Working Longer Helps Square the Circle

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Today, the average retirement age for men is 64. The average retirement age is defined here is the age at which more than half of men are no longer participating in the labor force. The comparable age for women is 63. If people continue to retire at 63 or 64, they are going to face a severe decline in their living standards.

The reasons for this decline are twofold. First, retirement needs are increasing – people are living longer, continuing to retire early, and facing rapidly rising health care costs and the prospect of uninsured long-term care costs. Second, the retirement system is contracting – Social Security will replace less of pre-retirement income even under current law, retirees will be increasingly dependent on 401(k)s with modest balances, and people have seen a sharp drop in the value of their house.

Exhorting people to save more on their own simply won’t work. People save through institutionalized savings mechanisms such as employer-sponsored plans or paying off their mortgage; they accumulate very little outside their pensions or their house.

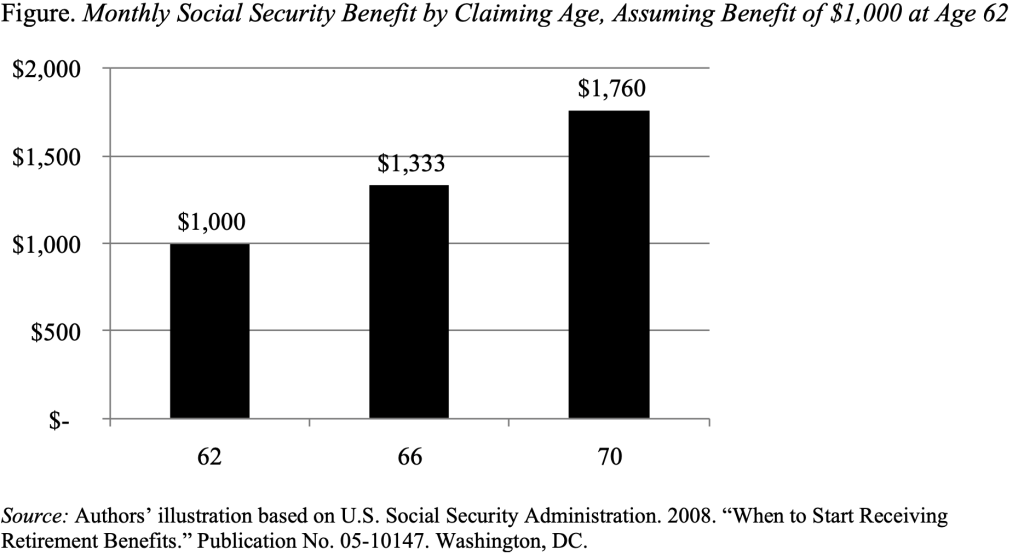

For most people, the most potent antidote to reductions in retirement income and rising health care costs is to work longer. Each additional year in the workforce increases income directly through earnings from work and investments. It also increases Social Security benefits. The age at which full Social Security benefits are paid is currently 66 and will reach 67 in 2022. Actuarially reduced benefits can be claimed at 62 and, after the Full Retirement Age, are actuarially increased until age 70. As a result of the actuarial increases, Social Security benefits at age 70 are 76 percent higher than benefits at age 62 (see Figure). Delay in tapping 401(k) plans allows balances to increase commensurately.

The response to the proposal to work longer is often “I don’t want to work until I’m 90!” In fact, future retirees need not panic. A few additional years of work can make retirees in 2030 as well off as those of the current generation. Clearly, only two additional years of work are needed to compensate for the increase in the Full Retirement Age from 65 to 67. And an additional two years will compensate for rising Medicare premiums, increased taxation of Social Security benefits, and other factors contributing to the deteriorating outlook. An additional four years dramatically changes the arithmetic. Instead of roughly two years of work for each year in retirement, adding four years to worklife and subtracting four years from retirement changes that ratio to three to one.

Working longer is a feasible option for the bulk of the population. People are not only living longer but are increasingly healthy. In addition, jobs are much less physically demanding than they were in the past. And the gap between the educational attainment of the old and the young has disappeared. Right now, of course, the prescription to work longer must be tempered by the fact that 9 percent of the labor force is unemployed. And, a significant portion – maybe 25 percent of older Americans – will find continued employment either impossible or very difficult due to health problems or antiquated skills. But for most of today’s workers, the best thing they can do to ensure a secure retirement is to make plans to work four years longer than they had originally planned.