Does It Matter If Social Security Checks Are Delayed?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

It does indeed for about 13 million retirees for whom Social Security is a lifeline.

With the prospect that Congress may fail to raise the debt ceiling and the possibility that Social Security benefits may not be paid on a timely basis, one obvious question is whether it matters if people get their check a few days, a week, or a couple of weeks late. From my reading of the evidence, it matters very much.

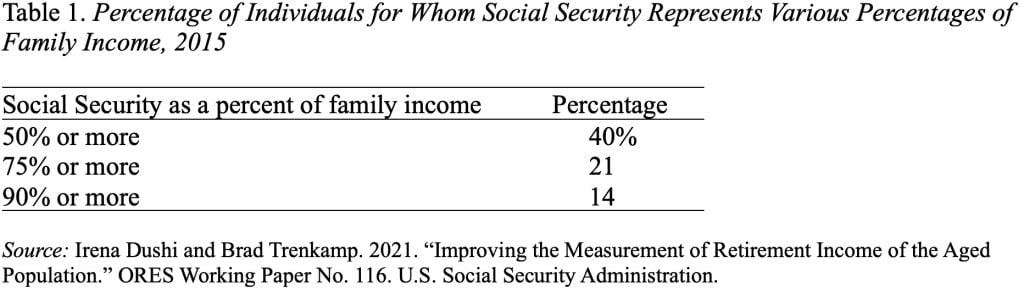

First, millions of older people are almost totally dependent on Social Security. The best numbers come from a study by Social Security researchers, using administrative tax and benefit data, that shows that, in 2015, 21 percent of individuals received 75 percent or more of their family income from Social Security (see Table 1). With 48 million people ages 65 and over in 2015, that would have been 10 million people. Since 2015, two things have changed that would make that number larger. First, the 65+ population has grown from 48 million to 60 million, and, with the decline in the share of lower-paid households that have a 401(k), Social Security has become a more important source of retirement income. So, the number of people substantially reliant on Social Security is about 13 million.

Does it matter if the checks for these 13 million people are delayed? They will definitely be paid in full eventually; the issue is whether timing is important. Beyond the fact that these 13 million people have virtually no other source of income by the end of the month, a body of research suggests that timing is very important for cash strapped low-income households. Several studies have looked at Social Security recipients. The U.S. Social Security Administration’s current schedule for depositing pension checks in bank accounts is based on each retiree’s birth date, which determines whether the check is deposited on the second, third, or fourth Wednesday of each month.

One study found that people who get their Social Security checks early in the month are more likely to resort to payday loans and other measures than people who receive their checks later in the month. People who get their checks on the fourth Wednesday will use it to get their biggest expense – rent – out of the way and then make do for the rest of the month. They had fewer bounced checks, account overdrafts, and payday loans. Timing matters in terms of whether people have to resort to desperate measures.

Another issue was identified by health care researchers who studied the distribution of Social Security checks among Medicare recipients. They found that when Social Security checks are distributed, prescription fills increased by 6-12 percent among recipients who pay small copayments; they found no such pattern among recipients who face no copayments. That means individuals are waiting for their Social Security check to be deposited before getting their medicine. So, a delay in Social Security could have adverse consequences for cash-strapped retirees.

Other researchers explored whether timing mattered in terms of bill paying for people receiving food aid under the federal Supplemental Nutrition Assistance Program (SNAP). SNAP supplies 10 to 25 percent of household incomes up to 35 percent above the federal poverty level. This study took place in an unidentified New England state where recipients’ SNAP debit cards are refilled on the first day of every month. When the card is refilled, it frees up money for other bills coming due at the same time, such as utilities. After following the SNAP recipients for a full year, the researchers found that the unpaid balances on their utility bills were smaller if the bills came in at the same time as the SNAP-card deposits.

So, yes, for about 13 million people the timing of their Social Security check is very important.