Social Security Actuaries Update Projections for COVID-19

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Long-run deficit changes little and trust-fund depletion date moves forward one year.

After months of speculation by commentators, Social Security actuaries have released an updated assessment of the program’s finances to reflect the impact of the pandemic and ensuing recession. These new numbers will replace the intermediate projections in the 2020 Trustees Report as the baseline for evaluation of legislative proposals until the next Trustees Report is issued in the spring.

The actuaries characterize the impact of the pandemic and recession as “significant” and, indeed, a number of important assumptions look quite different in the next few years. Mortality is up, fertility and immigration are down, disability incidence is down in 2020 and then up for the next three years, unemployment is up, real wages down then up, and real interest rates down.

But the impact on Social Security finances appears to be modest. Most of the pandemic/recession effects end by 2025, and the effects on the long-term deficit and on the depletion of the trust fund are negligible.

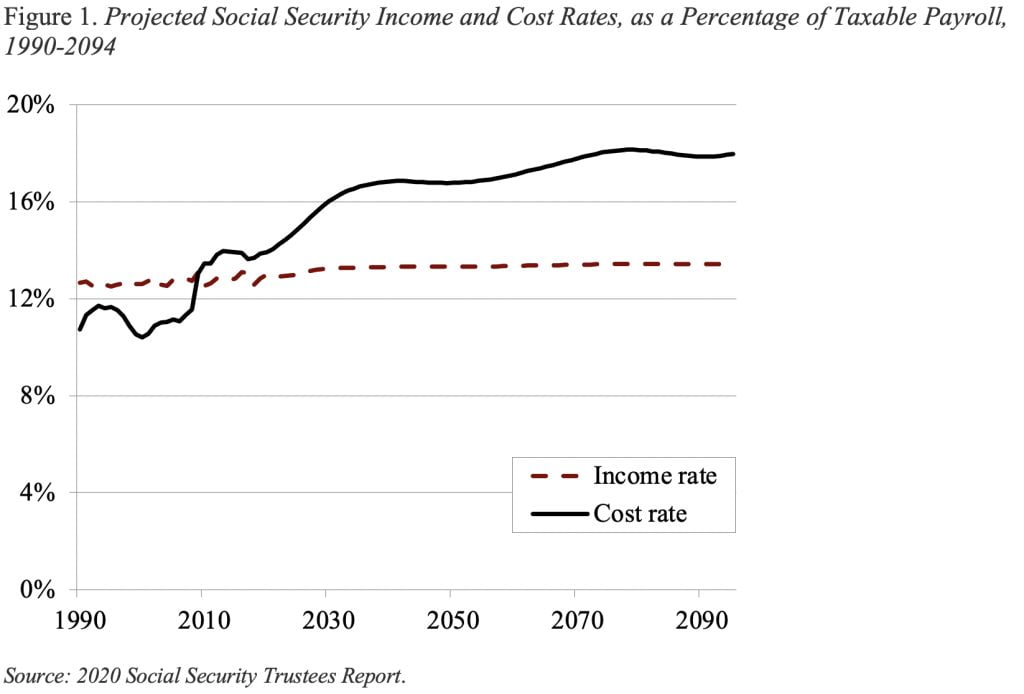

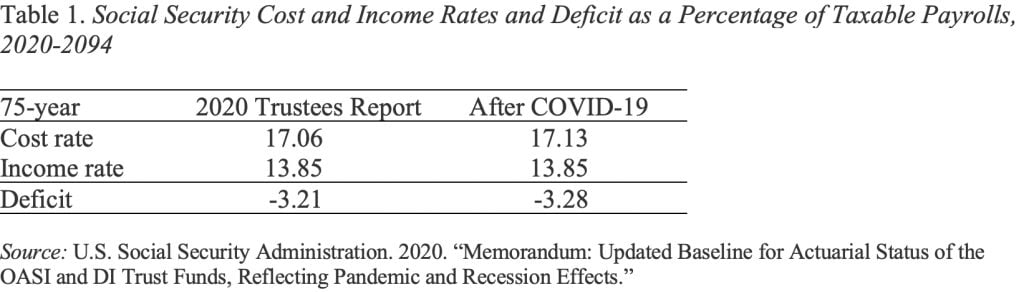

Figure 1 shows Social Security’s income and cost rates over the next 75 years as reported in the 2020 Trustees Report. The average income rate did not change at all and the cost rate rose a tiny bit, leading to a slight increase in the 75-year deficit from 3.21 to 3.28 percent of taxable payrolls (see Table 1).

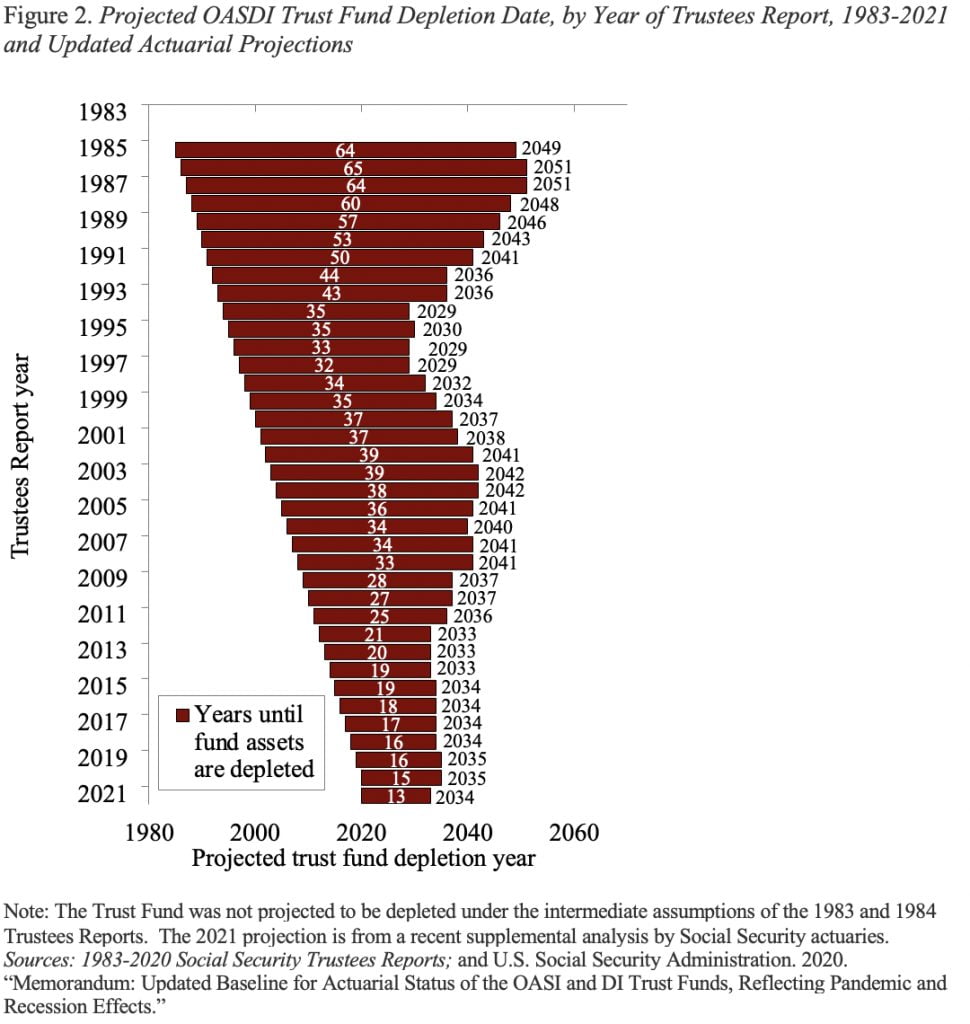

Most of the attention, however, has not been focused on the long-run cost and income curves, which shift with glacial speed, but rather on the depletion date for the trust fund that has been bridging the gap between costs and revenues. We have always known that the trust fund was scheduled to run out of money. The problem is that, whereas we used to have 65 years to figure out what to do once the trust fund was depleted, with the 2020 Trustees Report’s projected depletion date of 2035, that number dropped to 15 years (see Figure 2). Once the trust fund reserves are depleted, the payroll tax produces enough revenue only to pay 75-80 percent of promised benefits. The new Social Security projections move the depletion date from 2035 to 2034, and the time for finding a solution drops to 13 years (as we enter 2021).

The message I take away from the new actuarial projections is that Social Security is facing a long-run deficit – something we have known since the mid-1980s – and that the trust fund, which bridges the gap between cost and revenues, is going to run out by the mid-2030s – something we have also known for many years The bottom line was and continues to be that, as soon as we get other more immediate issues off our plate, it would be a good idea to turn our attention to Social Security financing to ensure that beneficiaries do not see a 20-25 percent cut in benefits.