Workers Overestimate their Social Security

The U.S. Social Security Administration reported a few years ago that half of retirees get at least half of their income from their monthly checks. For lower-income retirees, the benefits constitute almost all of their income.

Yet Americans have only a vague understanding of how this crucial program works – one of many obstacles on the road to retirement. A new study by the University of Southern California’s Center for Economic and Social Research finds that workers are overly optimistic about their future benefits, which is one reason so many people don’t save enough for retirement.

Workers “would probably have fewer regrets after retirement” if they were better informed, the study concluded. And many retirees in the study have regrets. Roughly half wished they’d done a better job of planning.

The researchers’ focus was on working people ages 30 and over. In a survey, the workers were asked to pick the age they plan to start Social Security and to estimate their future monthly benefits. To get as good a number as possible, they were instructed to predict a range of benefits in today’s dollars and then assign subjective probabilities to the amounts within that range.

Their guesses were compared with more precise estimates, made by the researchers, who predicted each workers’ future earnings paths – based on characteristics like their age, gender, education, and past and current earnings – and put them into Social Security’s formula to calculate the expected benefits.

The subjective estimates made by every group analyzed – men, women, young, old, college degree or not – on average exceeded the researchers’ more accurate estimates, though to different degrees. For example, women were more likely than men to overshoot the reliable estimates. Interestingly, people who said they had “no idea” what their benefits would be came closer to the mark than anyone – having less confidence apparently offset the tendency toward overestimation.

Young adults, who aren’t naturally focused on retirement, overshot their benefits the most. This is not surprising but still unfortunate, because good decisions made early in a career – namely, how much to save in a 401(k) – will greatly improve financial security in retirement.

One explanation for workers’ widespread inaccuracy, the researchers found, is that they aren’t clear on how much their benefit would be reduced if they claim it before reaching Social Security’s full retirement age.

What does all this mean for individual retirees? The more optimistic workers are, the more likely they are to save less than they will need in the future, the researchers found.

The upshot of workers’ miscalculations, they said, is “too much consumption during the working years and too little consumption in retirement.”

To read this study, authored by Maria Prados and Arie Kapteyn, see “Subjective Expectations, Social Security Benefits, and the Optimal Path to Retirement.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

If you ask someone to “guess” almost anything, they’re almost always going to get it wrong – how fast they’re running, how fast they’re driving, how much taxes they owe, what time it is right now, and yes…..even (especially) their Social Security benefit at retirement many years (or decades) from now.

What I always found valuable (rather than guessing) was either to use the SSA’s calculator (at https://www.ssa.gov/) or to hand-calculate it myself using SSA’s pamphlet as a guide – for my birth year at https://www.ssa.gov/pubs/EN-05-10070-1955.pdf

Either way, I’m left with a better understanding of a good estimation (rather than a guess) of what I’ll receive when I claim my retirement benefit.

By my own calculations, Social Security will – at best – replace 30% of my pre-retirement income. Less optimistically I expect it’ll actually replace about 1/5 to 1/4 of my pre-retirement income. Moreover, this is if I make sure my highest 35 years of income (what Social Security uses) in my lifetime don’t include the years when I worked over the summers in high school scraping gum from underneath classroom desks. I think Social Security overestimates its impact on retirement income, and that obviously, according to this article, has terrible consequences.

The future beneficiaries are usually getting yearly updates as to what their SS benefits at FRA (full retirement age) will be if they keep earning the same income as they are currently. Benefit amounts are adjusted until they reach 60 years of age to reflect the current market value of their reported income. It does not take into account any COLAS that occur each year under the current system based on the average COLAs of past years. No wonder they are confused!

Excellent points, and similar to those I was going to write myself. I used to get those annual notices of estimated benefits, but they cut them off when I took a widower’s SS at age 63. And their online system would not give me an estimate based on my own earnings because I was already collecting. Then I found out that you can do a manual estimate on the SS website by inputting your year-by-year earnings. I did that before I hit 70, and I was approved for exactly that amount once I claimed my own.

My sister was a school teacher for many (50?) years. Prior to retirement her Social Security statements for the previous 5 years all said she would be receiving around $2000 in Social Security benefits at full retirement age. When she finally filed at FRA she was told that since she was a teacher in CA, they did not withhold Social Security and therefore her benefit would only be $1200/mo. What an unbelievable letdown for her! How can SS be so terribly incorrect in their estimates for so many years?

There is a paragraph advising of WEP in every SSA statement. Unfortunately it is rarely read, and so many workers with a non-FICA job are never told that that job/pension can reduce their SS benefits from other jobs.

The windfall elimination provision (WEP) is a modified benefit formula that reduces the Social Security benefits of certain retired or disabled workers who are also entitled to pension benefits based on earnings from jobs that were not covered by Social Security and thus not subject to the Social Security payroll tax. Its purpose is to remove an unintended advantage or “windfall” that these workers would otherwise receive as a result of the interaction between the regular Social Security benefit formula and the workers’ relatively short careers in Social Security covered employment.

I think one of the toughest issues surrounding Social Security involves whether to follow the conventional wisdom (including from CRR) recommending that you delay claiming your benefit after you retire. For a typical middle class worker, that means spending down a good chunk of retirement savings and giving up on the upside potential thereof. On the other hand, it also means worrying less about the impact of cognitive decline on retirement security.

I think many people don’t understand how social security works and don’t look at the calculator and just assume the government gives you what you need.

I think another issue is upper middle class people that assume SS will always be there in its current state and are planning based on that assumption. Should changes such as means testing go into effect, they will end up with a shortfall and be unable to make up the difference. Any changes that make it more difficult to retire should be reserved for those under age 50, to allow better planning.

If I retired at 62 what is likely to be my average payment monthly?

Go online and look at your SSA statement. It lists your FRA amount (full retirement age), as well as estimated amounts at 62 and 70.

You can claim SS at any month after 62. Claiming at 62 will reduce your benefit by 30%, but you’ll be getting payments for a few more years.

FYI, the average benefit at FRA is $1543/month.

Not too many people know that Medicare premiums are deducted from the monthly payment which can have a significant impact. Also in many cases a large portion of the amount is subject to tax as ordinary income.

These are surprises to many new recipients.

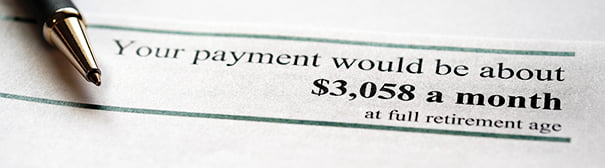

I thought it was ironic that an article about the over-estimation of benefits is led by a clip / photo announcing the estimate of 3,058 for Social Security… The average SS benefit in 2021 is approximately 1,543, or 50% of this very misleading photo.

For someone at full retirement age, the maximum amount is $3,148. You would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment. This number is more than three times the median individual income of 43,206.

For an article discussing the ‘vague understanding’ of this program, it clearly shows where this communication failure comes from. A better option would have been to take this absurd photo clip, red line the original amount and place the average amount instead. Disinformation comes in all forms. An article about social security assumptions that showcases impossible numbers in the only portion of an article that most would see is at best negligent.

You can do better.

I don’t fault anybody at CRR – they have better things to do than screen graphics – but, yeah, I noticed that too.

Yes, I noticed that too – unfortunately it was too late.

Readers’ comments, even on the photo and graphic choices, are always welcome!