Women’s Progress on Retirement Saving – Within Limits

Working women have clearly made progress since the 1970s, led by the boomers who streamed into the labor force. They are better educated today, and their pay has been rising relative to men’s.

But women continue to contend with lower pay and interruptions in their work histories and premature retirements to care for children or aging parents, making it more difficult to save. The financial challenge of having enough money to retire is compounded by the fact that they usually live longer than their husbands.

In the Transamerica Institute’s 2023 survey report on retirement, women recognize that things are looking up. But it’s tough for them to feel satisfied with where they are.

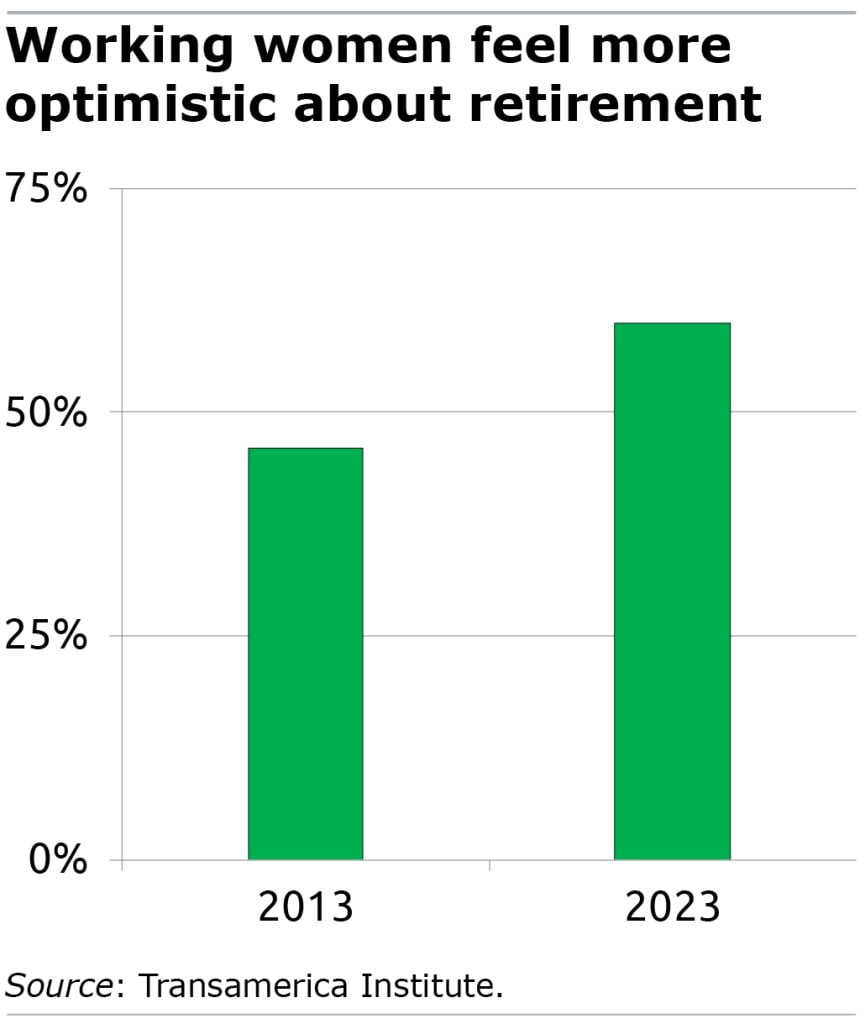

Currently, 60 percent of working women said they expect to retire comfortably. That’s up smartly from 46 percent a decade ago, which is consistent with the gains they’ve made in the labor force, but still less than the 73 percent of men who feel confident today.

Working women’s 401(k) balances are also still significantly lower than men’s. In Vanguard’s annual report on its own clients – remember, this is a fortunate group of employees who have a savings plan at work – the typical female worker has saved about $25,000, compared with $35,000 for men.

However, women seem to have gotten the message about how important it is to prepare for old age and are trying to do something about it.

In the Transamerica Institute survey, they identify retirement as their second-highest financial priority – up from third place a decade ago, when women were more concerned about paying off debt and “getting by” after the Great Recession. Men’s top priority today is retirement.

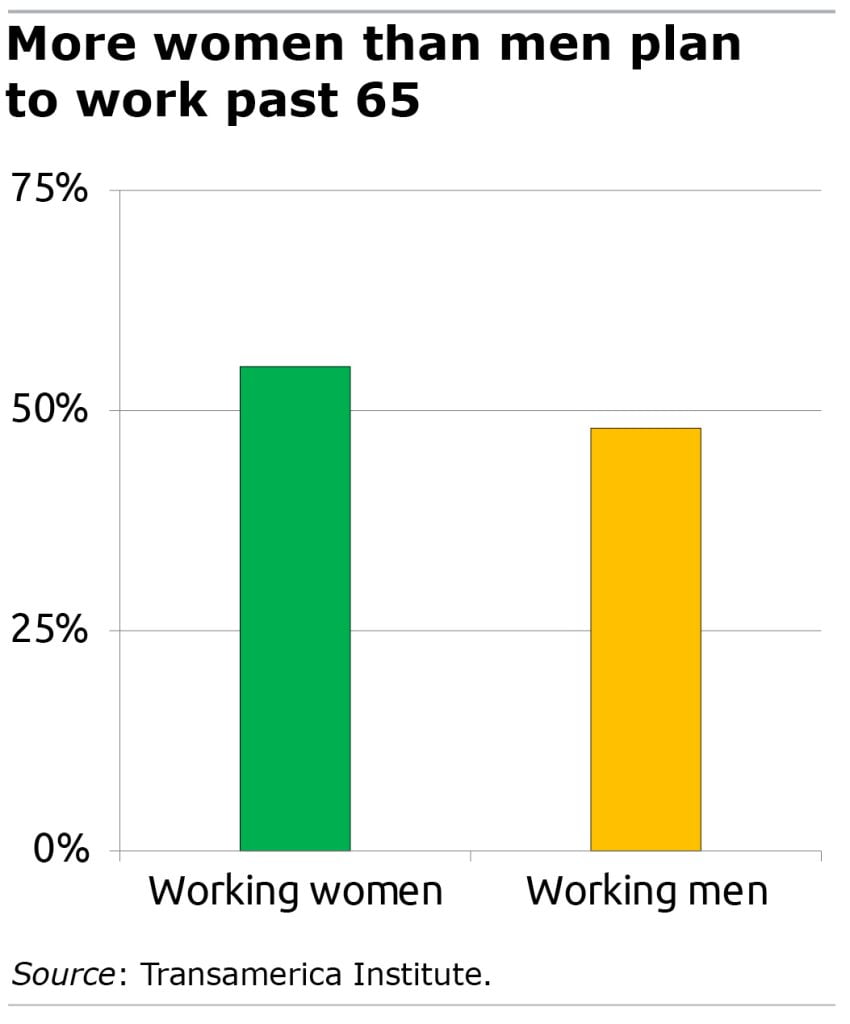

For people who haven’t saved enough, working past age 65 is a smart strategy to significantly improve their outlook by increasing the size of the monthly Social Security checks. This year, 55 percent of women say they’ll work past 65, which is a couple points higher than a decade ago. Men are going in the opposite direction, with only 48 percent who are planning to work longer.

The other benefits of working longer include increasing the amount of time an older worker can contribute to her 401(k) and reducing the number of retirement years she’ll have to draw on that savings.

Despite women’s best efforts, Catherine Collinson, president of the Transamerica Institute, concludes that they need more support – from the government through policy, from employers through pay and benefit design, and from society through a recognition of the toll of unpaid caregiving.

“Everyone must play a role in improving women’s retirement security so that all women can retire with dignity,” she said.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.