Social Security Delay: the Value to You

What matters most in retirement is how much money comes in the door every single month. That’s why this blog – and its sponsor, the Center for Retirement Research – hammers away at the wisdom of delaying when you sign up for Social Security in order to increase the size of your monthly checks.

So here’s a very quick project for the long Thanksgiving weekend: insert your birthday and earnings into this new online tool to get an anonymous, back-of-the-envelope estimate of how much a delay is worth to you.

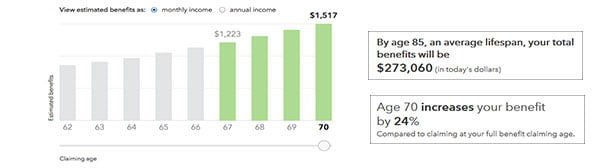

The age you claim your benefits is crucial, because two out of three households rely on Social Security benefits for more than half of their retirement income. Yet the majority of people still sign up before they’re eligible for their full benefit, which is age 66 for most baby boomers. Monthly benefits are increased for every year of delay, up to age 70.

The cool part of the tool, released last week by the Consumer Financial Protection Bureau and the Social Security Administration, is the sliding feature. It shows how much monthly benefits rise if you change your claiming age from 62 to 66 to 70. Click here to try the tool.

For example, a 50-year-old worker with median earnings – $32,140 – would receive just $898 per month by starting Social Security at 62. This rises to $1,268 at the full retirement age and to $1,572 at age 70 – that’s 75 percent more each month than the benefit claimed at 62.

To determine your benefit based on your specific earnings history requires setting up a personal account on Social Security’s website – it’s easy to do.

To encourage people to plan better and to become less reliant on Social Security, the Center has developed two online calculators to help you determine how much income you’ll need in retirement and how much workers under 50 should save.

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.