How Big Will Social Security’s COLA Be?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Much lower than previous years, but COLA has fully protected retirees against ravages of inflation.

The speculation seems to start earlier every year. I just got my first press call regarding the likely magnitude of Social Security’s cost-of-living adjustment (COLA) for 2024. This automatic indexing of benefits to keep up with rising prices – always a wonderful feature of our Social Security program – has been particularly valuable over the last few years as we have experienced high rates of inflation.

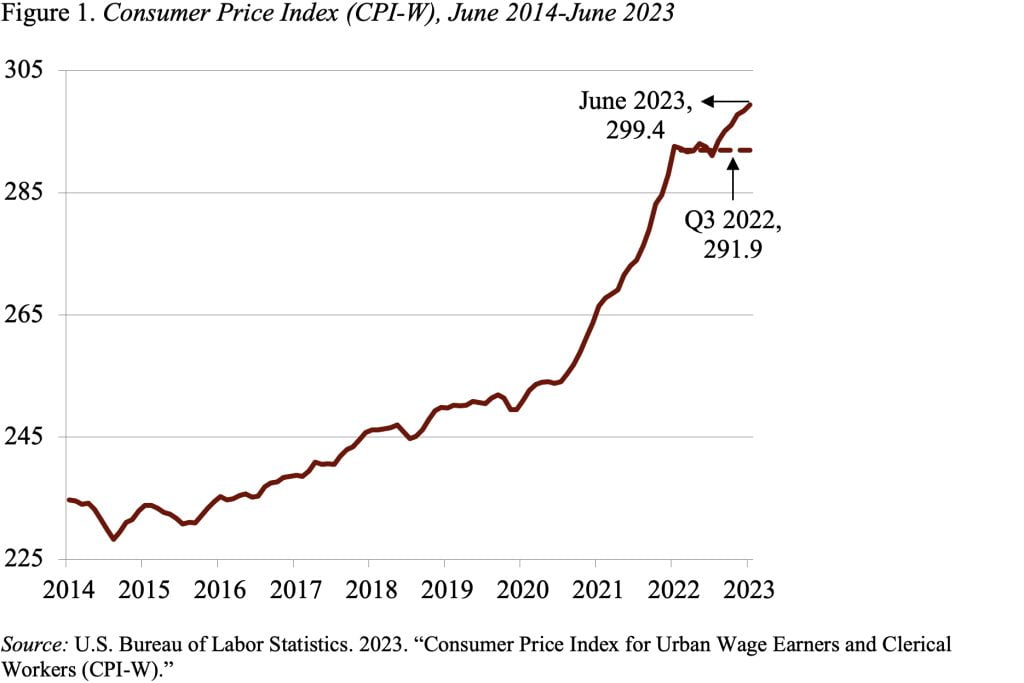

Since the COLA first affects benefits paid after January 1, Social Security needs to have figures available before the end of 2023. As a result, the adjustment for 2024 will be based on the increase in the CPI-W for the third quarter of 2023 over the third quarter of 2022. We know the 2022 number (see Figure 1), but we need data for July, August, and September to calculate the third quarter average for 2023. All we have so far is the June number.

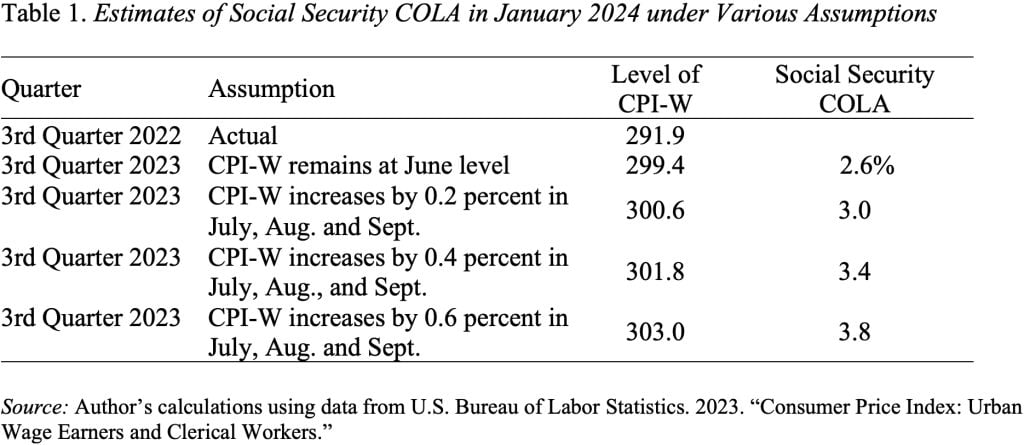

The only option is to make some assumptions. As a starting point, Table 1 shows what the COLA for 2024 would be if the CPI-W remained at its June level for the next three months – a very unlikely event. More reasonable options have the CPI-W increasing by an average of 0.2 percentage points, 0.4 percentage points, and 0.6 percentage points, respectively, in July, August, and September. This exercise suggests a 2024 COLA between 3.0 percent and 3.8 percent. For now, I’m going with 3.4 percent.

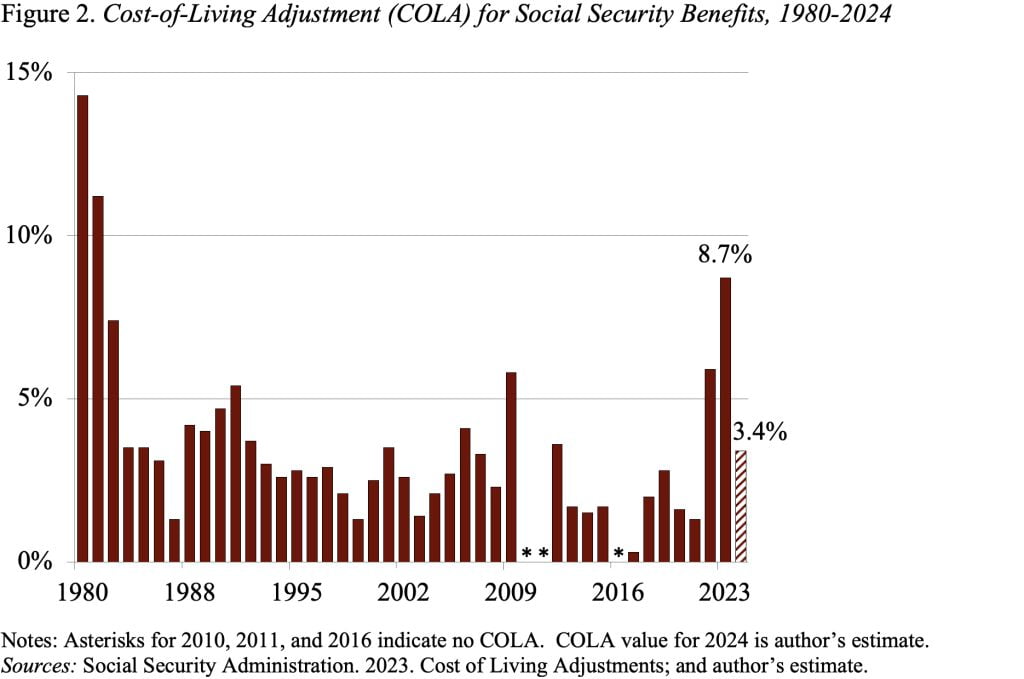

The range of estimates is in line with the 3.3 percent COLA projected by the Social Security actuaries in the 2023 Trustees Report and well below last year’s COLA of 8.7 percent (see Figure 2).

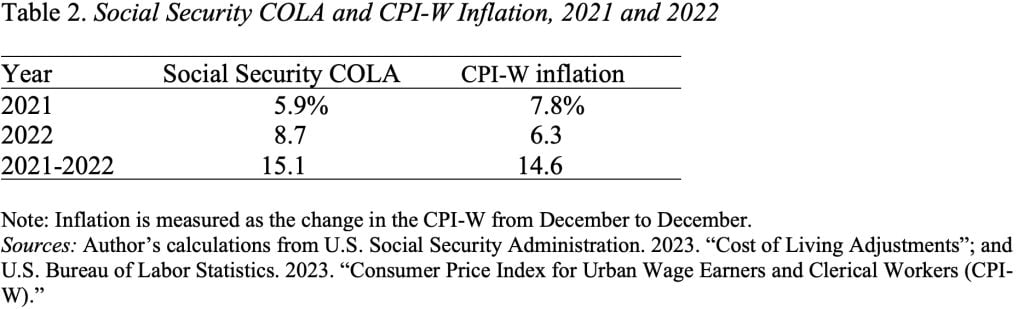

My best guess is the 2024 COLA will be roughly in line with 2024 inflation. In contrast, the COLA over the last two years has been out of sync with actual inflation: too low a COLA in 2021 and too high a COLA in 2022 (see Table 2). This pattern is the inevitable result of a backward-looking calculation. But it makes perfect sense to base the COLA on actual data rather than a forecast, which could involve constant corrections for over- or under-predicting. And most importantly, over the whole inflation cycle, retirees have received the appropriate increase.