Will Millennials Be Ready for Retirement?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Picture was improving, but Millennials still far behind earlier cohorts in saving for retirement.

The Federal Reserve’s 2019 Survey of Consumer Finances (SCF) offers an opportunity to reassess the outlook for Millennials just prior to the pandemic.

Millennials – defined here as those born during 1981-99 – are unique in several ways. They are the first full generation to grow up with computers; they are more ethnically diverse than previous cohorts; and they are the most educated generation.

But Millennials got off to a slow start. They left school with substantial student debt and began their careers in the tough job market that followed the Great Recession. An earlier study – based on data from 2016 – showed that these factors hurt their labor market activity, delayed major life milestones such as getting married and owning a home, and limited their ability to accumulate wealth.

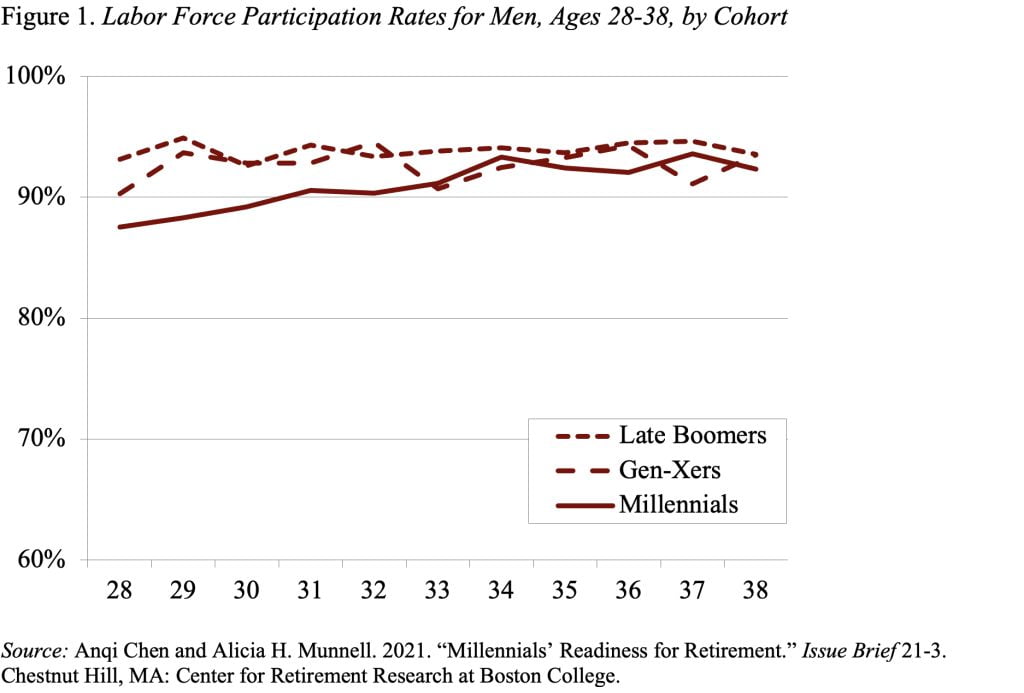

Our updated assessment based on the 2019 SCF showed that Millennials had caught up to earlier cohorts in terms of labor force measures. For example, by their late 30s, the labor force participation rate for Millennial men looked very much like that of earlier cohorts (see Figure 1). (Millennial women seem to have been less affected by the weak economy early in their careers.) And earnings success for Millennials matched or exceeded that of earlier cohorts.

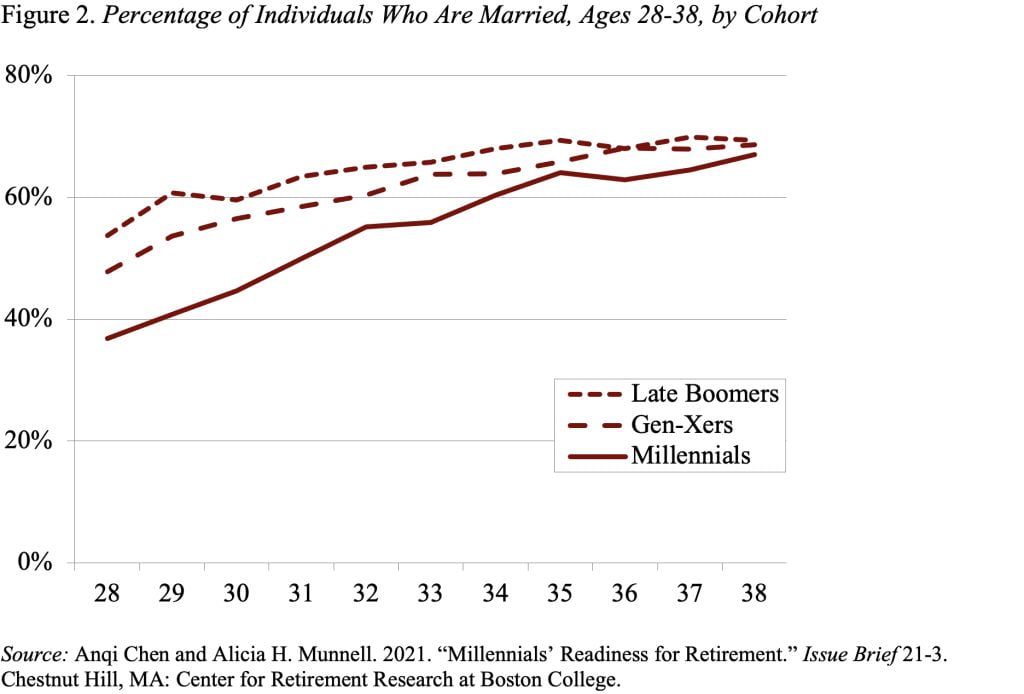

And Millennials were also catching up in terms of life events. While the percentage of Millennials who are married by age 28 is still well below that for Late Boomers and Gen-Xers, Millennials nearly match earlier cohorts by their late 30s (see Figure 2). Not surprisingly, homeownership – which often follows marriage – increasingly looks comparable across cohorts.

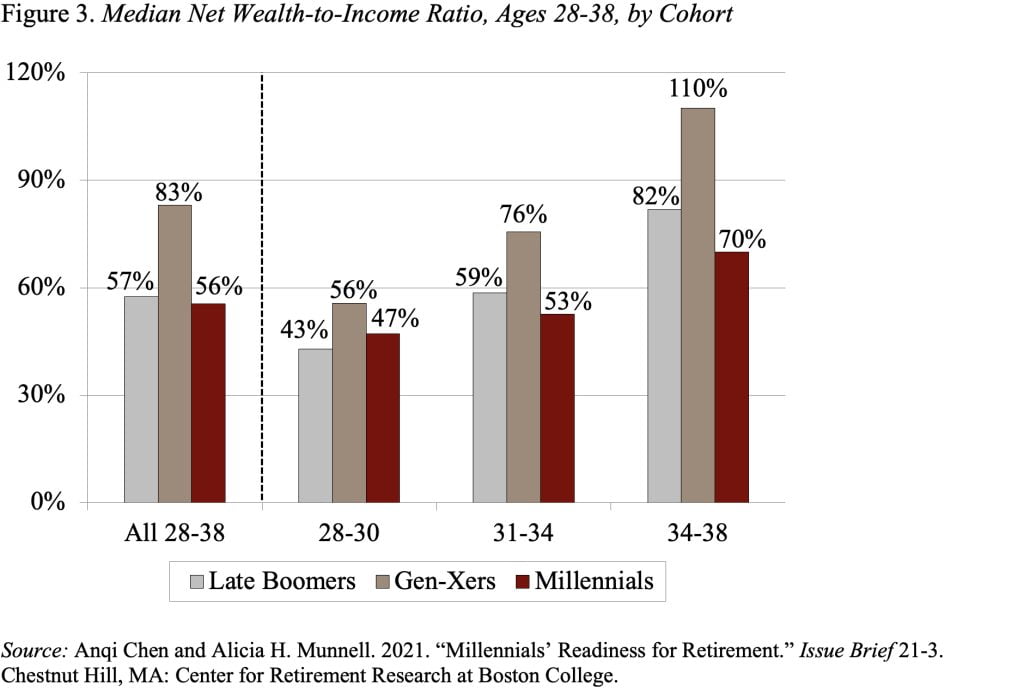

Unfortunately, the good news does not carry over to retirement preparedness. The median ratio of net wealth to income for Millennials is significantly behind that for earlier cohorts even for households in their late 30s (see Figure 3).

The reason for this wealth gap is student loans. Forty percent of Millennial households ages 28-38 are burdened by student debt and, among these households, the outstanding loan balance amounts to more than 40 percent of income. Excluding student loans, the median net wealth-to-income ratio for the leading edge of the Millennial generation looks very similar to that for previous cohorts (see Figure 4). That is, Millennials are saving for retirement, despite the student loans. But student loans continue to be a drag on their balance sheet.