Yes, Retirement Benefits for Police and Fire Are Expensive

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But they make up a very small share of local government spending.

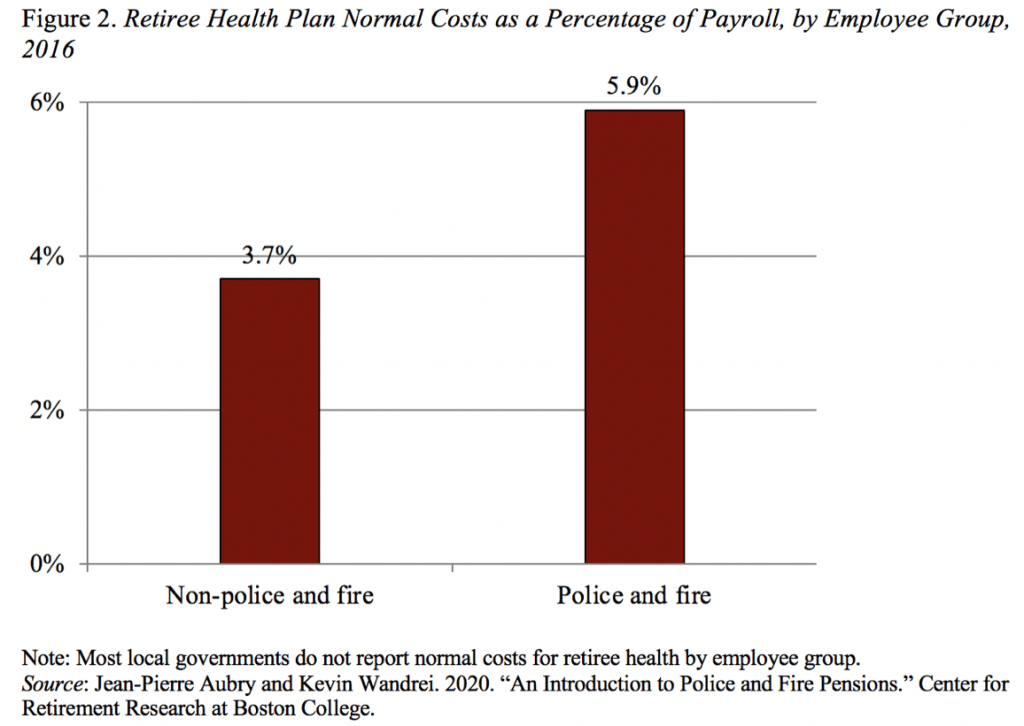

Every now and then we release a study that is received with skepticism. Our current piece on police and fire retirement benefits is the most recent example. It makes the argument that these benefits are expensive – consistent with most people’s intuition – but that they constitute only 2 percent of total local government spending – not the budget buster that you might expect.

I am very sympathetic with the skeptics and, in fact, tormented the authors for months. But it turns out they were right, and I was wrong. Expensive yes; budget buster no. Probably should be reformed, because police and fire personnel could probably work longer. But reforms would have limited impact on government expenditures – particularly given that any cut to benefits might need to involve an increase in wages to ensure the recruitment and retention of quality workers.

Local governments – meaning cities, counties, and school districts – employ nearly all police officers and firefighters and, thus, are mainly responsible for their personnel costs. They provide two major types of retirement benefits: defined benefit pensions and retiree health insurance.

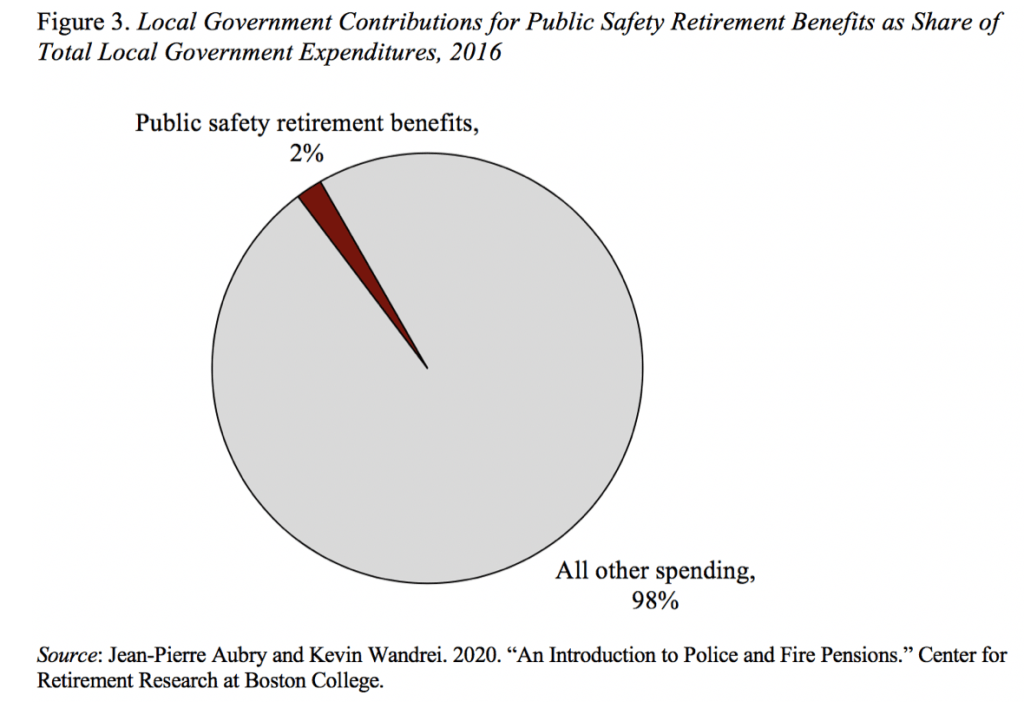

The “normal cost” of pensions for public safety workers is twice that for other government employees (see Figure 1). The reason is not so much that the benefits are high as the fact that public safety personnel can retire early and receive their benefits for a long time.

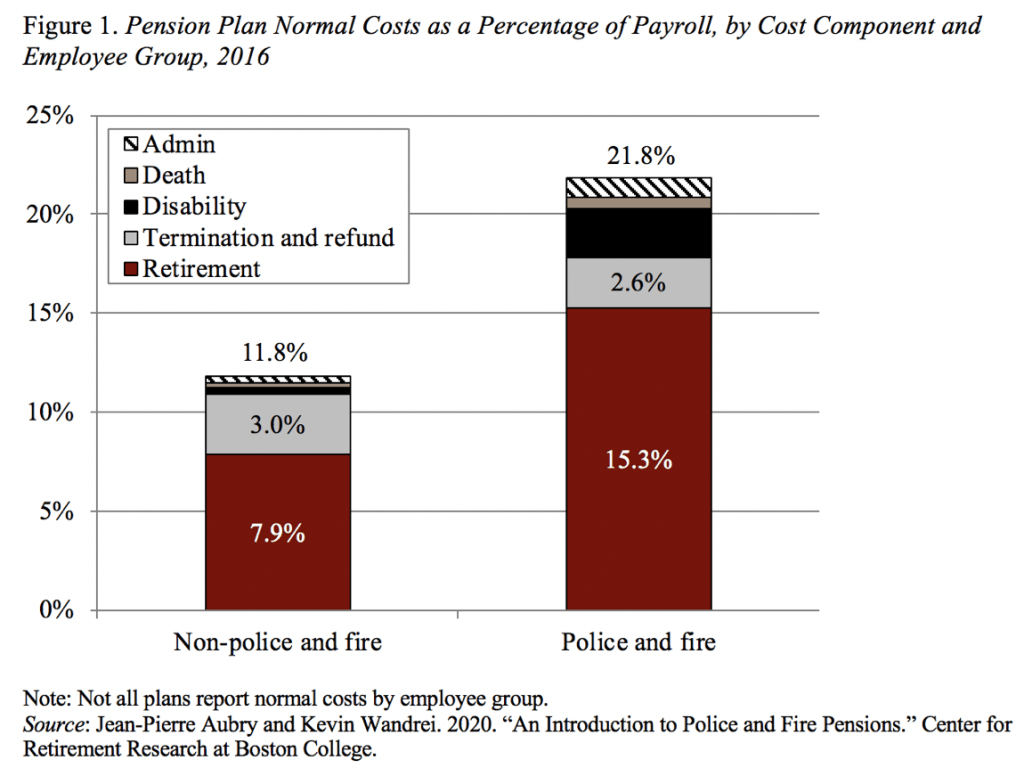

In addition to pension benefits, most local governments provide employees with government health insurance after they retire. Similar to pensions, the average normal cost of these benefits for public safety retirees is substantially higher than that of other government employees (see Figure 2). While some of this difference may be due to differences in the cost of insurance provided or the generosity of the premium subsidy, earlier retirement ages also play a role by creating longer periods of coverage under the government’s health insurance before the retiree begins Medicare.

Although public safety retirement benefits are expensive, the overall impact of these costs on local finances – the combined expenditures of cities, counties, and school districts – is smaller than one might expect for three reasons.

- First, compensation costs (i.e., wages, health insurance, and contributions for government-sponsored retirement benefits and Social Security) account for only 55 percent of total local government expenditures.

- Second, public safety workers account for only 17 percent of total local government compensation costs.

- Finally, retirement contributions account for about 25 percent of total compensation.

Therefore, as a share of aggregate local government spending, contributions for public safety retirement benefits are very small – just 2 percent (see Figure 3). The simple calculation is 55 percent (compensation share of total budget) x 17 percent (public safety share of total compensation) x 25 percent (public safety retirement share of public safety compensation) = 2 percent.