The Decline in Social Security’s Family Benefits

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Old benefit structure not well suited for today’s families.

Social Security provides not only benefits to workers who retire after a lifetime of work or become disabled but also spousal and survivor benefits. These “family” benefits were designed in the 1930s for a one-earner married couple. The spousal benefit guarantees the lower earning spouse – generally the wife – a benefit at the full retirement age equal to half her husband’s full benefit. The survivor benefit guarantees a widow a benefit equal to her husband’s actual benefit. Divorcees are entitled to spousal and survivor benefits if the marriage lasted 10 years or more.

These family benefits have been a source of great controversy. Women’s groups viewed it as unfair that women did not get a return for their first dollars earned, because they were already guaranteed a benefit equal to half their husband’s. And economists wrung their hands about the inequity between one and two-earner couples. That is, a one-earner couple and a two-earner couple with the same household earnings would pay the same amount in Social Security payroll taxes, but the one-earner couple would get 150 percent of the benefits.

Candidly, I could never get myself worked up about this issue. From my perspective, female workers under Social Security are treated just like male workers plus women who did not work got some free benefits to recognize their contribution to the household. It always seemed like a good deal for women. Similarly, the inequity between one- and two-earner households seemed like a problem that would take care of itself as women increasingly went to work.

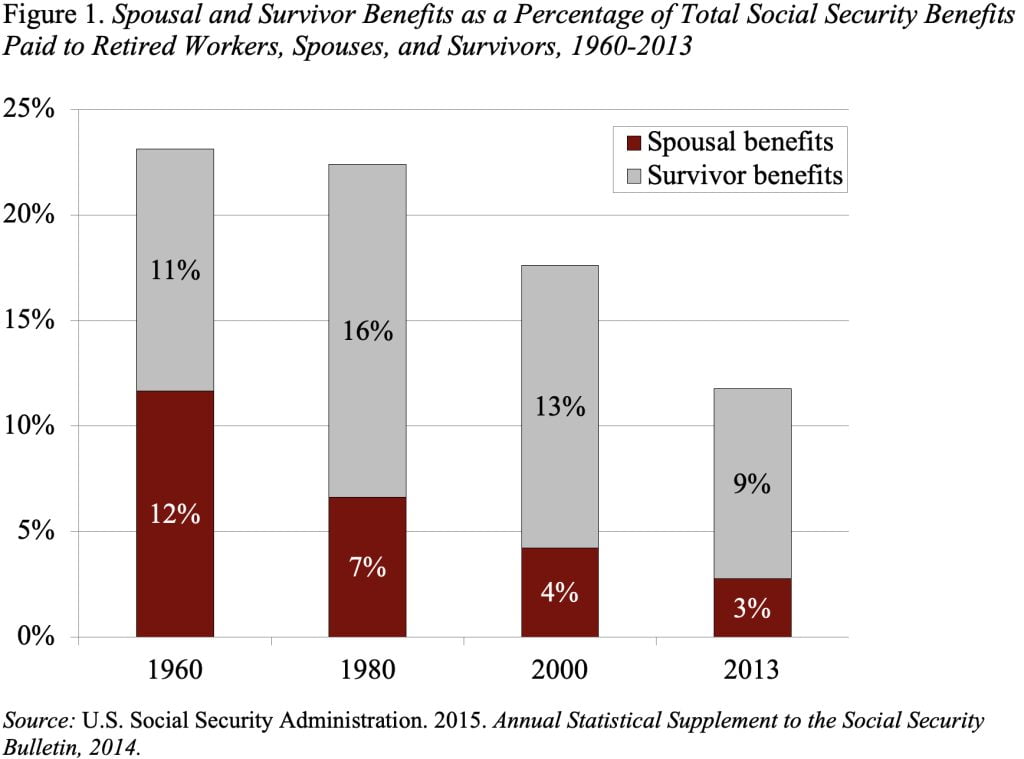

And this is indeed what has happened. As Figure 1 shows, spousal benefits have almost disappeared, accounting for only 3 percent of benefit payments in 2013. Survivor benefits are still significant, but they too are on their way down.

The flip side of this story is that Social Security’s 1930s family benefits are not well suited for today’s families. Most married women work, and many households are headed by single mothers, who are not eligible for family benefits. The same is true for divorced women who were married less than 10 years. Single women often find it hard to earn an adequate Social Security benefit on their own, as their work opportunities are constrained by child-rearing duties.

In response, policy experts have resurrected some old ideas and introduced some new ones to help today’s families. The old idea is “earnings sharing” where covered earnings are divided equally between the husband and the wife. This approach would eliminate the one-earner/two-earner problem and could raise benefits for women who later become divorced. The difficulty with the proposal is that sharing inevitably means taking earnings from men and giving them to women, creating an enormous political headwind to any such change.

The other proposal getting some attention is introducing child care credits for people regardless of their marital status, reflecting the notion that child rearing, while desirable from a national perspective, has an adverse effect on a caregiver’s earnings history. Such a proposal could be as simple as allowing people with children to drop some years when calculating their average earnings in the benefit calculation process.

Now that everyone seems to be talking about expanding Social Security, introducing a child care credit would be a great addition.