Who Pays for Long-Term Care?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

People are really confused.

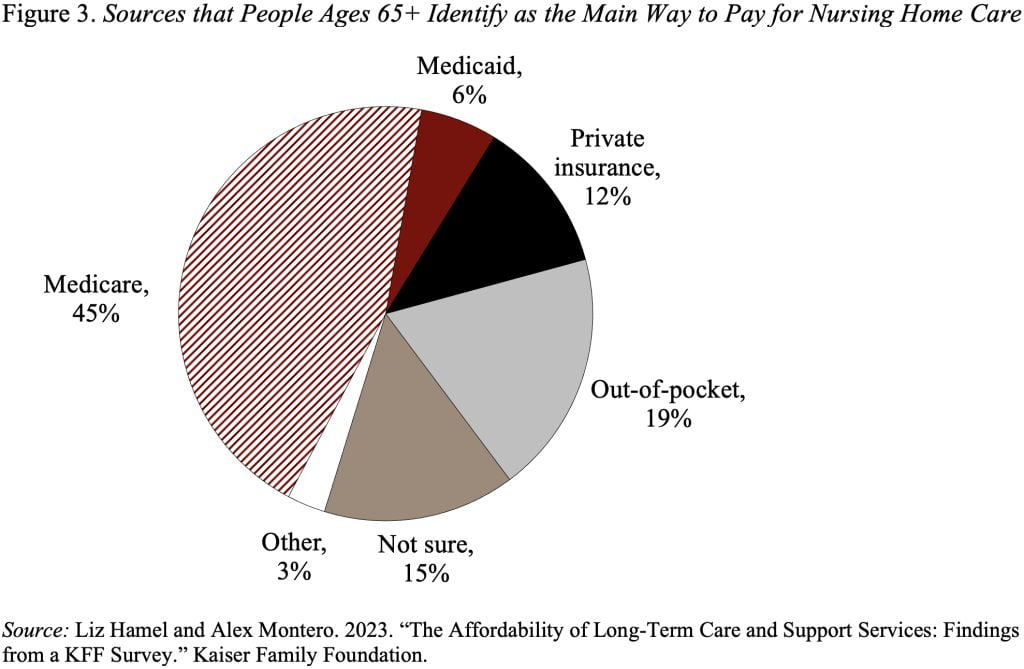

We’ve embarked on a host of studies about long-term care. One component of that effort is to assess the public’s understanding of how these costs are financed. A bunch of surveys over the last 10 years indicate that people are confused; most think that Medicare plays a major role. In fact, Medicare doesn’t cover any type of long-term care, whether in a nursing home, assisted living community or at home.

Medicare covers medical services – hospital care (Part A), physician care (Part B), and prescription drugs (Part D). It won’t pay for a stay in a long-term care center or the cost of custodial care, such as assistance with the activities of daily living like bathing, dressing, eating and using the bathroom — if that’s the only care needed. One potential source of confusion may be that Medicare will pay for short-term stays in a skilled nursing facility within 30 days of 3+ days in a hospital. However, over half of Medicare-covered skilled nursing facility stays are for 20 days or less, and over 90 percent for 60 days or less. Medicare also provides hospice care to individuals meeting a minimum level of need threshold. Since much of the care covered by Medicare is short term and associated with an acute event, no one should expect Medicare to cover their day-to-day long-term-care needs as they age.

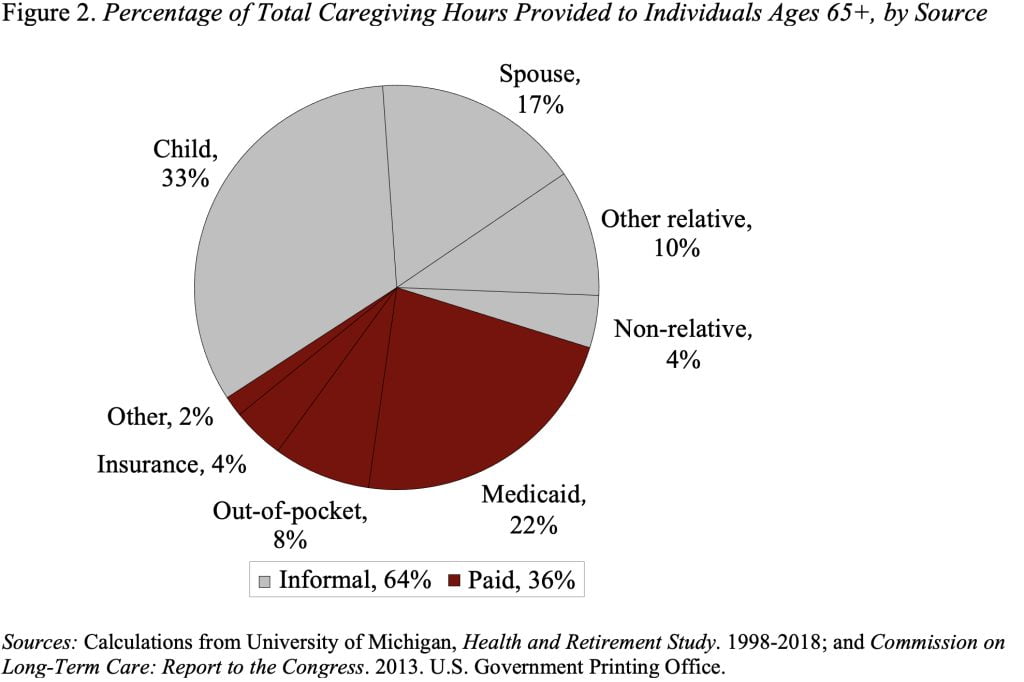

In terms of long-term care, the major public player is Medicaid – a joint federal-state program – which covers about 20 percent of the nation’s total care hours provided and pays a considerable portion of the nation’s nursing home bills. In order to qualify for Medicaid, however, retirees must have both a certain level of functional limitations and low levels of income and assets. Because the income and asset limits are so low, even with allowable exemptions, it can be hard for individuals to qualify for Medicaid when they initially develop care needs. However, over time, some of those with extensive needs spend down their assets and do end up qualifying. Therefore, Medicaid plays a bigger role than one would think at first glance.

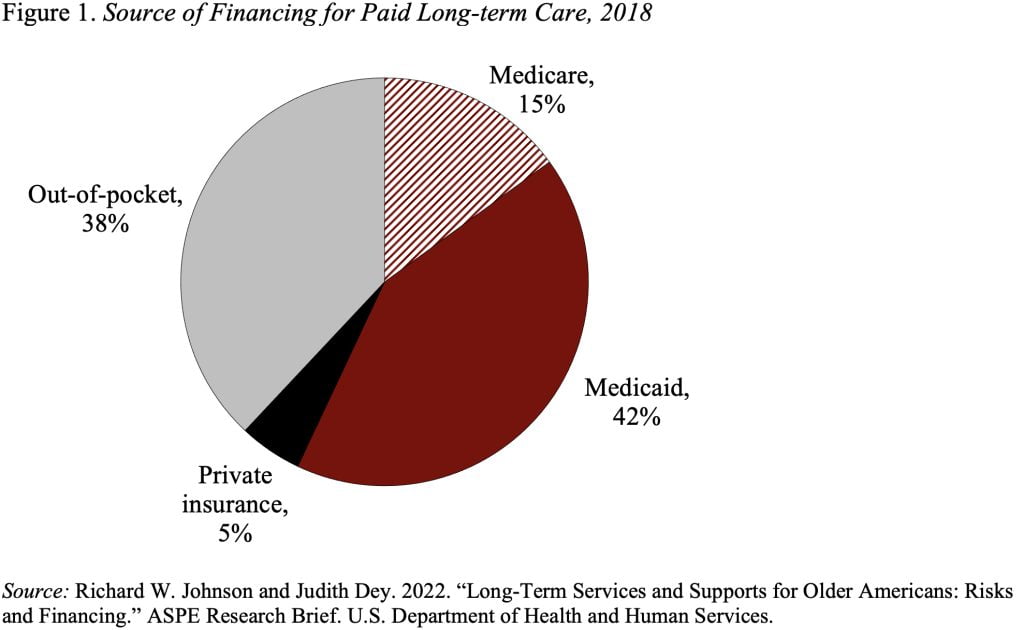

A recent study projected expenditures for people ages 65 through death for users of paid care; this calculation showed that 42 percent of the total came from Medicaid and another 38 percent from out of pocket (see Figure 1). The small amount attributable to Medicare is mainly hospice care – not something conventionally considered as traditional long-term care. Private insurance pays for only a sliver since most people do not have long-term care insurance.

It’s important to note that our estimates show that paid long-term care covers only 36 percent of total hours of care provided; most comes from informal care provided primarily by family (see Figure 2).

All that said, in a recent survey KFF asked participants: “If you or a family member had a long-term illness or disability and had to go into a nursing home, how would the bill mainly be paid?” The responses for those 65+, which are shown in Figure 3, indicate that 45 percent of respondents believed that Medicare would cover the cost.

Clearly, we have not done a very good job explaining the need for long-term care, how it is currently provided (mostly by family), and how the formal care is financed.