Low Earners Need More Retirement Income

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Social Security alone is simply not enough, new Vanguard study confirms.

People often assume that the retirement needs of low-wage workers are covered by Social Security’s progressive benefit formula. That assessment has never been correct.

Social Security was never intended to be the sole source of income for any group of retirees. Social Security replacement rates – benefits as a percentage of pre-retirement earnings – fall far below the generally accepted benchmarks. And low earners are more likely to claim early, which results in an actuarial reduction in their replacement rate. As a result, at age 62, Social Security currently replaces just 41 percent of a low-paid worker’s pre-retirement earnings. For those low-income workers who must pay some or all of their Medicare premiums, the net replacement rate from Social Security is even lower. Thus, low-income workers – like their middle- and higher-paid counterparts – need supplementary retirement income.

A new report from Vanguard drives this point home in spades. The researchers estimate retirement readiness for different cohorts and income groups. The estimates incorporate inputs from Vanguard’s capital market model in combination with empirical data on household balance sheets, savings rates, and spending patterns to estimate retirement readiness.

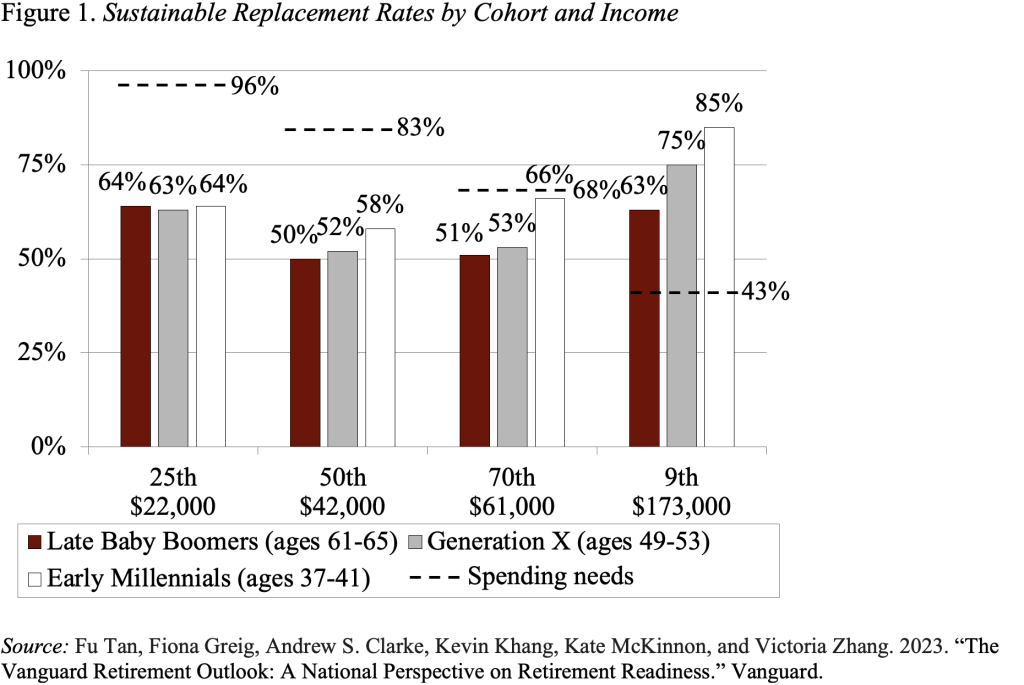

Retirement readiness involves comparing two replacement rates. The first is the sustainable replacement rate – the highest level of consumption as a share of pre-retirement income that the worker can sustain in 90 percent of market return/mortality scenarios. The second is a target replacement rate based on retirement spending needs inferred from national survey data. The difference between these two replacement rates is the household’s projected savings gap at age 65. The basic results are shown in Figure 1. While high-income workers across all generations are on track to meet their spending needs, all other groups are projected to fall short. The shortfall is not that large for those at the 70th percentile, and the picture improves substantially for the youngest cohort.

The story for the bottom half of the population is much grimmer. The gaps between target and projected replacement rates are very large for those at the 25th percentile and the 50th percentile of the income distribution. For the 50th percentile, the situation appears to be improving slightly for younger cohorts, but no improvement is evident across cohorts for low-wage workers.

Let me make two comments. First, the Center for Retirement Research has been putting out a similar – albeit less sophisticated – product since 2006 – the National Retirement Risk Index. This Index has consistently shown that a very large share of working-age households in the bottom third of the income distribution will not be able to maintain their consumption in retirement. It’s wonderful to have another study from such a respected source that supports those findings.

Second, the Vanguard numbers make the case that low-wage workers need a way to save. This concern has led to the adoption of Auto-IRA programs in 14 states for workers whose employer does not offer a plan. These plans are essential, and we need to do everything to strengthen them. The plight of the low-wage worker also underlines the importance of the launching of the expanded Savers Credit. Finally, the numbers show how crucial it is to find a solution for Social Security before the depletion of its trust fund reserves in the early 2030s.