“Yellow Vest” Protests Are a Good Excuse to Look Past Tax Burdens

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

They may explain part of the problem in France, but the really interesting fact is the low U.S. burden.

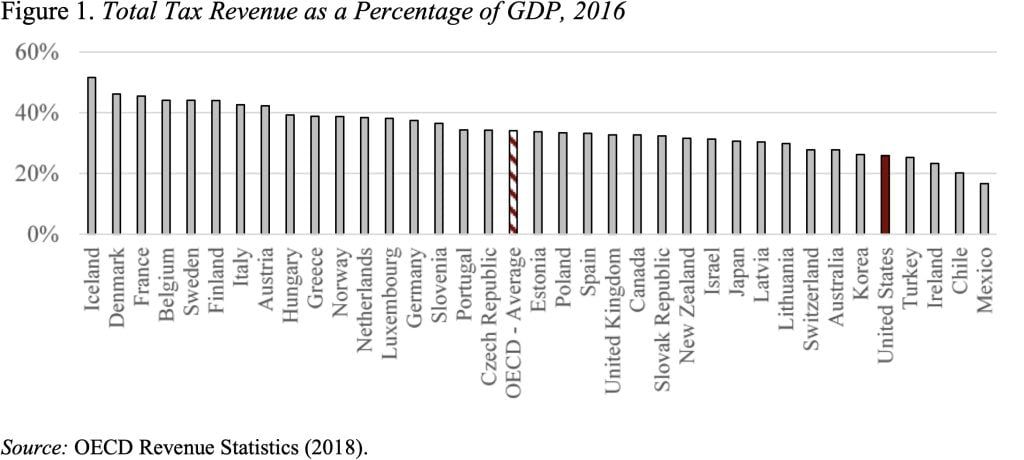

I was trying to figure out what made French workers put on their yellow vests. The action-forcing event appears to have been a proposed hike in gasoline and diesel taxes. Are the French overburdened with taxes? Figure 1 presents the ranking of countries by total taxes as a percentage of GDP. These data, from the Organization for Economic Cooperation and Development (OECD), show that the French do indeed pay a high share of their GDP – 45.5 percent – in taxes.

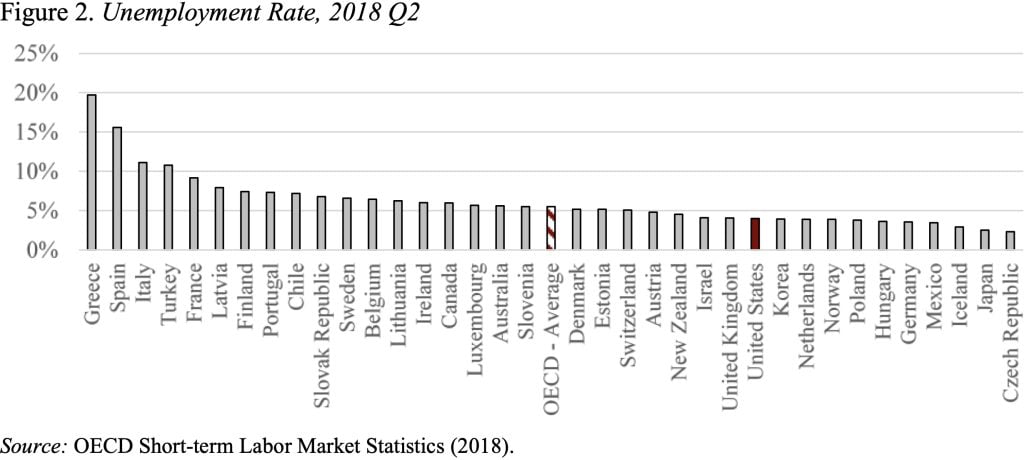

But Denmark has an even higher tax burden than France, and people do not appear to be putting on their yellow vests in Denmark. Perhaps, the problem has less to do with taxes than with people’s labor market experience. Figure 2 shows the unemployment rates in France and Denmark in early 2018. While the French rate, despite a recovering economy, was 9.2 percent, the unemployment rate in Denmark was only 5.2 percent. Moreover, President Macron has tried to overhaul the labor system, by peeling away protections and red tape to encourage job creation. The reforms, however, have also resulted in some major layoffs – obviously creating anxiety among workers.

Clearly this is not an in-depth analysis of the French situation, but it allows me to show the tax-to GDP figure. Forget about France and Denmark, and look where the United States sits on that scale – fifth from the bottom. Residents of this country are not highly taxed, and we need not be highly taxed. But we do have room to increase revenues to cover those services that we have decided to provide through the federal government – that is, we have no reason to be running large deficits. And we could even pay to fix our crumbling transportation and electricity infrastructure and maybe even set up a system of high-speed rail. In other words, our taxes need to go up not down.