Why Do So Many People Need Financial Help?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Easy answer: most households have little savings, and many jobs provide little flexibility.

A reporter called recently to ask why Americans are using Twitter to plead for financial assistance during the coronavirus. The answer is that the coronavirus is shining a spotlight on the vulnerability of a wide swath of American households.

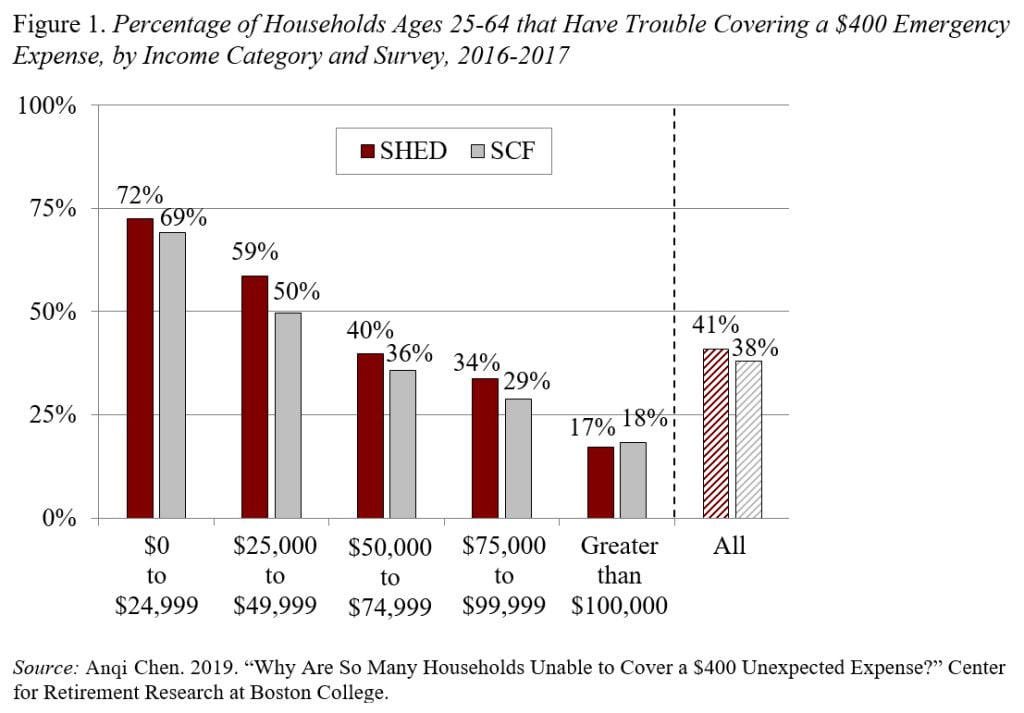

Start with financial resources. In 2017, in the midst of the strong economic recovery, about 40 percent of households interviewed by the Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED) said that they would have trouble paying for a $400 unexpected expense. Yes, it’s true that another Federal Reserve survey – the Survey of Consumer Finances (SCF) – shows only 20 percent literally have less than $400 in their bank accounts. But some households that have at least $400 in their bank accounts also have outstanding credit card debt of an equal or greater amount. Combine those households that have less than $400 in cash on hand (21 percent) with those that would have less than $400 in cash once they paid off their credit cards and the two surveys produce a very consistent picture (see Figure 1). Many households simply do not have the resources to weather a small emergency — much less a pandemic that might go on for months.

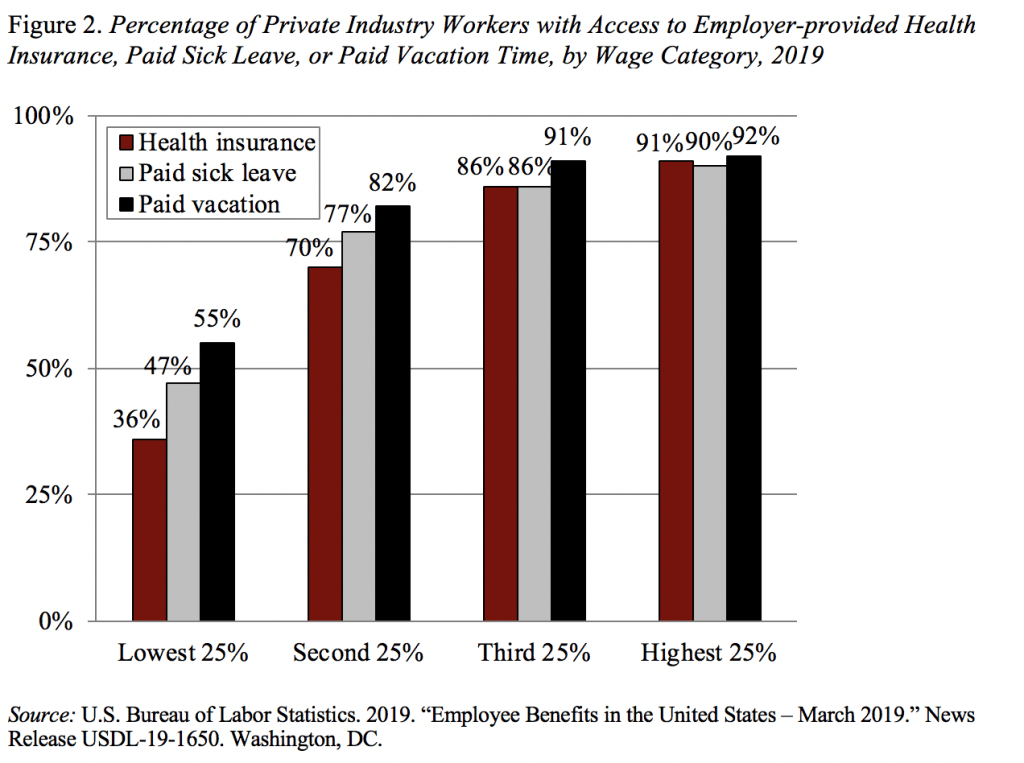

In addition to virtually no financial buffer, most lower-paid workers don’t have any ability to take time off from work if they get sick or are ordered to stay home. If they don’t work, they don’t get paid (see Figure 2).

These problems – little financial buffer and no benefits at work – have existed for decades, but the pandemic will drive home the financial vulnerability of millions and millions of Americans.