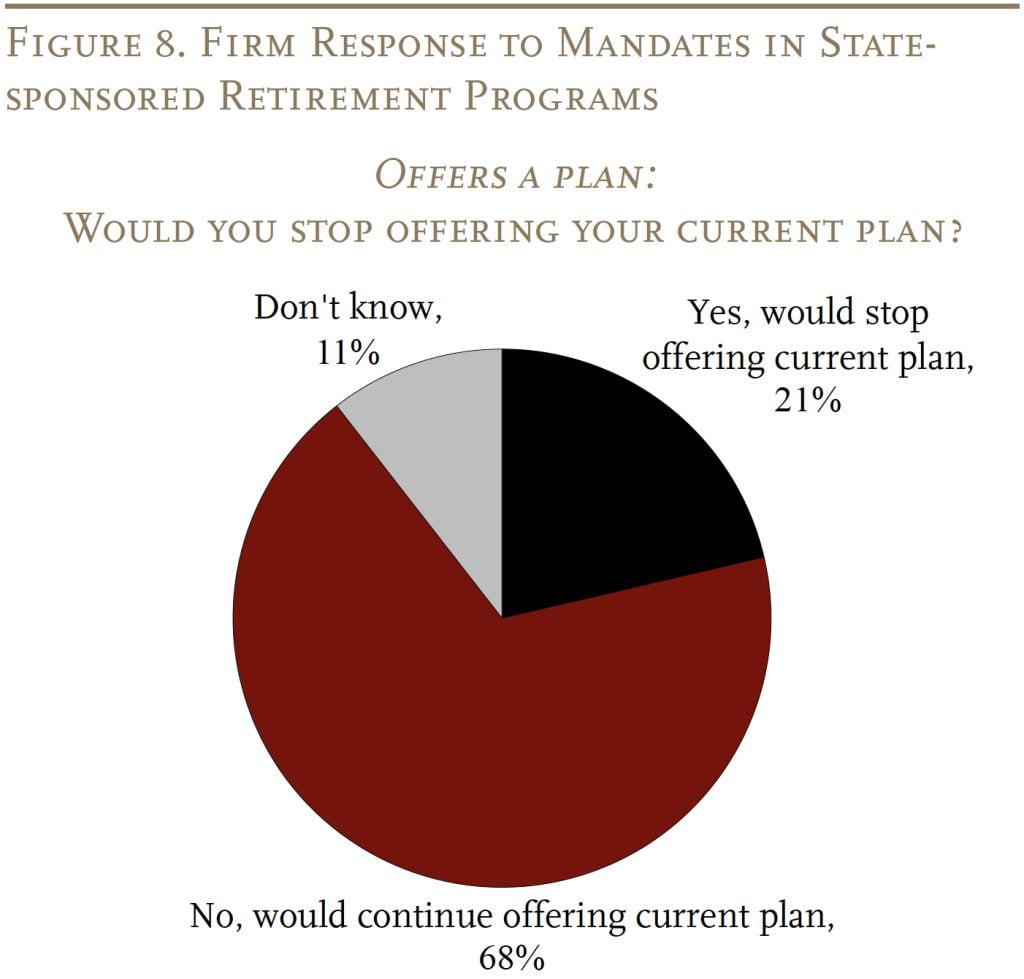

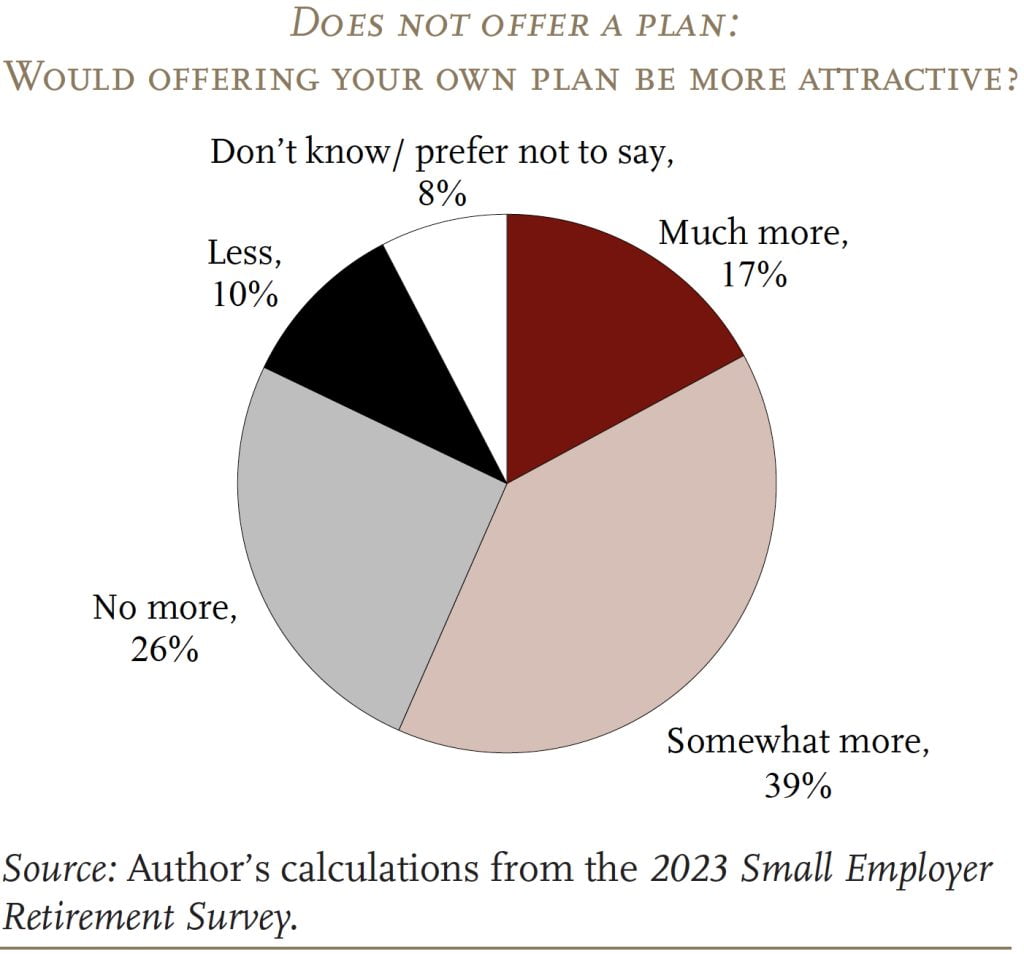

- The results also suggest that state auto-IRA programs are more likely to encourage than discourage firms from offering their own plan.

Introduction

At any given time, only about half of U.S. private sector workers are covered by an employer-sponsored retirement plan, and few workers save without one. The coverage gap, which undermines the retirement security of the nation’s workers, is driven by a lack of coverage among small employers. Interestingly, however, about half of firms with less than 100 employees do offer a plan for their employees. This brief, which is based on a recent study, presents the results of a new survey of small employers to understand why some offer retirement plans and others do not.1Chen (2023).

The discussion proceeds as follows. The first section describes the new survey and identifies factors that make a firm likely to provide coverage. The second section reports the barriers that firms perceive to offering a plan and assesses the accuracy of these perceptions. The third section examines whether the presence of state-sponsored retirement programs – which generally require firms without a plan to enroll their workers in the state program – shifts firm perceptions.

The final section concludes that important drivers to offering a plan, currently or in the near future, are a firm’s beliefs, such as whether they think retirement plans matter for employee hiring and retention. Importantly, many employers without a plan hold misperceptions about the financial and time costs of offering one. Therefore, better awareness of the many available options for small firms may help close the coverage gap. Finally, state-sponsored retirement programs are more likely to encourage than discourage the adoption of employer plans.

The 2023 Small Business Retirement Survey

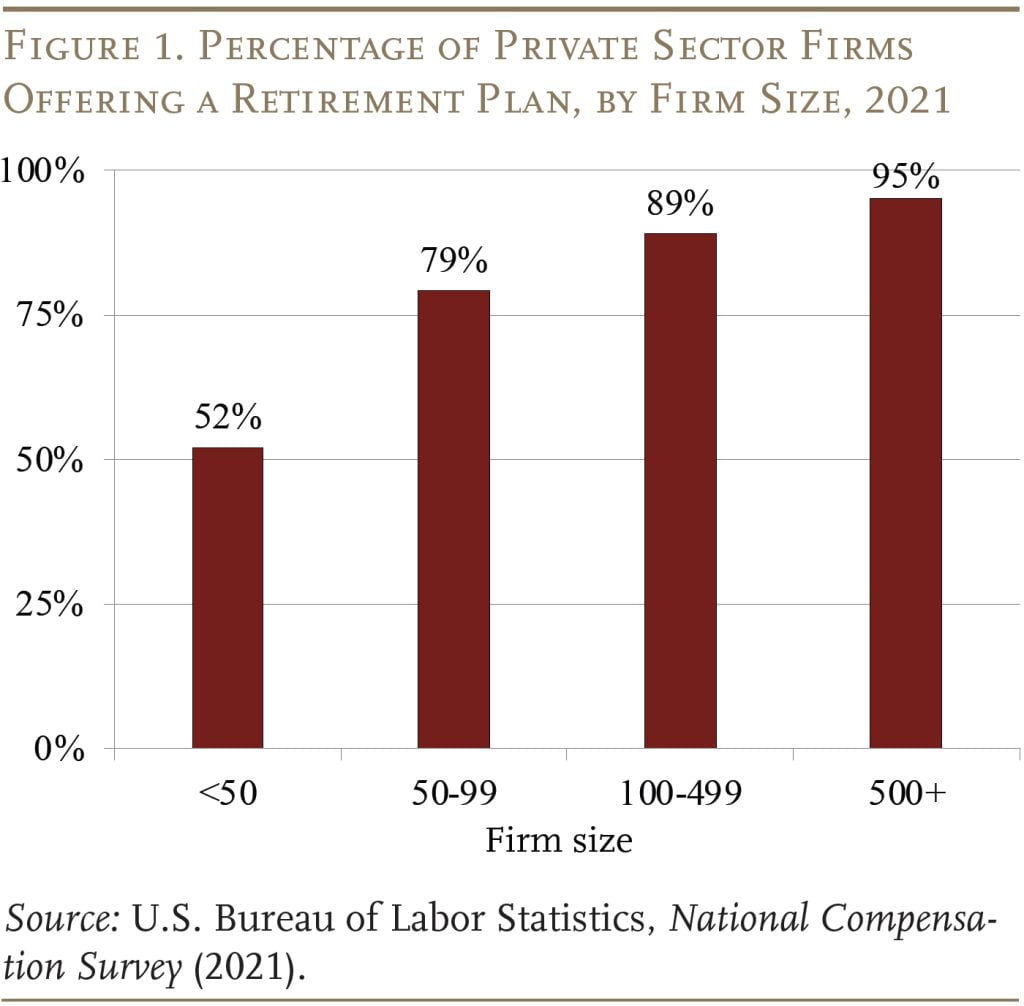

The 2023 Small Business Retirement Survey, which was produced in collaboration with the Employee Benefit Retirement Institute (EBRI) and Greenwald Research, was conducted between February and April 2023 and includes 703 firms with 100 or fewer employees. This survey replicates the last major survey focused on small business retirement plans, which was conducted in 1998 by EBRI and Greenwald Research. What is unique about the 2023 survey is that it includes a sample of 100 firms with 0-4 employees – a group usually excluded from surveys of small employers. Among all firms sampled, 46 percent offered a retirement plan, while the other 54 percent did not. Since 92 percent of all small firms have fewer than 20 employees, this pattern is fairly consistent with nationwide data (see Figure 1).2U.S. Bureau of Labor Statistics, Business Employment Dynamics (2022).

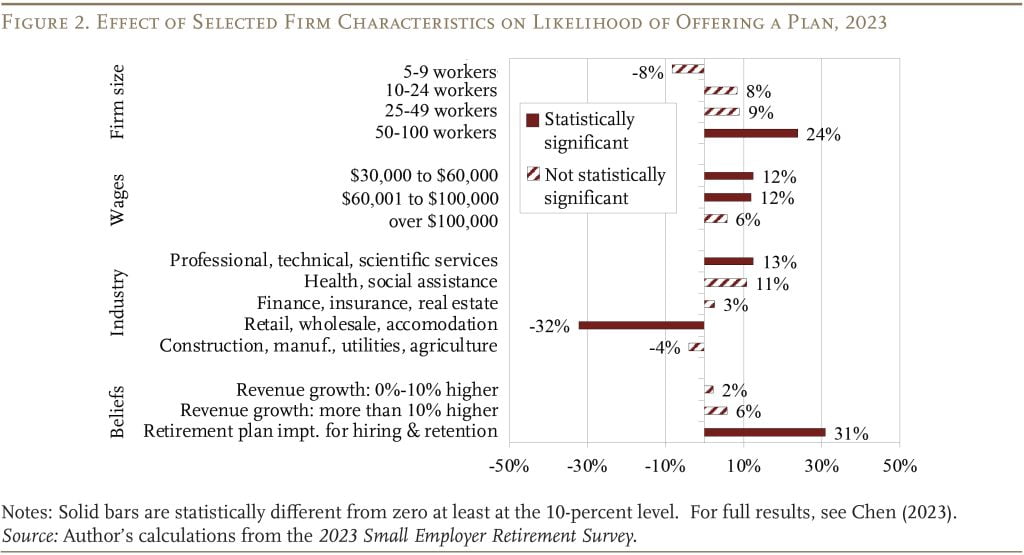

The survey responses can relate various factors to the likelihood of a firm offering a plan (see Figure 2). As expected from earlier studies, firms with 50-100 employees, those with higher average salaries, and firms in professional, technical, and scientific services industries are much more likely to offer a retirement plan. Meanwhile, firms in retail sales, wholesale sales, and accommodations (hospitality and food services) are much less likely to offer a plan. But other factors also mattered. Beliefs about whether having a retirement plan is important for hiring and retaining good employees are also a strong driver. Notably, a firm’s beliefs about revenue growth had little to no effect on having a retirement plan. Interestingly, for firms without a plan, beliefs are also an important predictor of their likelihood of adopting a plan in the near future.3For example, similar to firms currently offering a plan, firms without a plan that believe having one is important for hiring and retaining good employees are more likely to offer a plan in the near future. In addition, firms without a plan that think they will have strong future revenue growth are also more likely to adopt a plan in the future.

What Keeps Firms from Offering a Plan?

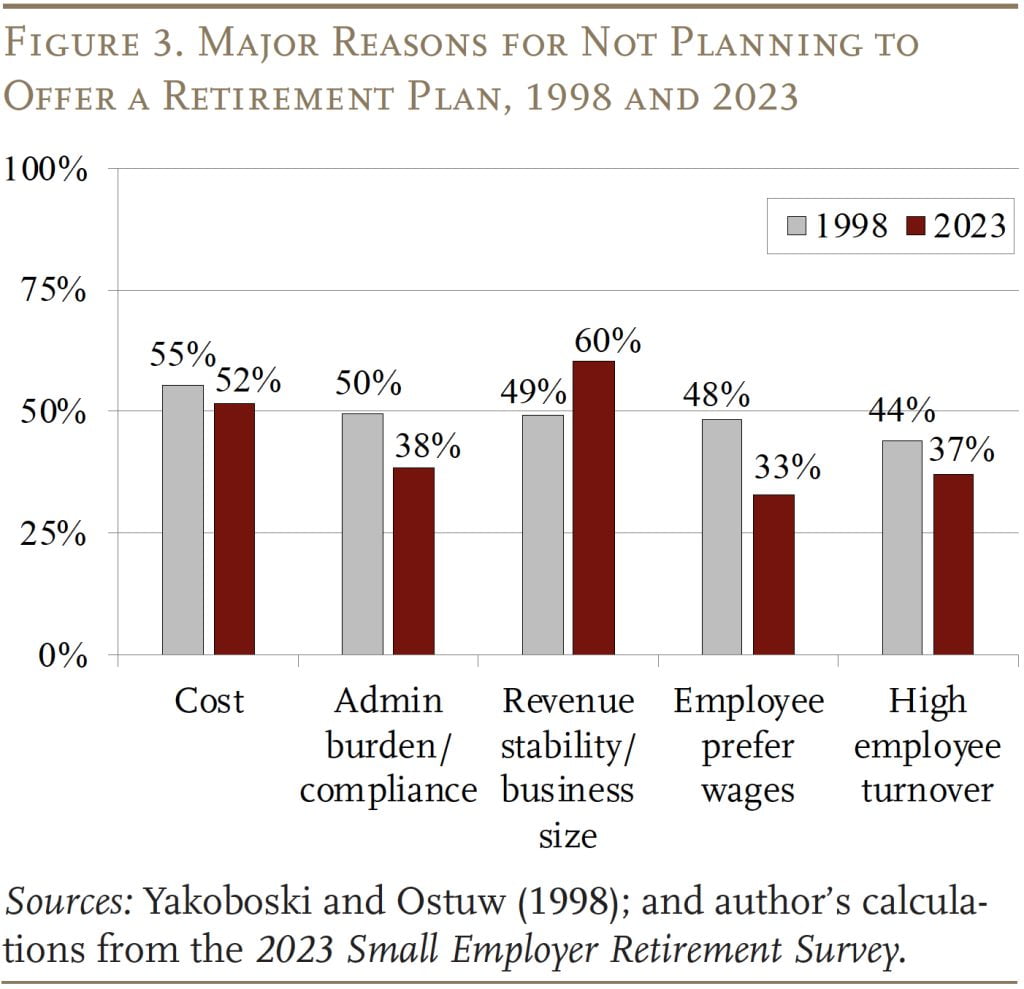

Historically, small firms that do not offer a plan have cited three main reasons: 1) uncertain revenues; 2) costs; and 3) employee preferences for wages. The third reason, employee preferences for wages, has dropped down the list, but costs remain important, while concerns about revenue stability/size have grown to become the biggest barrier (see Figure 3).4The 1998 survey did not include firms with fewer than 5 employees. If we compared the share of firms with 5-100 employers, the main takeaway remains the same; a rise in the share of firms – from 49 percent to 56 percent – that cite revenue stability or being too small as a major barrier to offering a retirement plan.

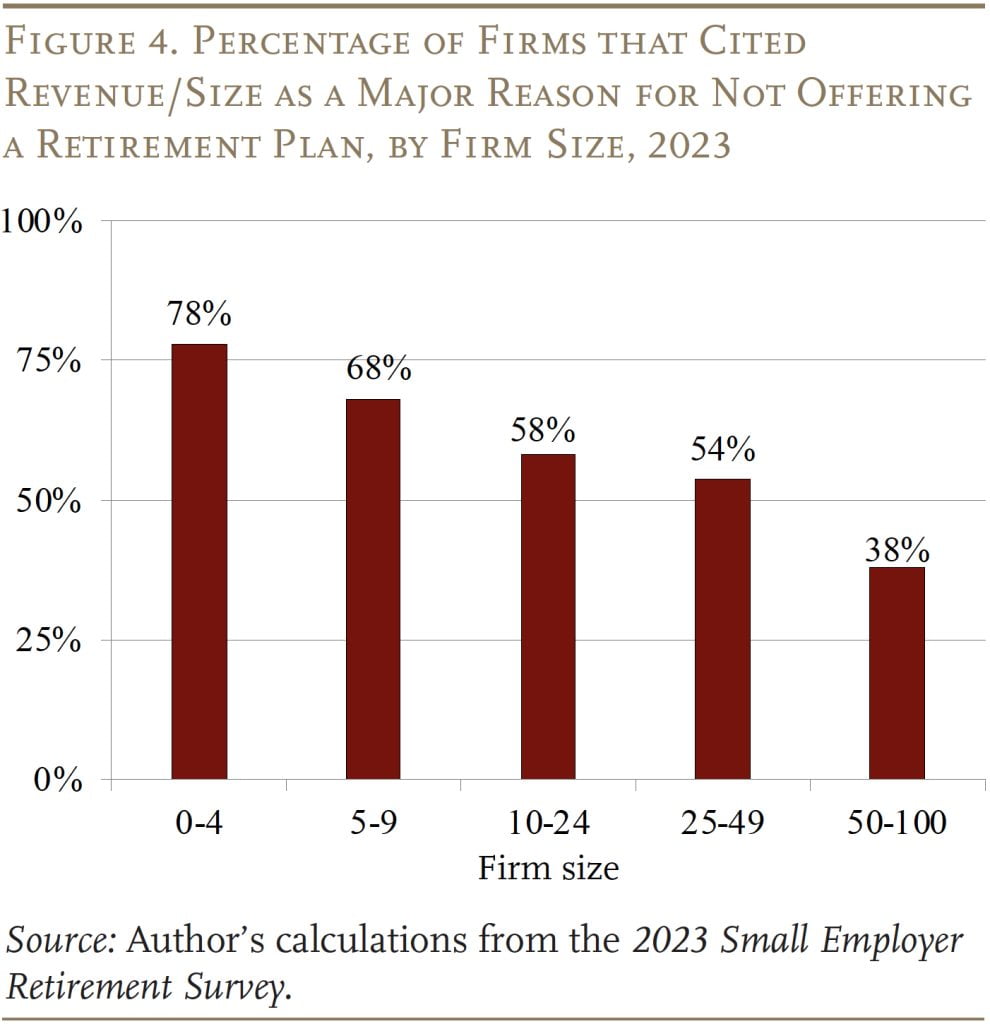

As one would expect, concern about revenues declines as firm size increases (see Figure 4).5It is important to note that revenue predictions are not the same as citing a concern for revenue stability. Figure 2 shows that revenue expectations do not influence the likelihood of offering a retirement plan, all else equal. But firms can expect higher revenue growth next year and still feel uneasy about revenue stability. For example, over half of the firms that believe revenue growth will be more than 10 percent higher next year still cite revenue stability as a major barrier to offering a plan. Indeed, close to 80 percent of firms with 0-4 employees cited revenue and size as a major barrier to offering a plan. The smallest of these small firms may simply have too much on their plate to add an additional benefit.6Some respondents provided explanations of why they did not offer a retirement plan. Many firms with 0-4 employees were self-employed or worked with part-time employees or contractors on an as-needed basis. They may not be aware of options such as solo-401(k)s and SEP IRAs or they may not consider having a retirement plan for themselves as “offering” a retirement plan. For established firms, costs and administrative burdens become the most important factor for not offering a plan.

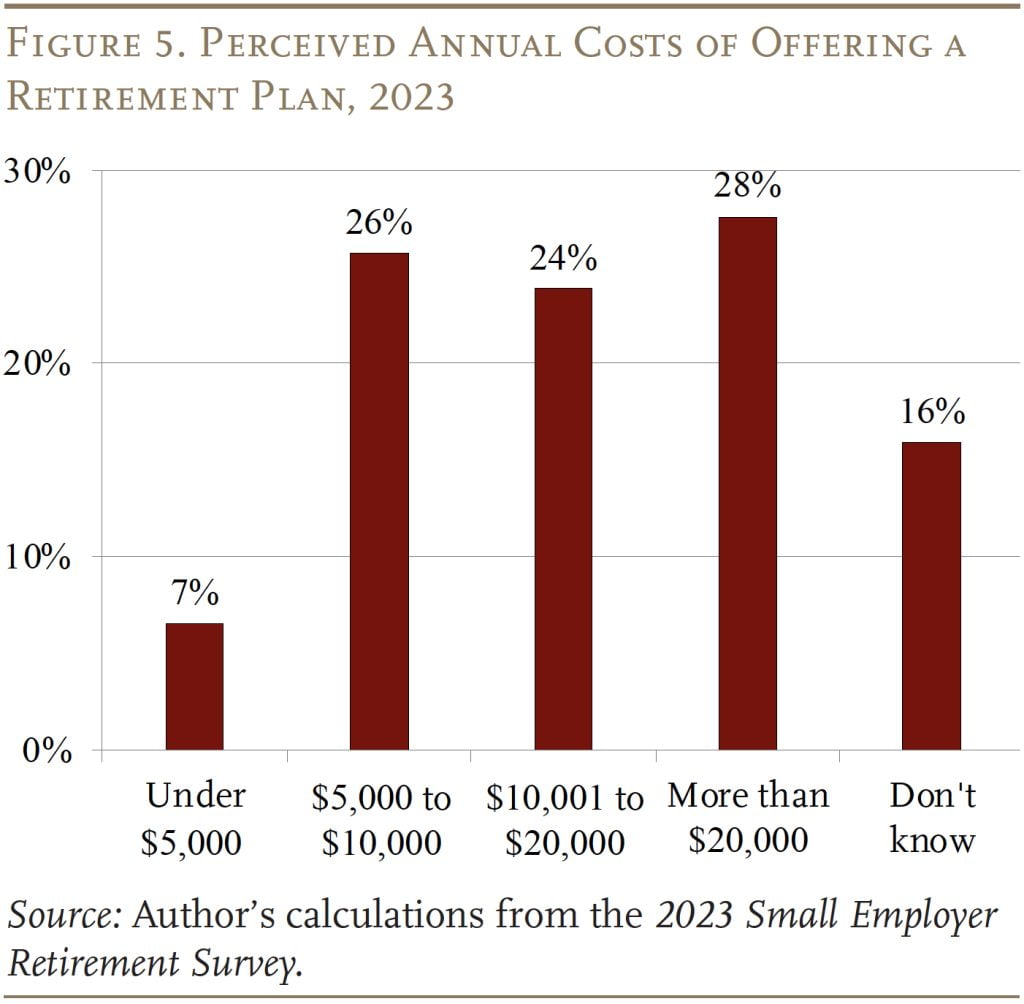

Interestingly, most firms surveyed that cite costs and administrative burden/compliance as barriers do not have a good sense of how much money or time is actually required to set up a plan. A quick Google search yielded several 401(k) options where annual employer costs would only be about $2,500 for a firm with 10 employees and $5,000 for a firm with 50 employees.7As of late 2023, the mid-tier plan offered by Guideline costs $79 a month and $8 a month per participant. The mid-tier plans from Betterment and Human Interest cost $150 a month and $6 a month per participant. Fidelity offers a small business retirement plan that charges a $500 start-up fee and a $300 per-quarter administration fee. However, it also requires employers to match employee contributions, which can increase costs. But, over half of small firms believe providing a retirement plan would cost more than $10,000 per year; and nearly 30 percent think it would cost more than $20,000 per year (see Figure 5).

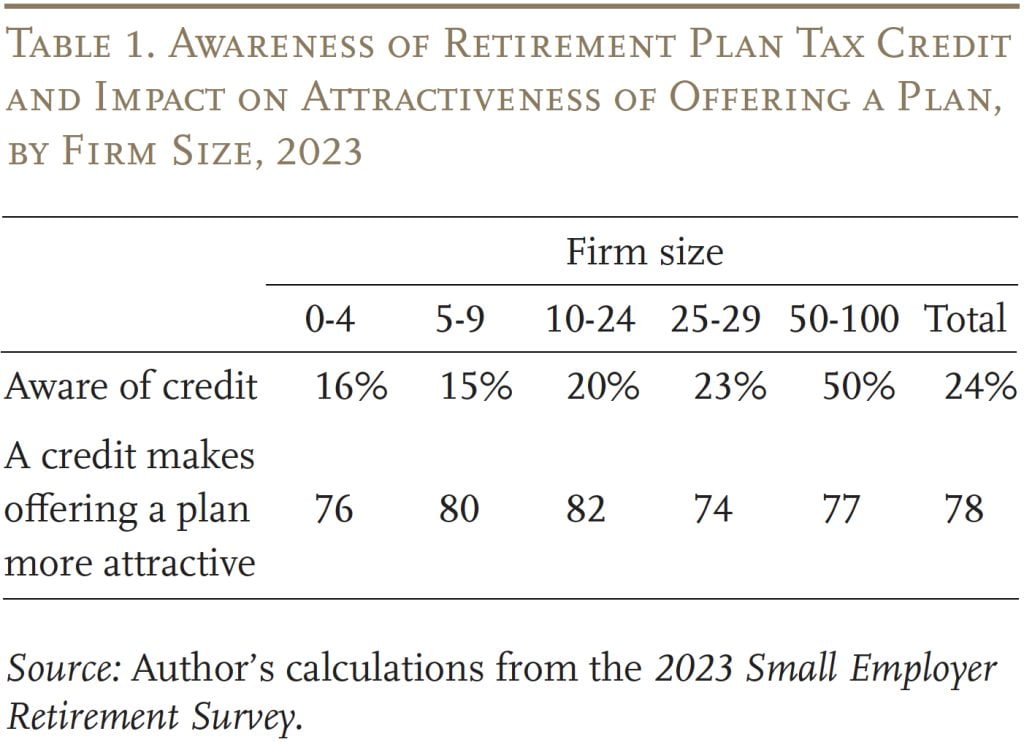

Not only do small firms overestimate the cost of offering a plan, but the vast majority – particularly those with fewer than 50 workers – are not aware that they can claim a tax credit of up to $5,000 for three years to help offset the costs of starting a plan (see Table 1). Interestingly, about 80 percent of employers say that such a credit would make offering a plan more attractive.

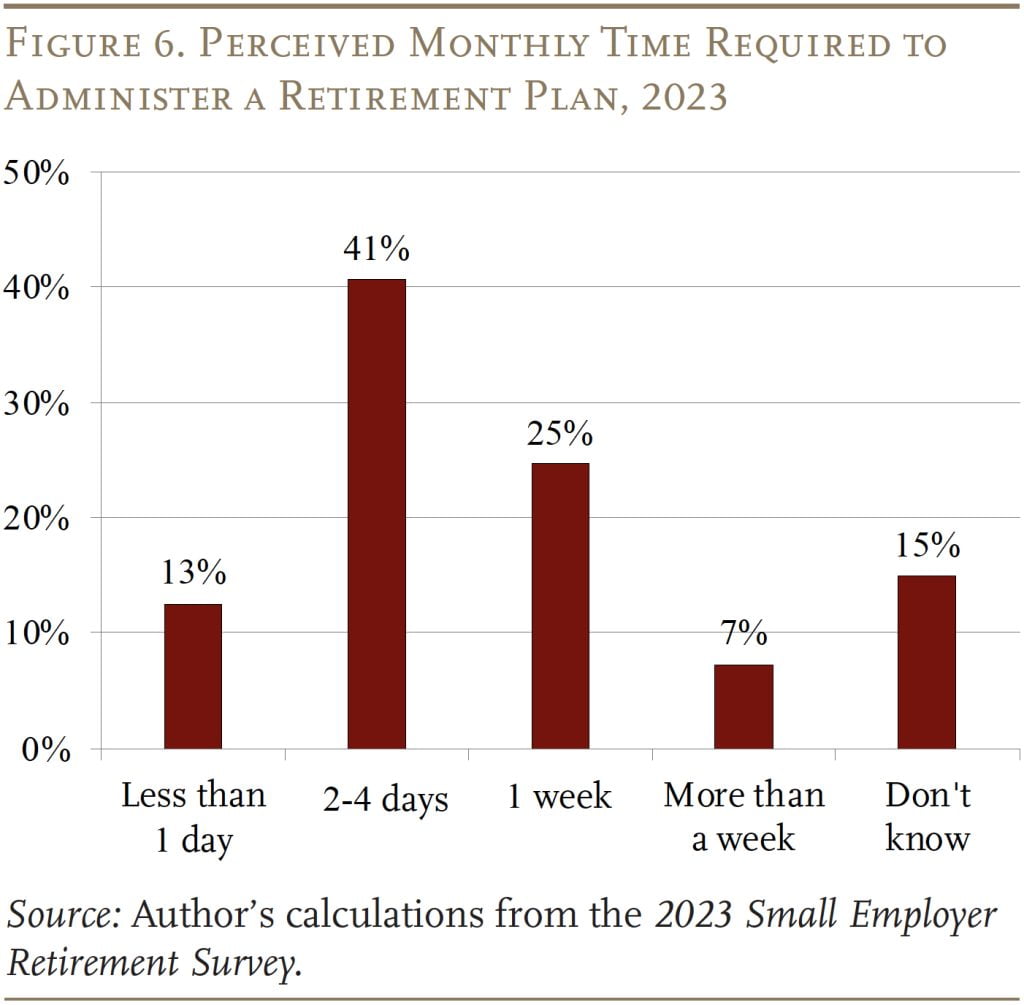

Additionally, small firms do not have a good sense of how much time it would take to administer a retirement plan (see Figure 6). Most firms believe it would take several days to a whole week every month. But in reality, after the initial set-up, operating a retirement plan should only take a few hours a year.8Drobleyn (2023).

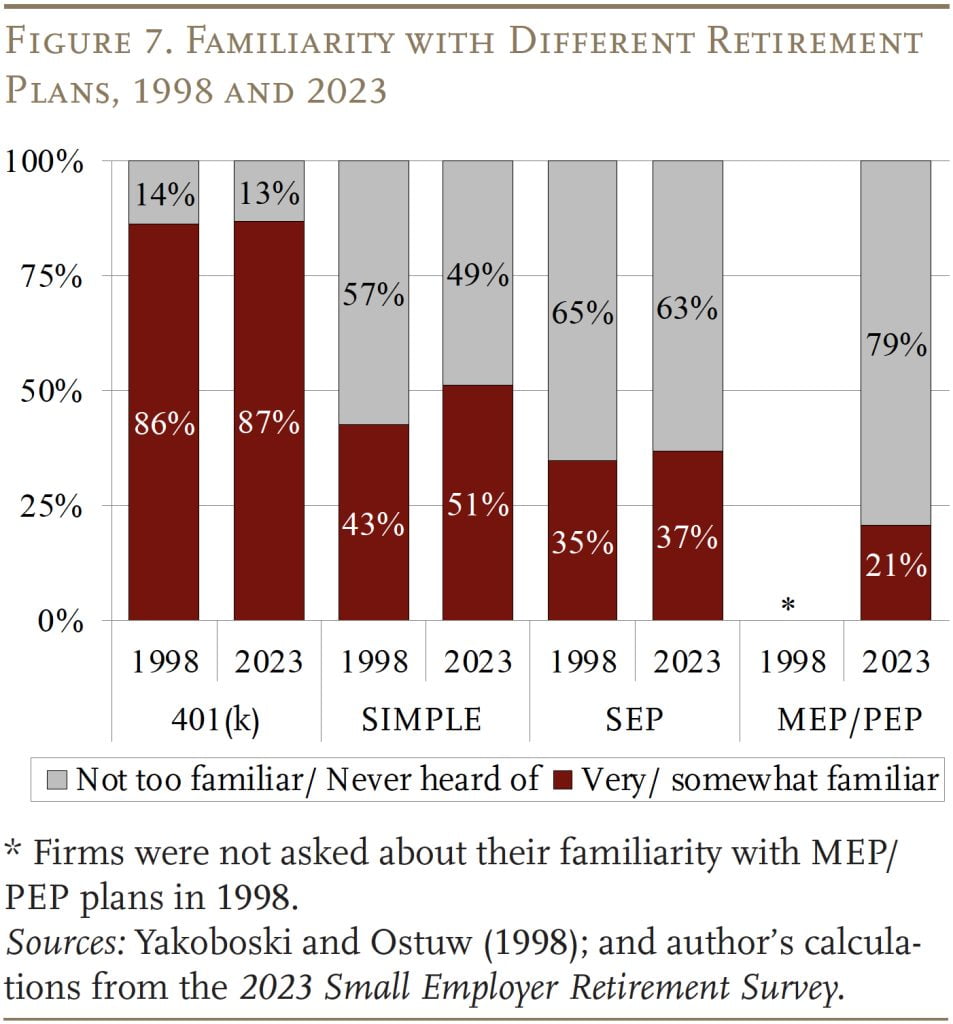

Many small firms are also unfamiliar with the various retirement plan options that are designed to help ease the cost and administrative burden of offering a plan. While most small firms are at least somewhat familiar with 401(k)s, the vast majority are not familiar with SIMPLE, SEP, and MEP/PEP plans (see Figure 7). And this percentage has barely budged in the last 25 years.

These results suggest that many firms overestimate the financial and time costs required to offer a plan, so better awareness of actual costs as well as available options could help reduce the barriers that small firms perceive.

Will State-sponsored Programs Impact Firm Behavior?

Currently, 14 states have launched or are preparing to launch programs requiring employers without a plan to automatically enroll their employees in an Individual Retirement Account (“auto-IRAs”). The survey asked all employers in the sample – not just those in states with auto-IRAs – whether the presence of such a program would make them less or more likely to have their own plan.9Theoretically, it is unclear how firms might respond to mandates for state-sponsored retirement programs. Firms could stop offering their own plan and treat state-sponsored plans as an alternative to offering a retirement plan. Alternatively, a state mandate could be the catalyst needed to encourage firms to offer their own plans and change business or industry norms.

The results show that, overall, the presence of state-sponsored programs does not make firms less likely to offer their own retirement plan (see Figure 8). Among firms that already offer a plan, about 70 percent say they would continue to offer their own if their state introduced a mandate. Among firms that did not offer a plan, almost 60 percent said a mandate would actually make offering their own retirement plan more attractive.10A recent study, linking Form 5500 data and individual-level Census data, found that auto-IRA mandates increase the probability of firms offering a retirement plan by 3 percent and the probability that a worker participates in an employer plan by 33 percent (Bloomfield et al. 2023). A similar study by Guzoto, Hines, and Shelton (2022) also found that state auto-IRAs complement the private market for retirement plans.

Conclusion

The coverage gap is a pressing concern for the nation’s retirement income security, and the gap is driven by small employers. In order to encourage growth in coverage, it is important to understand the characteristics of small firms that do and do not offer a plan.

For firms that offer or are considering offering a retirement plan in the near future, their beliefs are important – such as whether they think retirement plans matter for employee hiring and retention.

For firms that do not offer a plan, two major longstanding barriers – revenue stability/size and costs or administrative burden of having a plan – remain top concerns among small firms today.

Revenue concerns are highly associated with firm size, particularly firms with fewer than 10 employees. It is understandable that firms may need to become established before setting up a workplace retirement plan is seen as a viable option.

Views on cost or administrative burdens, however, seem to be driven by misperceptions about the financial costs and the time it would take to operate a plan. These results suggest that better awareness of the actual costs as well as plan options designed for small firms could help reduce the barriers that small firms perceive.

Finally, the growth of state-sponsored retirement programs may actually encourage firms without a plan to adopt one.

References

Bloomfield, Adam, Kyung Min Lee, Jay Philbrick, and Sita Slavov. 2023. “How Do Firms Respond to State Retirement Plan Mandates.” Working Paper 31398. Cambridge, MA: National Bureau of Economic Research.

Center for Retirement Research at Boston College, Employee Benefit Research Institute, and Greenwald Research. 2023. 2023 Small Employer Retirement Survey.

Chen, Anqi. 2023. “Small Business Retirement Plans: The Importance of Employer Perceptions of Benefits and Costs.” Special Report. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Drobleyn, Eric. 2023. “How Much Time Does Annual 401(k) Administration Take?” Mobile, AL: Employee Fiduciary.

Guzoto, Theron, Mark Hines, and Allison Shelton. 2022. “State Auto-IRAs Continue to Complement Private Market for Retirement Plans.” Washington, DC: Pew Charitable Trusts.

U.S. Bureau of Labor Statistics. Business Employment Dynamics, 2022. Washington, DC.

U.S. Bureau of Labor Statistics. National Compensation Survey, 2021. Washington, DC.

Yakoboski, Paul and Pamela Ostuw. 1998. “Small Employers and the Challenge of Sponsoring a Retirement Plan: Results of the 1998 Small Employer Retirement Survey.” Issue Brief Number 202. Washington, DC: Employee Benefit Research Institute.

Endnotes

- 1Chen (2023).

- 2U.S. Bureau of Labor Statistics, Business Employment Dynamics (2022).

- 3For example, similar to firms currently offering a plan, firms without a plan that believe having one is important for hiring and retaining good employees are more likely to offer a plan in the near future. In addition, firms without a plan that think they will have strong future revenue growth are also more likely to adopt a plan in the future.

- 4The 1998 survey did not include firms with fewer than 5 employees. If we compared the share of firms with 5-100 employers, the main takeaway remains the same; a rise in the share of firms – from 49 percent to 56 percent – that cite revenue stability or being too small as a major barrier to offering a retirement plan.

- 5It is important to note that revenue predictions are not the same as citing a concern for revenue stability. Figure 2 shows that revenue expectations do not influence the likelihood of offering a retirement plan, all else equal. But firms can expect higher revenue growth next year and still feel uneasy about revenue stability. For example, over half of the firms that believe revenue growth will be more than 10 percent higher next year still cite revenue stability as a major barrier to offering a plan.

- 6Some respondents provided explanations of why they did not offer a retirement plan. Many firms with 0-4 employees were self-employed or worked with part-time employees or contractors on an as-needed basis. They may not be aware of options such as solo-401(k)s and SEP IRAs or they may not consider having a retirement plan for themselves as “offering” a retirement plan.

- 7As of late 2023, the mid-tier plan offered by Guideline costs $79 a month and $8 a month per participant. The mid-tier plans from Betterment and Human Interest cost $150 a month and $6 a month per participant. Fidelity offers a small business retirement plan that charges a $500 start-up fee and a $300 per-quarter administration fee. However, it also requires employers to match employee contributions, which can increase costs.

- 8Drobleyn (2023).

- 9Theoretically, it is unclear how firms might respond to mandates for state-sponsored retirement programs. Firms could stop offering their own plan and treat state-sponsored plans as an alternative to offering a retirement plan. Alternatively, a state mandate could be the catalyst needed to encourage firms to offer their own plans and change business or industry norms.

- 10A recent study, linking Form 5500 data and individual-level Census data, found that auto-IRA mandates increase the probability of firms offering a retirement plan by 3 percent and the probability that a worker participates in an employer plan by 33 percent (Bloomfield et al. 2023). A similar study by Guzoto, Hines, and Shelton (2022) also found that state auto-IRAs complement the private market for retirement plans.