Social Security COLA Drops as Inflation Cools

Alicia H. Munnell is a columnist for MarketWatch and director of the Center for Retirement Research at Boston College.

But over the last four years, the COLA has fully protected retirees.

The inflation data for August gives us a pretty good idea about the likely magnitude of Social Security’s cost-of-living adjustment (COLA) for 2025. This automatic indexing of benefits to keep up with rising prices – always a wonderful feature of our Social Security program – has been particularly valuable in light of the recent bout of inflation.

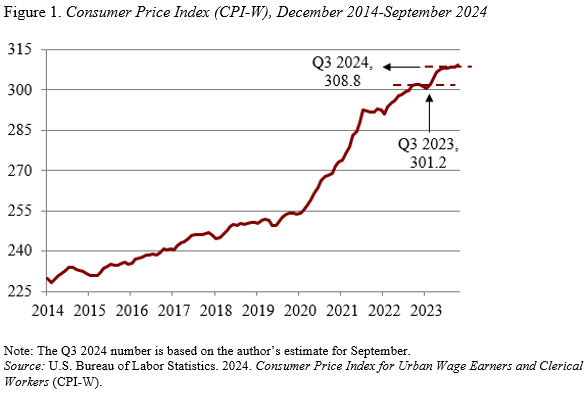

Since the COLA first affects benefits paid after January 1, Social Security needs to have figures available before the end of 2024. As a result, the adjustment for 2025 will be based on the increase in the CPI-W for the third quarter of 2024 over the third quarter of 2023. We know the 2023 number (see Figure 1), but we need data for July, August, and September to calculate the third quarter average for 2024. For 2024, we now have the numbers for July and August. Assuming that the September increase is similar to that in July and August, the average for the third quarter of 2024 will be 308.8, which represents a 2.5-percent increase over the third quarter of 2023. A COLA of 2.5 percent is very close to the 2.6-percent projection in the 2024 Social Security Trustees Report.

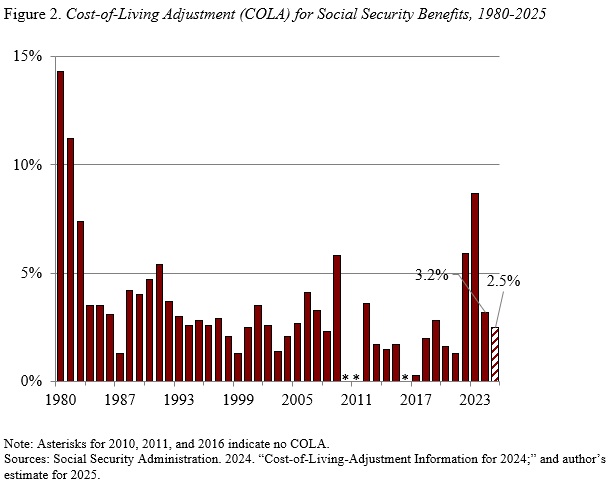

Some bemoan that this year’s COLA is smaller than those in the past few years (see Figure 2). But the adjustment is designed to compensate for rising prices, so as inflation drops, the magnitude of the required adjustment also falls.

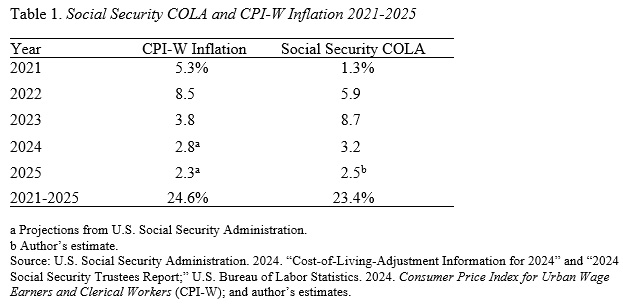

When higher increases were required, Social Security did its job. By design, the timing was not perfect – the COLA lagged when inflation took off, but then more than compensated as inflation slowed (see Table 1). The important point, however, is that over the entire period, the Social Security COLA has fully protected retirees from the rise in the CPI-W.

Social Security’s COLA is one of the most valuable aspects of the program’s design. It has always provided invaluable protection. Even an inflation rate as low as 2 percent cuts the purchasing power of a $1,000 benefit to $600 over a 25-year retirement. The COLA prevents that erosion. But the lack of drama means that the COLA goes unappreciated. The only good thing that may be said about the current inflation spike – which is harmful for all aspects of our lives – is that it has highlighted the value of having retirement benefits that keep up with prices.