The Stock Market Has Been Kind to the Boomers

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

When the stock market tumbled almost 5 percent in early August, thoughts hearkened back to the market collapse when equity prices fell 57 percent from October 9, 2007 to March 9, 2009. Much of the losses in equity values occurred in 401(k)s and IRAs held by Early Boomers approaching retirement. Those already retired were more reliant on traditional defined benefit plans for retirement income and therefore held relatively modest 401(k) balances. Late Boomers had smaller balances than their older counterparts, and Gen Xers had not yet accumulated substantial 401(k) assets. Therefore, not surprisingly, the decline in equity values experienced by older workers received an enormous amount of attention.

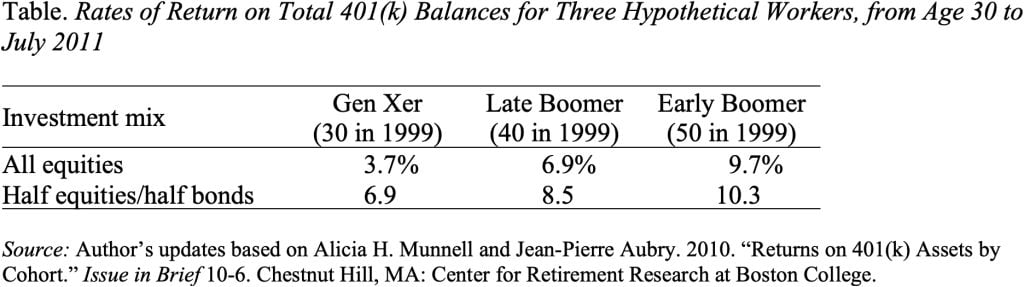

As jarring as the financial collapse and today’s gyrations may be for the Early Boomers, the market has actually treated them well over their lifetime. In an earlier study, which I have updated for this blog, we estimated the internal rate of return for three hypothetical employees who were age 30 (Gen Xer), 40 (Late Boomer), and 50 (Early Boomer) in 1999. All three employees began contributing 6 percent to their 401(k) at age 30, and their employers made a matching contribution of 3 percent. The employees’ starting salary was based on median earnings for those 30, 40, and 50 with 401(k)s, as reported in the Federal Reserve’s 1998 Survey of Consumer Finances. Nominal salary growth was estimated at 3.3 percent.

The results show that Early Boomers have come out well ahead of subsequent cohorts. Despite the financial collapse, Early Boomers have earned an average annual return of 9.7 percent on an all-equity portfolio between age 30 to July 2011, a return roughly equal to the historic benchmark. The comparable numbers are 6.9 percent for Late Boomers and 3.7 percent for Gen Xers (see Table). The pattern is similar for accounts with half equities and half bonds.

This agreeable outcome for Early Boomers is the result of these workers accumulating substantial assets during the long bull market that began in 1982 and ended in 2000. Late Boomers and Gen Xers never benefited fully from the 1982-2000 market expansion and were hard hit by two market collapses.

The question is how much younger cohorts would have to earn going forward to end up with the same ratio of assets to income at age 60 currently enjoyed by the Early Boomers. Our calculations suggest that stocks would have to average a nominal compound return of 13.2 percent for the Late Boomers and 11.2 percent for the Gen Xers, who have more time until retirement. The returns required for both the Late Boomers and Gen Xers may not be impossible, but they are certainly on the high side of average.

In short, subsequent generations are going to have to save more than the Early Boomers to be as well off. The only immediate way to help these later cohorts is to make sure that 401(k) auto-enrollment and savings escalation policies cover existing workers as well as new hires.