What’s Up with Medicare Advantage Ads?

Starting months before my 65th birthday, my mailbox has been swamped with advertisements for Medicare Advantage insurance plans. The ads are still coming in.

And then there are the television commercials with promises of Advantage plan benefits that original Medicare doesn’t cover – vision, dental, hearing services, rides to doctors’ appointments, zero premiums. Sounds amazing, doesn’t it?

The advertising blitz surely has contributed to the doubling in Advantage plan enrollment since 2013, to 28 million last year. The plans are overtaking Medigap plans, which the nonprofit Commonwealth Fund estimates do not bring in as much profit for brokers as Advantage plans.

It is true that the vast majority of Advantage plans provide some type of vision, dental and hearing coverage. And retirees with these benefits in their Advantage plans spend slightly less for the services than other retirees, the Kaiser Family Foundation, a healthcare non-profit, found.

But the devil is in the details.

For example, the average dollar limit for vision benefits in Advantage plans was $160 in 2021, said Meredith Freed, a senior policy analyst at Kaiser. That $160 probably wouldn’t be enough to pay for an exam and buy the prescription glasses. The television and mailed advertisements are short on these details.

Or consider dental coverage for preventive services, such as cleanings and X-rays. This coverage might be useful, but the plan might not cover cavities, root canals and caps. Or, if they are covered, a $1,000 limit is fairly common and insufficient for many expensive procedures, Freed said. And what about the two out of three Advantage plans that do not charge a premium? The ads touting “zero premiums” aren’t usually clear that you’re still responsible for Medicare’s Part B premium of $164.90 per month.

“I’m hesitant to use the word misleading,” Freed said. But when choosing a Medicare Advantage plan, “Unfortunately, it’s on the consumer to dig more when they’re interested in a plan” to understand not only how the specific plans work but also how Medicare’s underlying benefits work, she said.

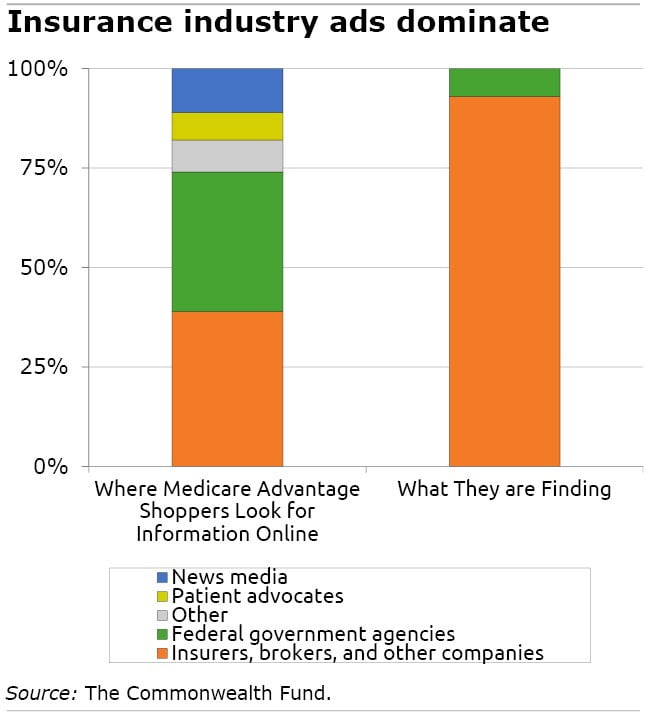

An analysis of Google search data has found that older Americans are not finding the kind of information online that they are seeking about their Medicare options. Instead, they are being bombarded with advertising by insurance companies, agents, and brokers, according to the Commonwealth Fund.

Older people search for Medicare information online from a diverse range of sources – patient advocacy groups, the media, and federal agencies including Social Security and the Centers for Medicare and Medicaid Services (CMS). A minority of the searches are for insurance industry information.

But online advertisements by agents, brokers, and insurers are prevalent in the top links in their Google searches and account for 87 percent of all online Medicare ads.

CMS, which provides useful information about the basic benefits or open enrollment dates or urges beneficiaries to shop around, is the primary source of the remaining 13 percent of the ads.

Meanwhile, retirees have more than 40 Advantage plans to choose from – more than double the choices five years ago.

If online searches aren’t turning up the information you need, try calling your State Health Insurance Assistance Program (or SHIP). Every state has one. Our blogs – two published in November and one during 2021 open enrollment – provide more detail about the process and the options available to retirees.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Medicare Advantage plans are great for people who don’t plan to get sick. But if you are sick, you likely care about the quality of the physician. Medicare Advantage plans restrict participants to networks, and you may find your preferred physician is not a member of the insurer’s network

They should not allow these profit making entities to make political contributions to Congress and Senators.

A couple of comments regarding these advantage plans… 1) The hype begins in the fall and pushes the fact that they have until (this year) December 7th. The ads get very tiresome and we look forward to December the 7th. However as soon as January pops up so do the Ads. What gives and they are a PIA.

Another comment/question that is never mentioned and is very important is that Advantage plans require you to stay within your own system and do not have the ability to pick the doctor/hospital of your choice.

The ads pop up in January because from January 1st until March 31st there is a General Enrollment period when you can enroll for Medicare, including Advantage plans, if you didn’t do it when you were first eligible. Also during this time, you can switch to another Advantage planplan or drop your Advantage plan and switch back to Original Medicare.

Medicare Advantage plans love to skim off the cream – healthy seniors whose costs will be lower than average – and so tout things like gym memberships that will attract these seniors. They then try very hard to make their members APPEAR more sick by looking for diagnoses to up their payments from Medicare. Ever had a slightly high blood sugar – you are diabetic; one high BP reading – you have hypertension. Capitalism in action.

Actually, virtually all of the comments here are incorrect. You are speaking with someone right now who has been in this business since 1992.

Virtually every company that markets, Medicare advantage, plans markets, several types of different plans, including PPOs, that have very few to no network restrictions; and their co-pays aren’t much higher than the low co-pays in HMOs.

AARP is one of the largest contributors to politicians in the nation and is one of the most powerful lobbying organizations on the planet and they are the reason that Medicare advantage plans offer so many benefits. Everyone in this country is allowed to donate to politicians.

Dr. Hoffer, you are incorrect in your commentary regarding skimming off the cream. We are not allowed to even ask health questions, and we must enroll anyone in the plan who wishes to enroll. You are however, correct in the regard that Medicare advantage plans do, in fact, manipulate the system; have been caught doing so, and are going to be punished for it.

I hope this information helps; I have been marketing Medicare advantage plans since the very day the plan started in 2004

You need to do better research. The truth of the matter is that Medigap plans gouge seniors as they age and they perpetuate Medicare Fraud as physicians overutilize services when they know it isn’t costing the senior anything. This is not anecdotal it is personal experience. I was a healthcare compliance professional for over 25 years. I dealt directly with Medicare Fraud and billing issues. In addition, one of my current clients was sent to 56 specialists last year. The Blue Cross Med Sup that he was on never batted an eye and why would they, Medicare will pay them whatever they submit. However, the claims did get audited and Blue Cross had to recoup their payments for the unnecessary services. Your criticism of the vision is based on a lack of understanding as well. The advantage plans in Arkansas cover the office visit in full (and most have $0 copay), they provide $200-400 for frames and your lenses are covered in full. The Advantage Plans have FAR BETTER rates on prescription drugs than stand alone prescription drug plans and clients can save thousands in co-pays by moving. You are also wrong about agents earning more on Medicare Advantage Plans than Medicare Supplements (aka Medigap policies). When selling Supplements, agents earn a percentage of the premiums of the policies they sell. Unlike Medicare Advantage and Part D, CMS does not set a maximum broker commission fro Medicare Supplements. There are many more inaccurate generalizations in your article. Please educate yourself. I am not saying all Advantage plans are good. There are many that I refuse to sell because they are not good for my clients. Also, for what it’s worth…I move seniors off of Medicare Supplements every week and enroll them in Medicare Advantage and I’ve never had a client take advantage of the one-year guarantee to move back to their supplement. Speaks volumes to me.

I’m 69 with all my ducks in a row how do I get them to quit calling sometimes ten times a day? Enough is enough!

Agree with all the above comments, but I want to add that I can’t say enough good things about the SHIP program, esp. in MD, my state. I was all set to pick a Medicare Advantage policy and after visiting SHIP, I changed my mind to original Medicare. It’s not that they were biased against Advantage, but they pointed out the disadvantages so obscured in the advertising. You do have to find a Medigap policy but there are good options available.

Medicare Original Plans vs Medicare Advantage Plans

The largest draw of Medicare Advantage Plans over Original Medicare Plans is their coverage for prescription drugs, which can be costly for seniors. The other perks like vision or dental care are not normally worthwhile. Since most Medigap medical plans do not cover prescription drug coverage, one has to purchase a separate plan for prescription coverage on top of the cost of the Medigap Medical Plan, which can become an expensive added cost.

The choice of doctors and networks can be a valid concern. Medicare Advantage PPO Plans can help in this regard over the typical HMO Plans. They provide in and out of network access to providers. It helps to review the doctors in the provider network plans, but always call the providers you use to determine if they are in the network because some Advantage Plans publish a broader network of providers, many of whom don’t accept the plan.

The other challenge for seniors are healthcare providers who don’t accept either Original Medicare or Medicare Advantage Plans.

Just think about how much more money could be spent for actual health care, if Joe Namath didn’t have to be paid to “hawk” Medicare Advantage. Insurers do indeed

“cherry pick” and “lemon drop” and squeeze as much money from Medicare for each patient.

It is time to stop profiteers from shaking the Medicare money tree! We need a single payer health insurance plan that covers all Americans!

Other G7 nations manage to do this….why is the US an outlier?

If you have cancer stay in your medigap plan. This is where these plans fall way short on providing care for chemo or radiation treatment. You could hit max out of pocket quickly. I have been cancer free for 5 years but I can’t go back to a medigap plan,they won’t accept me. You maybe very healthy until the doctor says you have cancer, all of a sudden you are not healthy anymore

Read the fine print.

A few misleading items in the article. The dental limits range from 1k to 2k. The majority of individual dental plans & even employee plans generally have 1k limit. The companies that sell MA plans are the same companies that sell the Medigap plans and prescription drug plans. The provider network is a lot more extensive because a lot of doctors know if they want a part of the Medicare pie they need to accept MA plans. I’m a Medicare Counselor with the S.H.I.P. program. We help people to find the best Medicare plan for them. And that is the plan that works for tthem, not their neighbors, not their friends, but the plan that works for them which may be a Medicare advantage plan or it may be original Medicare. It depends on their medicines and their doctors. You cannot make a generalization about this. There is a SHIP program in every state. We are not connected to any insurance company and we help Medicare Beneficiaries and their families navigate the maze of Medicare and help sign them up with a plan with an informed decision. Look on the back of your Medicare and You handbook for the SHIP agency in your area.

I am a SHIP counselor in California, the program is identified as HICAP here. Here is a link to find SHIP counseling services: https://www.shiphelp.org/ click on “Ship Locator”

SHIP is chartered to provide free, unbiased help.

Medicare Advantage ads miss 2 pieces of info customers need to make an informed decision. 1. The amount of the Maximum out of pocket and how many customers hit it each year. No insurance company will give out this info. 2. PPO plan ads need to include the amount of coinsurance for going out of network. If it is more than 20% they need to look for another plan.

The article doesn’t mention the cost of hospital stay over a number of days. Some brokers post YouTube videos that show in the long run Medicare Advantage is a disadvantage, and you might do better with a Medicare Medigap plan. It can be very confusing especially when one has to pay for a Medicare Part D drug plan considering Medicare Advantage plans claim to offer a drug plan like Tier 1 that many seniors might not readily understand.

What we do to seniors—most of whom have contributed for years to fund Medicare — should be an embarrassment to us, as a nation. The Medicare choices seem endless, are absurdly confusing and those who are positioned to ‘help’ by selling us Medicare plans (other than SHIP, for example) are given bonuses by these plans once seniors buy into them. Why are we tolerating this?

Thank you for this information. These Advantage plans sound like insurance, not Medicare.

I’m not sure what you’re trying to say with this article. Medicare Advantage plans are a type of private health insurance plans that are an alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare.

“I’m hesitant to use the word misleading…”

Ah, yes, the words “cheating” and “stealing” are far more appropriate.

https://www.npr.org/sections/health-shots/2022/12/12/1141926550/medicare-advantage-plans-overcharged-taxpayers-dodged-auditors

Some of these reasons include increases in premiums, co-pays, or deductibles. The rule, proposed by the Centers for Medicare and Medicaid Services, would ban ads that market Medicare Advantage plans with confusing words.

Medicare Advantage plans love to skim off the cream – healthy seniors whose costs will be lower than average – and so tout things like gym memberships that will attract these seniors. They then try very hard to make their members APPEAR more sick by looking for diagnoses to up their payments from Medicare. Ever had a slightly high blood sugar – you are diabetic; one high BP reading – you have hypertension. Capitalism in action.

Do not miss the fact that all these companies have PPO plans in which you can go out of the network. Yes you pay more but likely not much more, 10% or $20 per visit. Also it is prudent to check if your doctors are in the network and that all your drugs are covered.

For me it’s not so much “capitalism in action” but rather what’s in action is corrupt, corporate crony capitalism condoned by a complicit Congress that has been bought and paid for by insurance companies.

Perhaps CMS will crack down on the deceptive ads run by MA companies?

See this:

https://health.wusf.usf.edu/health-news-florida/2022-12-15/cms-proposes-a-crackdown-on-scam-medicare-advantage-ads

There are a couple of independent agents who have content on their web sites and YouTube that expose the issues with MA plans. Here are two:

https://medigapseminars.org/medicare-explained/

https://seniorsavingsnetwork.org/medicare-advantage/

Question: Do you want your doctor/health care provider making medical decisions regarding your treatment OR do you prefer having a for (very) profit(able) insurance company making those decisions?

They should not allow these profit making entities to make political contributions to Congress and Senators.

Agree! Most of our health care system is a racket. And don’t get me started on one of its worst aspects: prescription drugs. I’m sorry to say that we, as citizens, are simply too busy to pay attention to how badly we’re being ripped off — especially by entities within the health care industry that are owned by private equity. And our legislators are too dependent on the money these entities provide to ride herd on them. At the root of all this evil is a political system that has allowed campaign funding to run wild. You pay, you get to play.