Why Do 37% of Older Workers Retire Earlier than Planned?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

In a horse race of competing explanations, health “shocks” win out.

More than a third of older workers retire earlier than planned: the question is why? My colleagues and I attempted to answer that question in a recent study.

The analysis uses data from the longitudinal Health and Retirement Study, collected between 1992 and 2012. The sample consists of all individuals who were working at the interview closest to their 58th birthday, an age when their retirement plans should be crystalizing. To identify when each worker planned to retire, the analysis uses a person’s response to the question, “at what age/year do you plan to stop working?”

The next step is to identify workers who retired earlier than they had planned. The actual retirement age is defined as the earliest age at which the respondent reports being fully, rather than partially, retired. In the final sample, about 37 percent of people meet this definition of early retirement.

Once individuals’ planned and actual retirement ages have been identified, it is possible to determine what shocks they experienced that may have led to an earlier retirement. The shocks were defined as follows:

- Health. Individuals faced two kinds of health shocks. The first occurs when existing health conditions affect one’s ability to work more than one anticipated – for example, when arthritis proves more debilitating than expected. The second occurs when someone’s health deteriorates between 58 and the planned retirement age.

- Employment. Employment shocks took three forms: 1) a voluntary shift to a new employer; 2) a job loss due to a layoff or business closing that is followed by a new job; and 3) a job loss due to a layoff or business closing that is not followed by a new job.

- Family. Familial shocks included: 1) spousal employment/retirement; 2) spousal health; 3) marital status; 4) the presence of resident children; 5) a first grandchild; 6) caring for a parent; and 7) a parent moving into the respondent’s home.

- Financial. Financial shocks were defined as a 50-percent+ fluctuation in a person’s wealth.

In determining which shocks matter most, two factors are important. First, how big is the impact of the shock on people who experience it? To determine a shock’s impact, a regression analysis related the occurrence of a shock to the probability of retiring early. Second, how many people actually experience it? After all, having one’s parents move in because they require care may have a big impact on retiring early, but this shock will not matter much if only a few people experience it. Determining the prevalence of these shocks simply involved counting up the occurrences in the raw data.

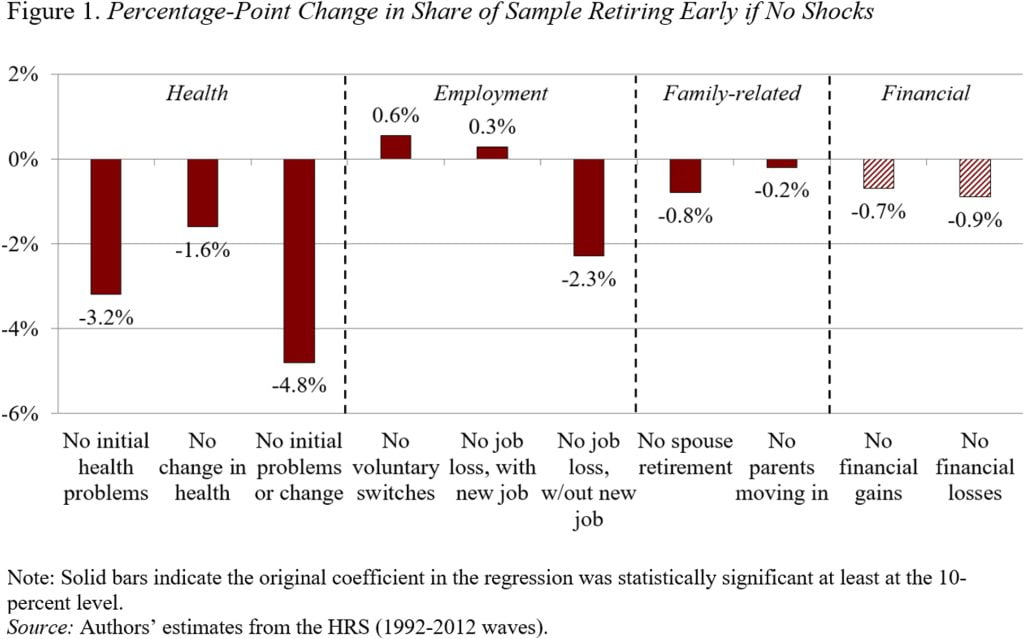

To determine which shocks matter most, the analysis calculated how much early retirement would drop if a given shock did not occur at all. For example, if everyone made their plans in perfect health and had no changes in their health, early retirement would drop by 4.8 percentage points, from 37.0 percent to 32.2 percent. And Figure 1 shows that health shocks win the horse race in explaining why people retire early.

An important caveat to these results is their limited explanatory power. Even if we set all shocks to zero, the counterfactual exercise would predict that the share of people retiring early would only fall from 37.0 percent to 26.9 percent. In other words, the factors considered here explain only about a quarter of early retirements.