What’s Going on with IRAs?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Retirement needs are increasing as people live longer and face skyrocketing health care costs. Meanwhile, retirement resources are declining as Social Security will replace less of pre-retirement earnings even under current law, employer-sponsored plans are increasingly 401(k) plans with modest balances, and people save little on their own. As a result, retirees will have a hard time making ends meet once they stop working.

Appropriately, policymakers want to make the retirement system work better, and their focus is on 401(k) plans. The Pension Protection Act eliminated barriers and introduced safe harbors to encourage automatic enrollment in 401(k)s. The legislation also recognized that the inertia that makes automatic enrollment effective for participation can lock people into low levels of contributions. To combat this problem, the legislation encouraged automatic increases in the default deferral percentage.

On the regulatory front, the Department of Labor has expressed concern about the cost to participants of 401(k) plans and has issued regulations requiring 401(k) sponsors to disclose fees and expenses. These items are extremely important. For example, an extra 100 basis points reduces a 401(k) participant’s real rate of return by about 25 percent.

In terms of ongoing debate, experts are concerned about how 401(k) participants will withdraw their funds once they stop working. If they withdraw too much early, they risk exhausting their resources; if they withdraw too little, they may deprive themselves of necessities. Annuities, which provide a guaranteed stream for life in exchange for a one-time premium, could solve this problem, but people hate annuities. So a debate has emerged about having a default provision whereby some portion of 401(k) balances would be automatically annuitized.

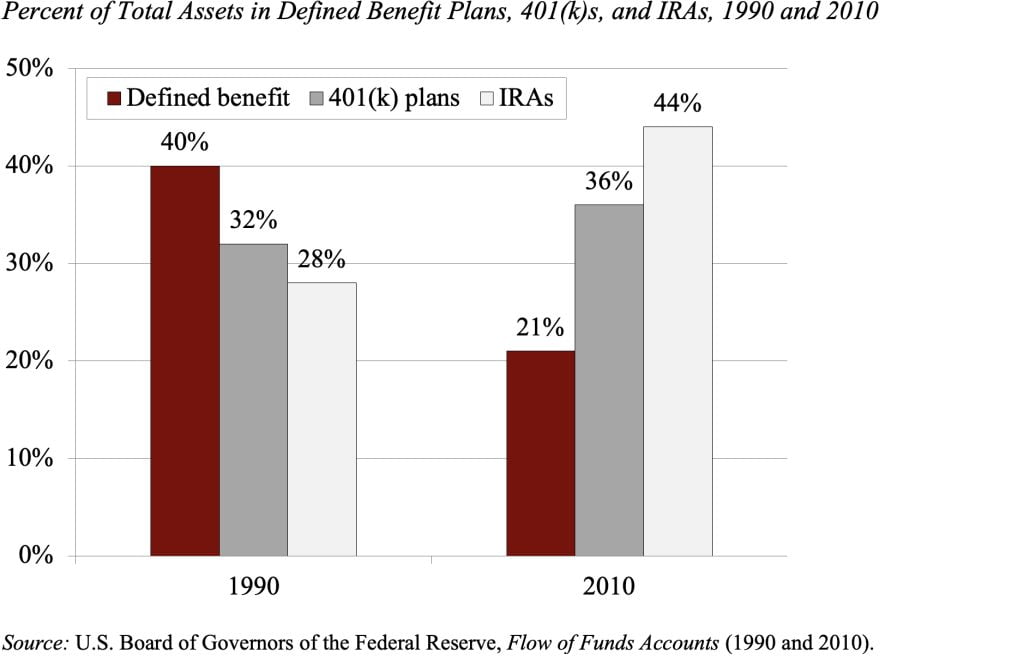

All the legislation, regulation, and debate is warranted. 401(k) plans need to work as well as possible. But that is not the end of the story. Contrary to public perception, most of people’s retirement assets are not in 401(k) plans. They are in Individual Retirement Accounts (IRAs), which currently hold more assets than either defined benefit plans or 401(k)s (see Figure). Most of the money in IRAs consists of rolled-over balances from 401(k) plans.

The bottom line is that everyone is focused on a component of the retirement system that holds a stagnant share of retirement assets. The real money is increasingly in IRAs. Yet virtually none of the legislation, regulation, or policy debate applies to these accounts. And participants are more at risk with IRAs than with 401(k) plans. IRA participants have no fiduciary to look after their best interest, they “pay retail” for their investments, and their spouses have little protection.

The challenge is that changes to 401(k)s do not automatically apply to IRAs. IRAs and 401(k)s are covered by different parts of the Internal Revenue Code, and most ERISA provisions cover only plans provided by the employer. But to keep focusing on 401(k) plans when the money increasingly migrates to IRAs just does not make sense. We are fighting the last war.