Social Security Is Valuable and Needs Attention Sooner Rather than Later

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

This program has demonstrated its worth in tumultuous times.

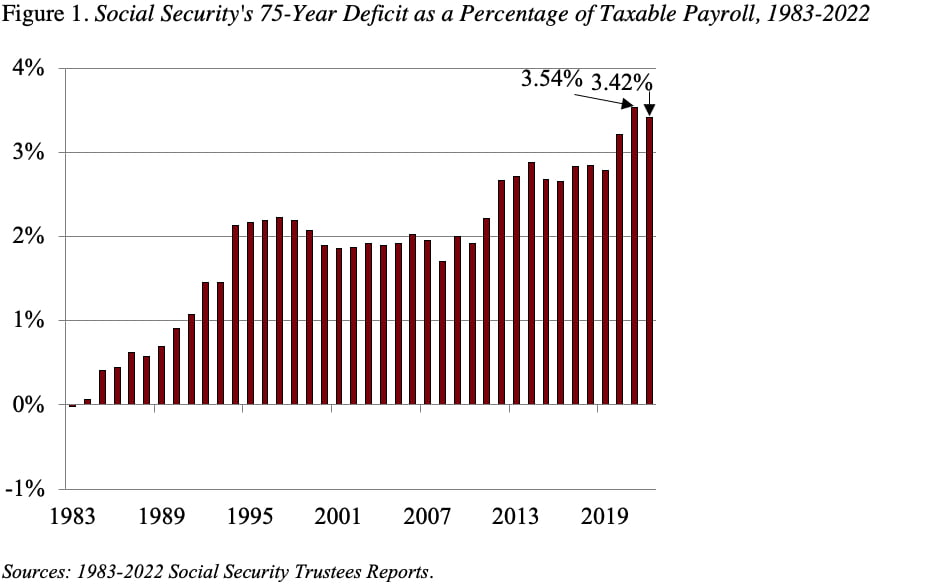

The 2022 Social Security Trustees Report, which was prepared in February when the outlook for the economy looked less uncertain, shows a slight decrease in the program’s 75-year deficit from 3.54% to 3.42% of taxable payroll (see Figure 1). The depletion date for the trust fund bounced back from 2034 to 2035.

What does a deficit of 3.42 percent of taxable payrolls mean? That figure means that if payroll taxes were raised immediately by 3.42 percentage points – about 1.7 percentage points each for the employee and the employer – the government would be able to pay the current package of benefits for everyone who reaches retirement age at least through 2096.

Any package, however, that restores balance only for the next 75 years will show a deficit in the following year, as the projection period picks up a year with a large negative balance. Realistically, eliminating the 75-year shortfall should probably be viewed as the first step toward long-run solvency.

What does depletion of the trust fund mean? The depletion of the trust fund does not mean that Social Security is “bankrupt.” Payroll tax revenues keep rolling in and can cover about 75 percent of currently legislated benefits over the remainder of the projection period. Relying on only current tax revenues, however, means that the replacement rate – benefits relative to pre-retirement earnings – for the typical age-65 worker would drop by more than 25 percent.

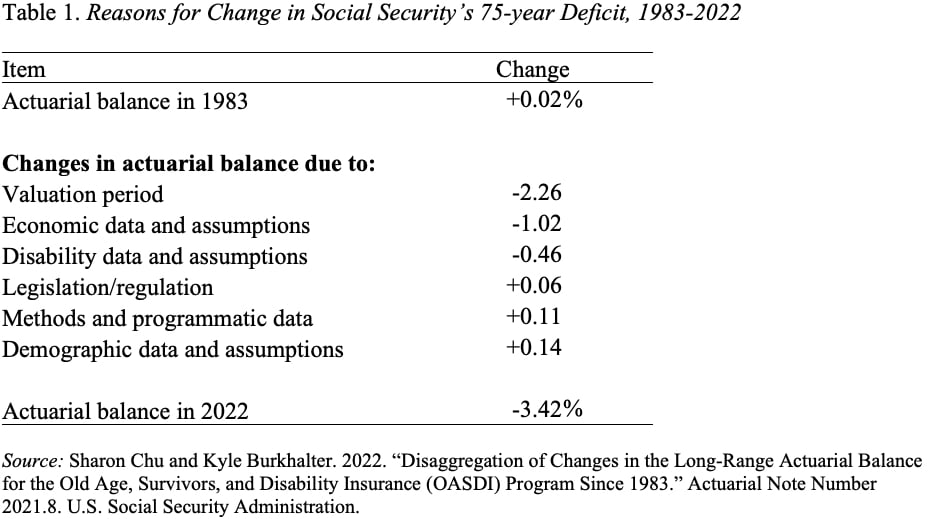

How did we get to a projected deficit in 2022 from a projected 75-year surplus in 1983? Leading the list is the impact of changing the valuation period (see Table 1). That is, the 1983 Report looked at the system’s finances over the period 1983-2057; the projection period for the 2022 Report is 2022-2096. Each time the valuation period moves out one year, it picks up a year with a large negative balance. A worsening of economic assumptions – primarily a decline in assumed productivity growth and the impact of the Great Recession – has also contributed to the increase in the deficit. Partially offsetting the negative factors has been a reduction in the actuarial deficit due to changes in demographic assumptions – such as higher mortality – and some changes due to legislation and methodology.

Why did the deficit drop between 2021 and 2022? The change was the net result of four factors. On the one hand, advancing the valuation period by one year and new demographic data/assumptions increased the deficit. On the other hand, a stronger and faster economic recovery than anticipated in last year’s report and a reduction in the ultimate assumption about the disability incidence rate more than offset the adverse changes.

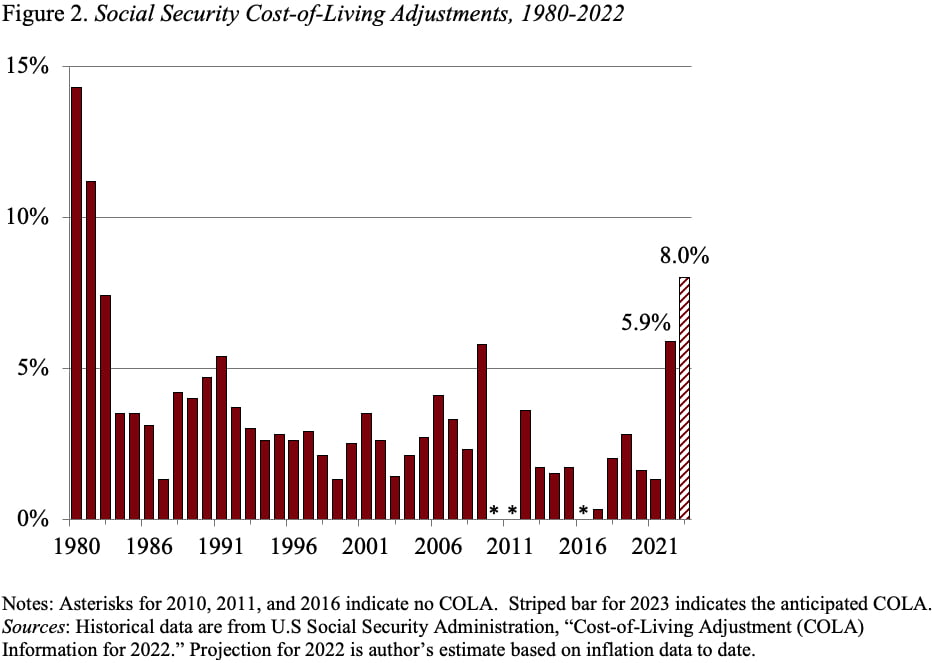

The bottom line is that Social Security continues to demonstrate its worth during these tumultuous times, when – in the face of economic collapse – it provided steady income to retirees and those with disabilities and – in the face of unprecedented inflation – it provides annual cost-of-living adjustments (see Figure 2).

The program faces a manageable financial shortfall over the next 75 years, which should be addressed so that Americans will have confidence that the program will be able to pay the full benefits going forward.