How Much Do People Rely on Social Security?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Answering that question highlights the need for better data.

A reporter asked the other day how dependent people were on Social Security. The query sent me scurrying to find the latest Social Security Administration statistical publication showing the percentage of households relying on Social Security for more than 50% or 90% of their income.

It turns out that the latest date for that publication was 2017. This didn’t come as a total shock, since the reported calculations were based on the Consumer Population Survey (CPS), and a 2017 study identified serious reporting errors in this survey, particularly for pension and retirement income. To state the obvious, underreporting of other sources of retirement income would overstate the importance of Social Security.

Fortunately, a pair of SSA researchers have produced a nice paper comparing the picture based on the CPS with that based on: 1) a survey with better reporting of retirement income (the Health and Retirement Study) and 2) the CPS survey linked to benefit data from SSA and income data from the Internal Revenue Service.

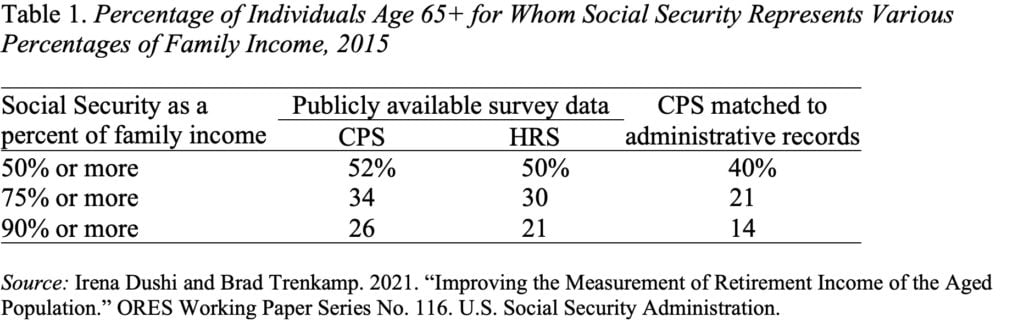

The bottom line is shown in Table 1. The CPS data suggest that for 52 percent of individuals Social Security accounted for more than 50 percent of their family income, for 34 percent it accounted for more than 75 percent, and for 26 percent 90 percent or more. Using the HRS produces slightly lower numbers.

Linking the individuals in the CPS with their SSA benefit and IRS tax data produces significantly lower reliance on Social Security. Now only 40 percent individuals are in households where 50 percent or more of family income comes from Social Security, 21 percent where it accounts for 75 percent or more, and 14 percent where it accounts for 90 percent or more. The main difference between these numbers and the CPS alone is the better measure of retirement income coming from the IRS tax data.

So, you say, use the survey linked to the administrative data and call it a day. That’s not a perfect solution, however. First, to protect personally identifiable information, it is very difficult for those not working for the government to get access to the administrative records from SSA and particularly the IRS. Second, all this linking takes a lot of time and work. Third, note the data are for 2015, because the process requires interagency cooperation and lengthy disclosure review that inevitably involves delays. Finally, as helpful as the SSA paper is, the authors didn’t do everything that I might like. It would be interesting to look at reliance by income level. It would be interesting to look at households rather than individuals. It would be interesting to look at reliance just for retirees so that earnings were no longer a source of income. And lots of other stuff.

So, the way forward in my view is to improve the reporting of other sources of retirement income (both payments from defined benefit plans and withdrawals from defined contribution plans) in the CPS. A redesigned CPS questionnaire was fielded in 2015, and comparisons using a split sample design indicated that the prevalence of retirement income other than Social Security was 50 percent higher than in the former questionnaire and income was 22 percent higher. So, the effort produced real improvement. But, the recent SSA study shows that a lot of work still needs to be done.

Let’s do it. We all need good data.