Vanguard Data Show 401(k) Leakage Process

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Leakages appear to reduce 401(k)/IRA balances at retirement by about one fifth.

This blog is to sing the praises of data put out by Vanguard (How America Saves) in helping to understand what is happening in terms of leakages from 401(k)s plans and Individual Retirement Accounts (IRAs). The only way to end up at retirement with significant accumulations is to put the money into a 401(k) account and leave it there until retirement. (IRAs are included in this discussion because 401(k) assets are often rolled into IRAs). But the 401(k)/IRA system clearly plays a dual role – it provides for retirement saving, but it also supports current consumption. In terms of policy, the favorable tax treatment of retirement saving and the imposition of a 10-percent penalty (in addition to regular income taxes) on any withdrawal before age 59½ are designed to encourage retirement saving. On the other hand, people are allowed to cash out when they change jobs, withdraw money for hardships, take out money penalty free after 59½ and take out loans, which involve the risk of default especially when they terminate employment. These leakages may be spent in worthwhile ways and the ability to gain access to funds appears to encourage participation and contributions, but money spent while working is not available at retirement.

The Vanguard data allow the researcher to understand how much is withdrawn from 401(k) plans and how much of these withdrawals is rolled over into an IRA or spent. Prior to the Vanguard data, I – like many others – wrote at length on components of the leakage process where data were available, such as whether people taking out loans used their borrowings for consumption or for investment. Researchers were like the blind man feeling different parts of the elephant, writing about the ear or the trunk or the tail, but with no sense of what the total elephant looked like.

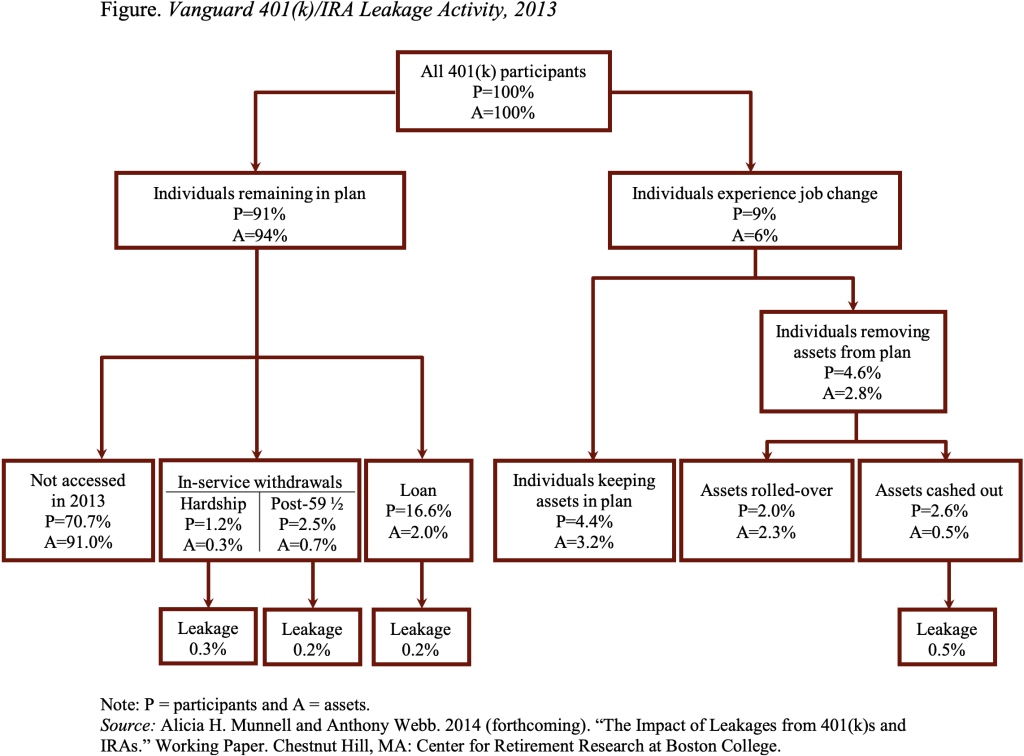

Vanguard lets us see the whole elephant by providing flows into and out of the defined contribution accounts that it administers. Workers who stay with their current employer can access their funds through a loan or through an in-service withdrawal for hardship or a penalty-free withdrawal after age 59½. Those who change jobs can access their funds by cashing out. Using the information in the Figure, plus some research on the leakage through loans (Lu et al. 2014), it is possible to calculate the percent of 401(k) assets that leak out each year. In 2013, the total was 1.2 percent. That number may sound small, but it results in balances at retirement that are almost 20 percent smaller than they would have been in the absence of leakages. Interestingly loans, about which we have all written so much, play only a minor role.

The Vanguard numbers on leakages must be viewed as a lower bound, since the company administers only about 10 percent of the market and large plans tend to be overrepresented in its data. Large plans – with higher-paid employees – most likely have lower leakage rates. Indeed, a study looking at leakages out of 401(k)s and IRAs put the figure at 1.5 percent. And studies using tax data suggest an even higher leakage rate. But at least we now know the overall picture.