5 Reasons Workers’ Stable Wealth Is Bad

Americans build wealth as they age, and this pattern of accumulation has been similar over three decades of U.S. Survey of Consumer Finances data collected by the Federal Reserve.

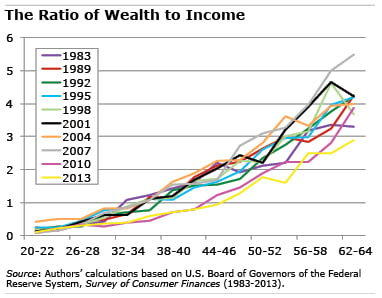

In the chart below, net wealth is expressed in terms of annual incomes for ages 20 through 64; for example, someone with $150,000 in wealth and $50,000 in income has a wealth-to-income ratio of 3. Net wealth equals financial assets such as 401(k)s and housing, minus debt and mortgages; income includes employment earnings and investment gains. This measure does not include Social Security or defined benefit (DB) pensions.

The stability of this wealth-to-income ratio over 30 years may, at first glance, be comforting. But it shouldn’t be – wealth should have increased during this time for five reasons.

1. Longer life spans than in the early 1980s require that Americans save more to fund more years in retirement.

2. Health care costs are rising, so people will need more wealth to cover their out-of-pocket costs.

3. Historically low interest rates mean that retirees today need more wealth to generate any given amount of income from their nest eggs.

4. Social Security is replacing less of what workers earned during their working years, so retirees need more wealth to compensate.

5. DB pensions are being replaced by 401(k) plans. This shift from unreported DB pensions to reported 401(k) assets means that the wealth-to-income ratios shown in the chart should have increased.

In short, stable wealth-to-income ratios mean that today’s workers are less well prepared for retirement than workers in the past.

Comments are closed.

Your #3 is something people are only starting to realize. They last thought of the cost of retirement income at the beginning of the century, and imagine that the old 4% rule is being really conservative.

Wealth will continue to erode for average people. Here’s how it’s happening right now:

Inflation on core (ex energy) has been drifting up for a few years while middle class wages stagnate. There are many economic reasons wages stagnate (tech replacement I think being the main one – we just don’t need as many workers), but there is one glaring reason their costs are rising – our interest rate policy.

Service costs are rising and rent increases are starting to pick up steam after house prices were boosted by 0% rates for the past 4 years. Anecdotally, I see average home buyer after average home buyer in middle class cities priced out by the wealthy who can come in, offer 10% over asking and waive inspections. Middle class buyers using a mortgage cannot offer 10% over asking (banks won’t finance over appraised value) and can’t afford the risk of waiving an inspection (I wouldn’t).

This wealth disparity has a name and it’s Fed policy. The wealthy snapping up homes (still a much larger than historical percentage) can pay cash or borrow from their private banker at 3.5% (thanks Fed 0% policy) and then rent to the poor fools who got priced out.

Also note that we have rising core prices without the effects of commodities – many of which have been in price downtrends for 2 or more years (iron, copper, grains, and now oil). What happens if commodity prices rise in a 0% rate environment? We will see a significant effect on prices people pay for stuff and as the middle class continues to see their wages stagnate, this will get uglier.

Fed policy needs to “normalize” soon or things may get out of hand. More income will be allocated to increasing rents, medical bills, insurance bills, college tuition, child care and other rising middle class expenses – with housing costs, the most glaring and direct result of house prices rising.

PS – I made no mention of the tyranny of low rates on savers. Some retirees benefit from a bigger cash out on their home prices, but all suffer by being forced to “chase yield” in savings elsewhere as banks offer 0% rates.

These type of worries are overblown. If Americans are willing to live overseas, they can live OK on about $12k a year in places like the Philippines (PH) – medical care is good, they speak passable English, and the weather is warm. Right now, however, Medicare does not extend to overseas doctors, but the docs here are cheap, and you can always travel back to the USA if you need extensive medical care. That said, I would not come to the PH if you are frail.