What’s Preventing More Small Businesses from Offering Retirement Plans?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

While concern about stability is understandable, worry about costs is based on serious misperceptions.

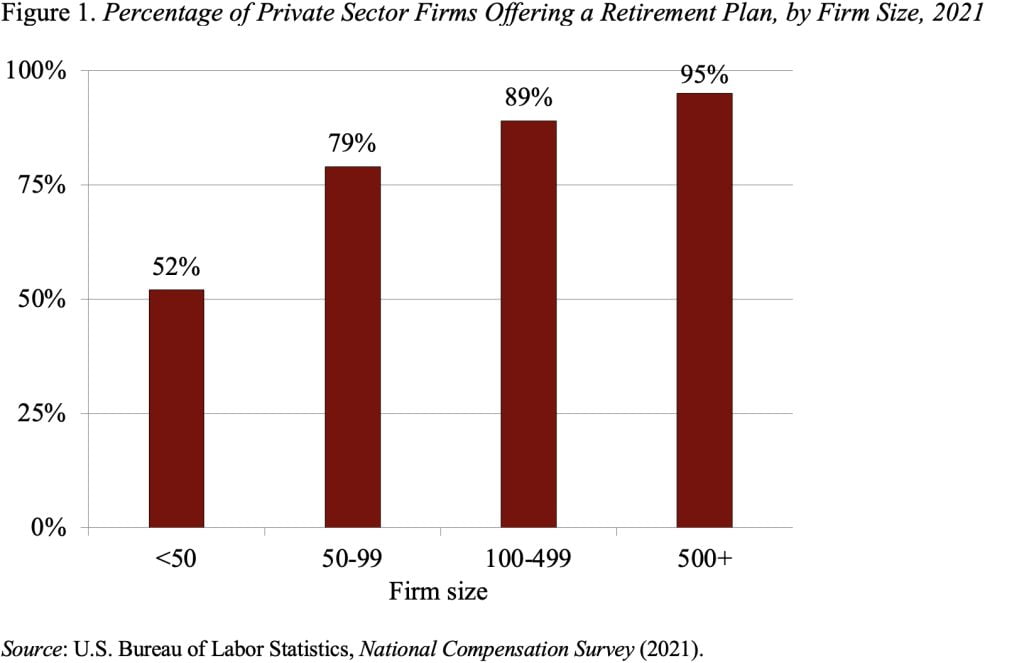

At any given time, only about half of private sector workers in the United States are covered by an employer-sponsored retirement plan, and few workers save without one. Numerous studies have shown that offering a retirement plan is closely related to firm size; firms with fewer than 100 employees are much less likely to offer a plan than larger firms (see Figure 1).

As a result, observers tend to dismiss small firms as a source for future growth in coverage. In fact, though, many small businesses do offer retirement plans. The question is what’s preventing other small firms from taking the leap?

While recent surveys have touched on small businesses and retirement plans, the last comprehensive survey was more than two decades ago. Historically, small firms have consistently cited the same three major barriers: uncertain revenues that make it hard to commit to a plan; employee preferences for wages and other benefits; and the costs associated with establishing and administering a plan.

To determine whether perceived barriers have changed over time, we worked with EBRI and Greenwald Research to replicate their 1998 survey. Interviews were conducted between February and April 2023 with 703 firms with 100 or fewer employees.

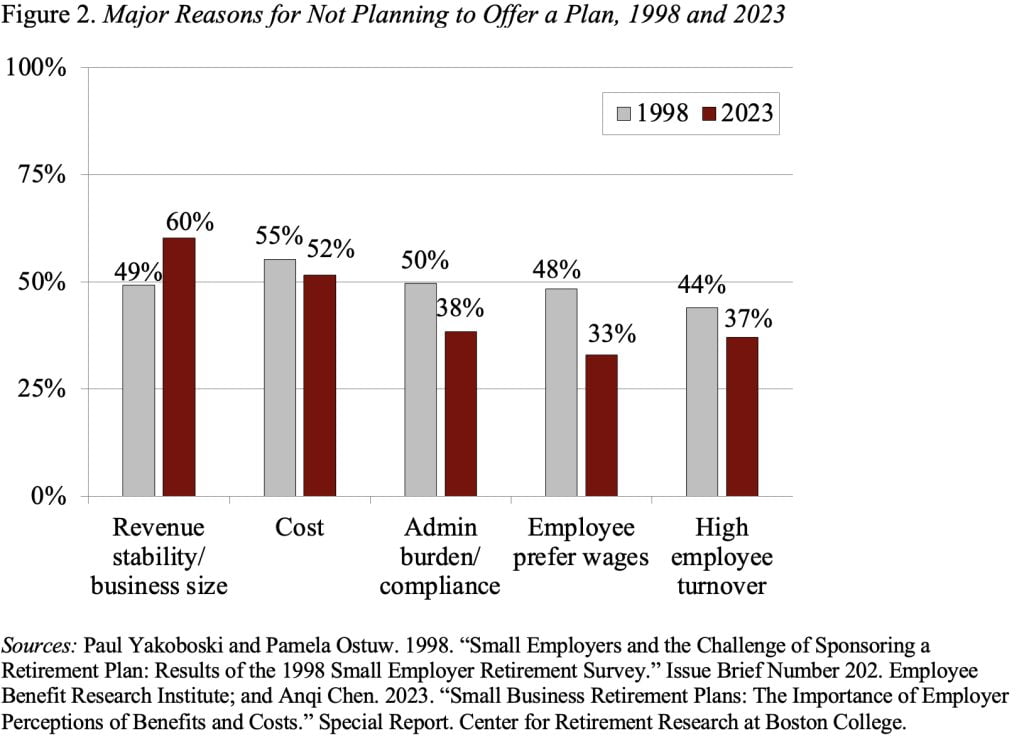

Figure 2 compares the responses of small businesses in 1998 and 2023. The top two barriers that prevent small firms from offering a retirement plan – revenue concerns/business size and costs or administrative burden – have remained important. Today, however, employers are far less likely to cite “employee prefers wages” as a major reason for not offering a plan.

The first concern – revenue stability/business size – seems compelling. Indeed, many small firms are new, and firms may need to become established before setting up a workplace retirement plan is seen as a viable option.

The second barrier, cost or administrative burden, however, seems to be driven by misperceptions. A quick Google search yielded several 401(k) options where annual employer costs would only be about $2,500 for a firm with 10 employees and $5,000 for a firm with 50 employees. But, over half of small firms believe providing a retirement plan would cost more than $10,000 per year; and nearly 30 percent think it would cost more than $20,000 per year.

Not only do small firms overestimate the cost of offering a plan, the vast majority – particularly those with fewer than 50 workers – are not aware that they can claim a tax credit of up to $5,000, for three years, to help offset the costs of starting a plan. Interestingly, about 80 percent of employers say that such a credit would make offering a plan more attractive.

These results suggest that many firms overestimate the financial and time costs required to offer a plan and that better awareness of lower-cost plan options for employers and tax credits could help move the needle on the coverage gap.