A Small Glimmer of Hope in the Security Security Trustees Report: Disability Costs May Be Lower than Projected

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Despite decline in disability rolls, Trustees did not lower their assumptions.

The Social Security Trustees recently released their 2018 Report showing little change in the financial outlook from last year – a 75-year deficit of 2.84 percent of payroll and a trust fund depletion date of 2034. A lot of economic and demographic assumptions go into these projections, and observers are always ready to kibitz on their validity.

Personally, I’m surprised that the Trustees maintained their fertility assumptions given the persistent decline in the total fertility rate (as I discussed in a recent brief). Lower fertility, of course, would increase long-term costs.

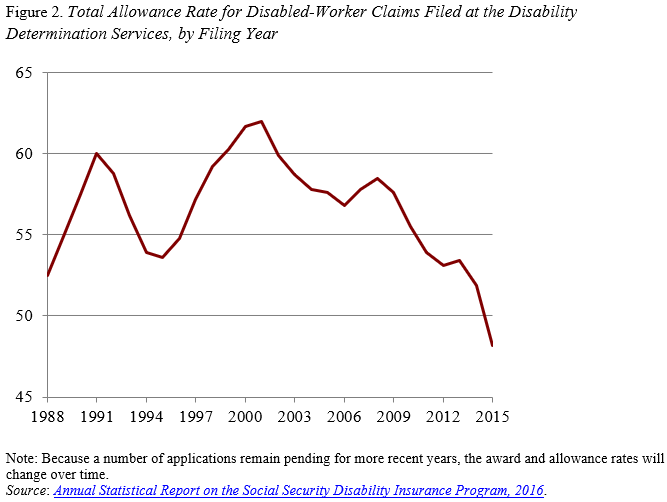

But the Trustees also did not change their assumptions about disability, and here the story is just the opposite: disability rates have been declining and if this decline persists, program costs will be lower.

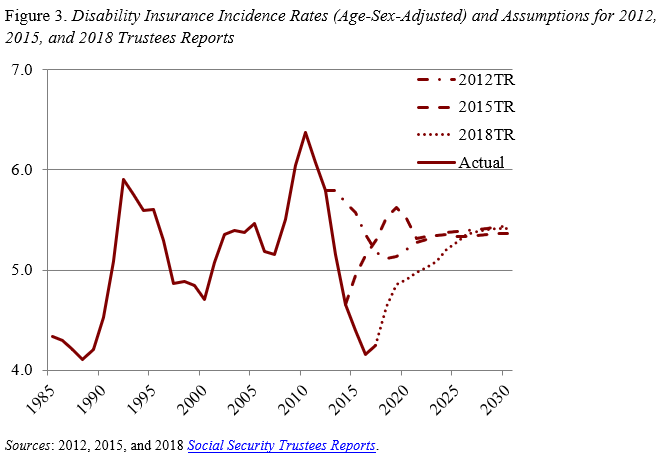

For most of the last 35 years, the disability rolls have been soaring. Three factors explain the steady increase. First, legislation passed in 1984 broadened the definition of disability and provided applicants and medical providers with greater opportunity to influence the decision process. Second, the population was aging, and the baby boom generation ‘aged into’ the higher incidence rates following the 1984 Congressional reforms. Third, the secular rise in female labor force participation increased the fraction of women eligible by their work history for disability benefits, and they too aged into the high incidence rates.

These three factors that led to the increase in the disability rolls over the 35 years are not likely to occur again. Further liberalizing of the program is unlikely. The aging of the work force has slowed with the baby boom moving into retirement, and women’s labor force participation has levelled off.

Indeed, two recent developments suggest that the trajectory of the program is shifting rapidly. First, in 2017 the stock of beneficiaries declined for the third year in a row – a sea change in the program’s development (see Figure 1).

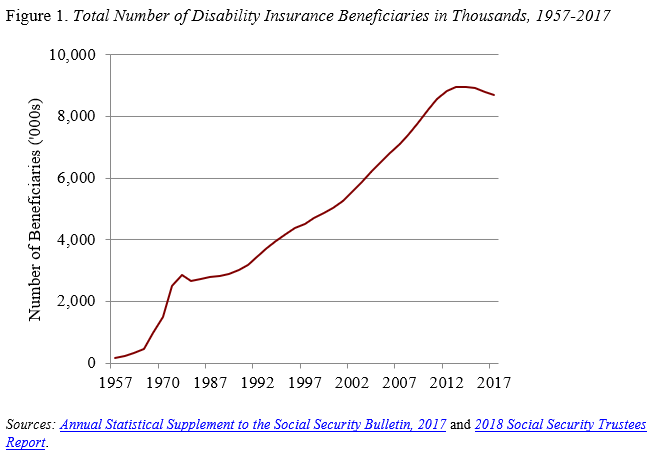

Second, since 2000 the DI allowance rate – the fraction of all DI applicants who are ultimately allowed benefits – has declined (see Figure 2). While this decline may in part reflect the impact of the Great Recession (since DI application rates typically rise and allowance rates typically fall during an economic downturn), a regime shift in the adjudication process also may be underway.

Despite these shifts, the Social Security Trustees have not substantially changed their key assumption regarding DI – namely, the incidence rate (the fraction of individuals insured for DI who are awarded benefits) (see Figure 3).