401(k) Participants Hit Hard by Weak 2022 Stock Market

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

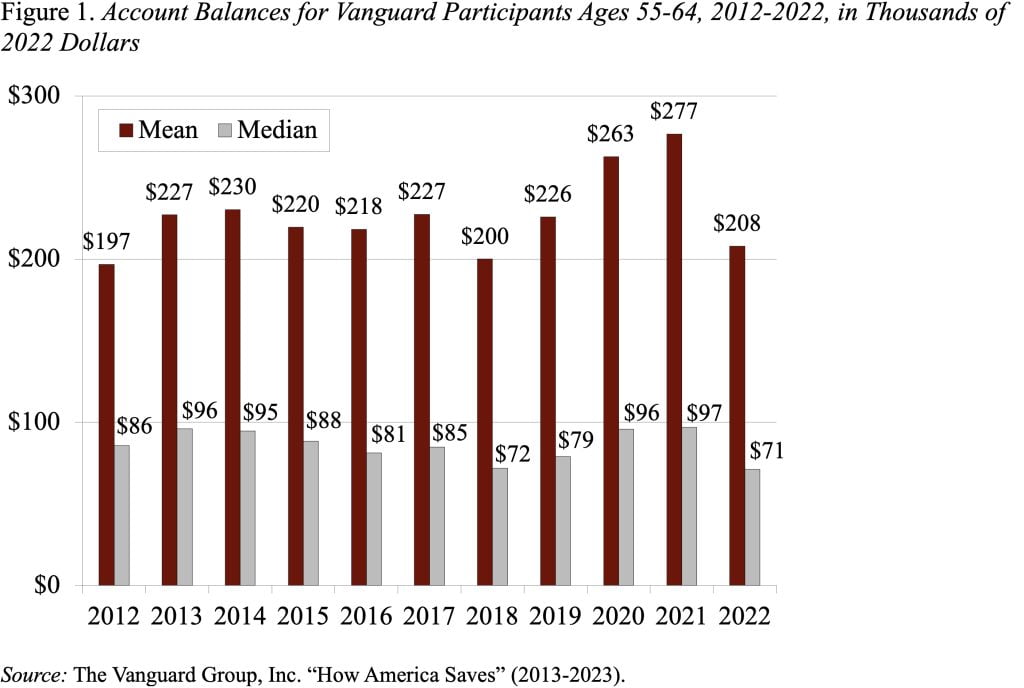

More importantly, long-run trends show little gains for median balances.

It is always interesting to look at Vanguard’s most recent edition of “How America Saves.” And it is particularly interesting to get the numbers for 2022 – not a good year for the stock market. Indeed, the news isn’t good for 2022. More importantly, the longer-run trends – despite a great expansion in auto-enrollment – are not very encouraging either.

Vanguard reports a substantial decline between 2021 and 2022 in both median and mean 401(k) balances. The big difference between the median and the average is due to a small number of accounts that have really big balances. Average balances are more typical of long-tenured, more affluent participants, while the median balance represents the typical participant. Mean balances dropped from $141,500 to $112,600, and median balances from $35,300 to $27,400 – declines of 20 percent and 23 percent, respectively, from 2021. Vanguard attributes the decline primarily to a negative return on plan assets in 2022 of -15.8 percent, plus a changing mix of participants.

But low balances are not just a short-run problem. Balances generally are puny. Consider the holdings of those approaching retirement – ages 55-64. As one would expect, these balances are much larger than those for the full participant population. But still the median is $71,000, which means that half of participants have less than this amount and half more (see Figure 1). Moreover, Vanguard tends to administer larger plans, so the plans are better designed than average and participants have higher incomes. In other words, it presents the best face of the 401(k) system.

Of course, these individual 401(k) balances do not tell the whole story about retirement saving. First, when participants change jobs, their 401(k) accounts may remain with their old employer, so individuals may have more than one 401(k) account. Second, 401(k) balances may be rolled over to an IRA, and financial services companies cannot track combined 401(k)/IRA holdings. Third, by necessity, balances are provided on an individual, rather than a household, basis. For all these reasons, we are looking forward to data from the Federal Reserve’s 2022 Survey of Consumer Finances, which will be released in the fall.

But assume that the median 401(k)/IRA holdings for households approaching retirement turn out to be twice the Vanguard number for individual participants – a ratio consistent with earlier years. That would mean that a household 55-64 with a 401(k) would have total 401(k)/IRA balances of $142,000.

If a couple uses its $142,000 to buy a joint-and-survivor annuity, they will receive – even with today’s high interest rates – about $745 per month. Since this amount is not indexed for inflation, its purchasing power will decline over time. Moreover, this $745 is likely to be the only source of retirement income to supplement Social Security, because the typical household holds virtually no financial assets outside of its 401(k).

Moreover, households with a 401(k) plan are the lucky ones. Only about half of households in the middle third of the income distribution have such a plan.

The bottom line is that our private sector retirement system works well for the top third of households, provides a little for the middle third, and offers virtually nothing for the bottom third. We should be able to do better than that.