State Auto-IRAs Are a Necessary Initiative

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

They will ensure that uncovered workers have some savings and will teach us much.

In a recent blog, my friend Andrew Biggs claims that “Auto-IRAs could hurt low-income workers.” My view is that – given the circumstances – state auto-IRA initiatives are a worthy experiment from which we can learn a lot.

The motivation behind the state auto-IRA initiatives is to provide a retirement savings vehicle for workers whose employer does not offer one. Estimates vary, but probably about half of private sector workers at any moment in time are not covered by a retirement plan of any sort. The lack of coverage means: 1) some households will end up at retirement without any retirement savings and thus will be entirely reliant on Social Security; and 2) projections of 401(k) accumulations based on steady contributions may not be realistic for households that move in and out of coverage.

No one in their right mind would think that the answer to this problem is to establish 50 different state retirement systems. Clearly, the problem requires a federal response like the NEST initiative in the United Kingdom where all uncovered employees earning above a given amount – equal to about $13,000 – are automatically enrolled in a plan. But, in the absence of federal action, states have ventured into the breach.

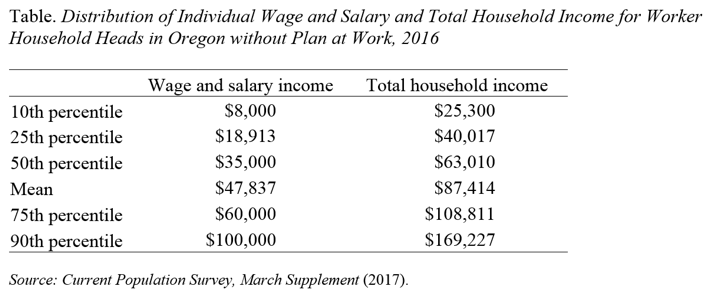

At this point, an auto-IRA plan is up and running in Oregon, soon to be followed by Illinois and California. Many other states are discussing such initiatives. In Oregon, an employer who does not offer a plan is required to automatically deduct 5 percent of an employee’s earnings and deposit that amount in an IRA. The 5-percent contribution will be gradually increased to 10 percent over time. Employees can always opt out. As I read it, the essence of Andrew’s argument is that low-income people don’t really need more saving and building up assets will disqualify them from receiving benefits under some government programs. He’s right that someone earning $13,000 or less over their lifetime would probably do fine with Social Security alone. But the uncovered workers in Oregon generally earn a lot more than that and are in households with incomes way above poverty levels (see Table). That means two things. First, most of them are not eligible for means-tested programs and therefore will not forfeit benefits. Second, most of them will need additional retirement income beyond Social Security.

Andrew also mentions the possibility that workers automatically enrolled in an IRA may build up IRA balances but also take on credit card and other debt to avoid reducing their current consumption. That concern is legitimate. The only way to answer that question is to follow households in the Oregon plan and see what happens to their balance sheets over time. If they do offset their IRAs with increased debt, that would be a serious problem.

One final note. Most of the auto-IRA discussion is focused on the benefits of more retirement saving. I think that these uncovered households also need some precautionary saving to cover unexpected expenses like a car accident or a water tank bursting. FINRA’s National Financial Capability Study shows that almost half of those in Oregon without a retirement plan could probably not come up with $2,000. Building up resources in an IRA will provide workers with access to cash in the short term since these IRAs are Roths, which allow participants to withdraw their contributions without a penalty.

As always, I agree with much of what Andrew Biggs has to say. I would much prefer a NEST-type system, but state auto-IRAs are all we have for now. Let’s try to make them work and learn what we can from them.