Will Multiple Employer Plans Help Close the Coverage Gap?

The brief’s key findings are:

- To encourage small firms to adopt retirement plans, policymakers have made it easier to participate in Multiple Employer Plans (MEPs).

- MEPs involve less administrative burden and fiduciary responsibilities than a stand-alone plan, and – in theory – could be cheaper.

- But few firms know about MEPs, some fiduciary tasks remain, exiting a MEP may be difficult, and MEPs can make mergers and acquisitions harder.

- Also, it’s not clear that they do cost less, and any such assessment should consider employee – as well as employer – fees.

- Overall, while MEPs could be attractive, adoption may be slow due to unfamiliarity with the product and uncertainty over any cost advantage.

Introduction

At any given time, only about half of U.S. private sector workers are covered by an employer-sponsored retirement plan. As a result, roughly one-third of households end up completely reliant on Social Security at retirement, while others move in and out of coverage throughout their careers and end up with only modest balances in a 401(k) account.1Biggs, Munnell, and Chen (2019).

The lack of consistent coverage – a pressing concern for the nation’s retirement income security – is driven by small employers. Only about half of small employers (those with fewer than 100 employees) offer a retirement plan compared to about 90 percent of large employers.2Chen (2023). In an effort to lower the cost of plans for small employers and thereby increase coverage, the SECURE Act of 2019 made Multiple Employer Plans (MEPs) less restrictive and potentially more attractive for this group. This brief, which is based on a recent study, explores both the possibilities and the limitations of MEPs in improving coverage in employer-sponsored retirement plans.3Chen and Munnell (2024).

The discussion proceeds as follows. The first section provides a brief history of MEPs and the creation of a less restrictive subgroup of MEPs, called Pooled Employer Plans (PEPs). The second section discusses the possible advantages of PEPs for small employers, and the third section discusses factors that may limit their adoption. The final section concludes that while PEPs could be attractive to small businesses, employers may be slow to adopt them.

A Brief History of MEPs

Most retirement plans are sponsored and maintained by a single employer. The employer offering the plan is usually the named fiduciary and must, according to the Employee Retirement Income Security Act of 1974 (ERISA), “run the plan solely in the interest of participants and beneficiaries.” In addition to serving as a fiduciary, employers have to select a recordkeeper, make decisions on plan design, file a Form 5500, and cover the fees involved in starting and maintaining a plan. Managing all these tasks may be particularly challenging for small employers.

Unlike single-employer plans, a MEP is a retirement plan adopted by two or more employers and administered by a MEP sponsor. Although a MEP can be either a defined benefit or defined contribution plan, the vast majority are 401(k)-type defined contribution plans. By allowing employers to join together to offer a plan, the MEP sponsor (typically a trade or industry group or professional employment organization) takes on the fiduciary burden and spreads the administrative, compliance, and cost burden of offering a plan across multiple employers. Participating employers in a MEP have their fiduciary responsibility limited to selection and oversight of the person or entity operating their plan.4Borzi (2010).

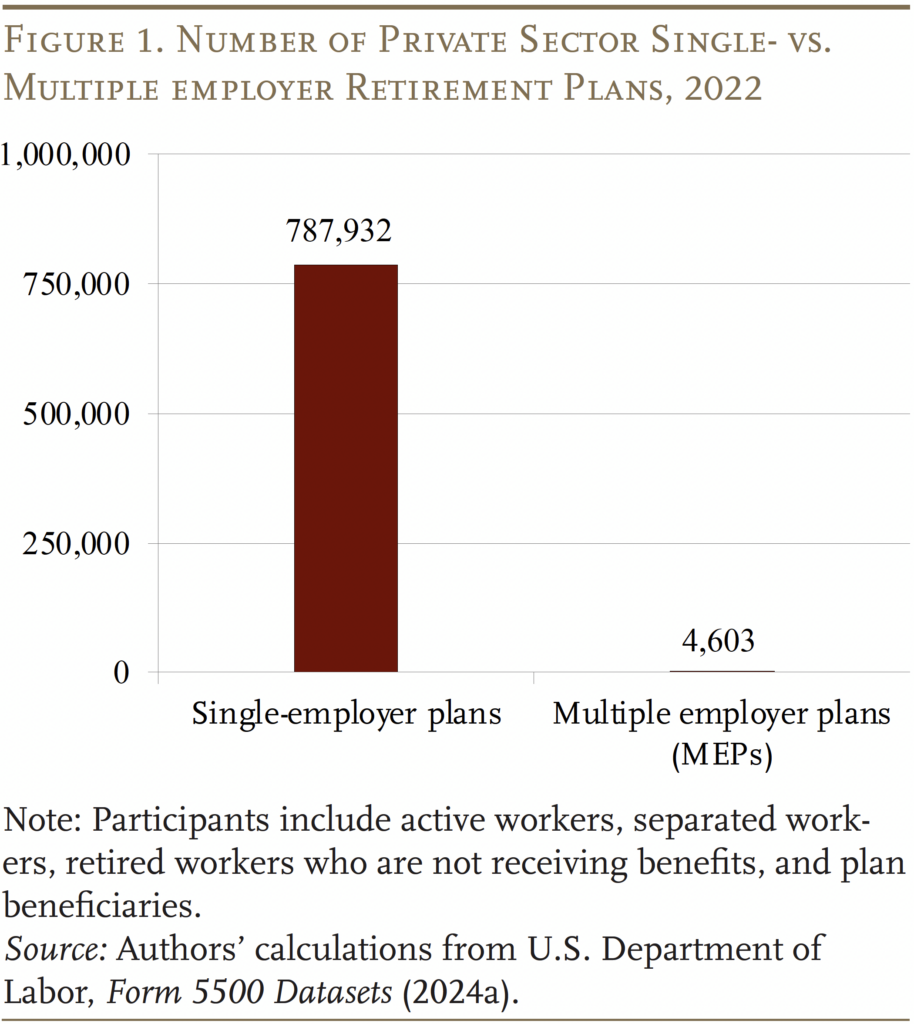

While MEPs have been around for decades, they have not moved the needle on coverage. In 2022, MEPs represented only a sliver – 0.6 percent – of total private sector retirement plans (see Figure 1), covering about 6 percent of active participants.5Data from 2022 Form 5500 filings and U.S. Department of Labor (2024a).

Two main restrictions of MEPs may have limited their adoption: 1) employers had to share a common bond; and 2) the whole MEP could lose its tax-qualified status if one employer within the group was not in compliance (the “bad apple” rule).

The SECURE Act of 2019 removed the “bad apple” restriction and created a new subclass of MEPs, called PEPs, which are not limited to employers with a common bond. The legislation said that PEPs can only be established by a pooled plan provider (PPP), which takes on the role of named fiduciary and attends to plan administration, compliance, and auditing. PPPs have to register with the U.S. Department of Labor (DOL) before publicly marketing their services and operating a PEP. The additional regulatory requirements are designed to ensure that PEPs operate in the best interests of employees.

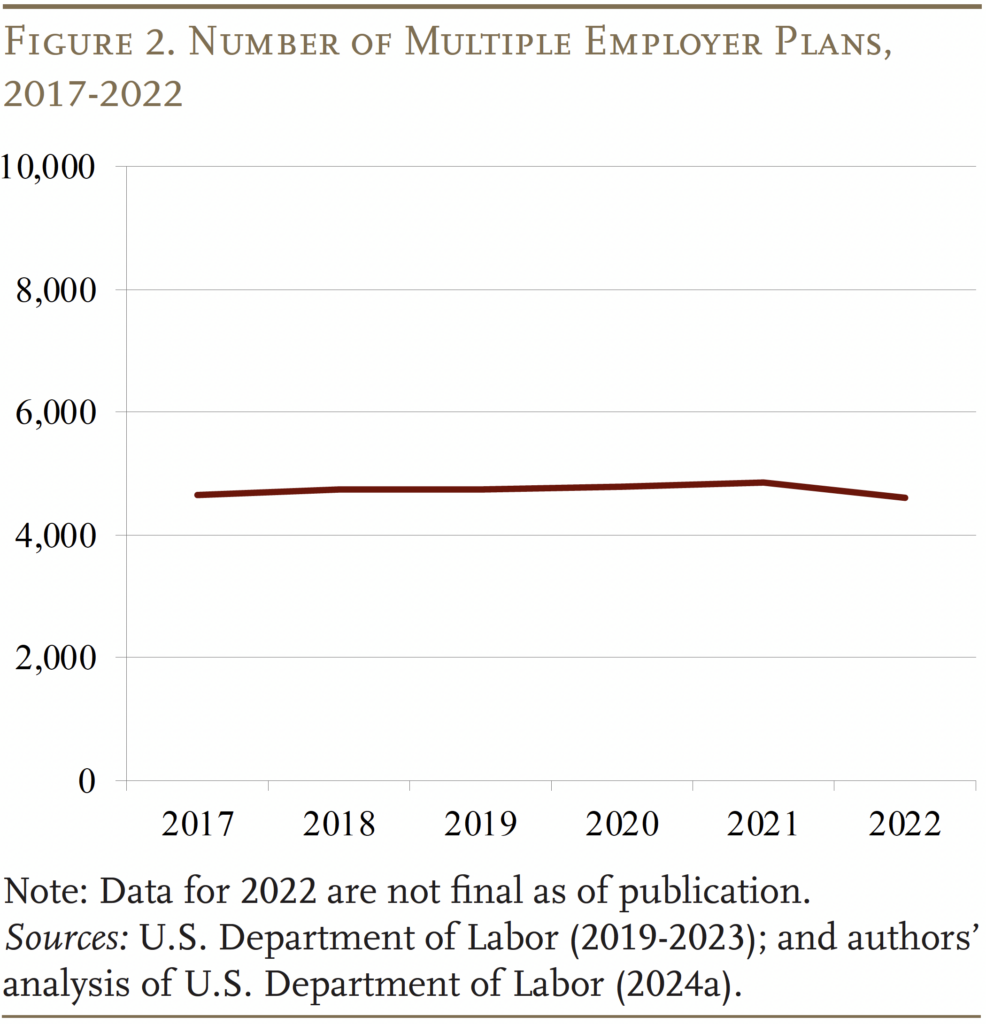

The removal of the common bond and bad apple restrictions has generated a lot of excitement, particularly among financial services firms, about the potential of these new plans to help close the coverage gap. The latest DOL data, however, show that initial take-up has been slow, with no significant growth in the number of MEPs since the passage of the SECURE Act (see Figure 2).

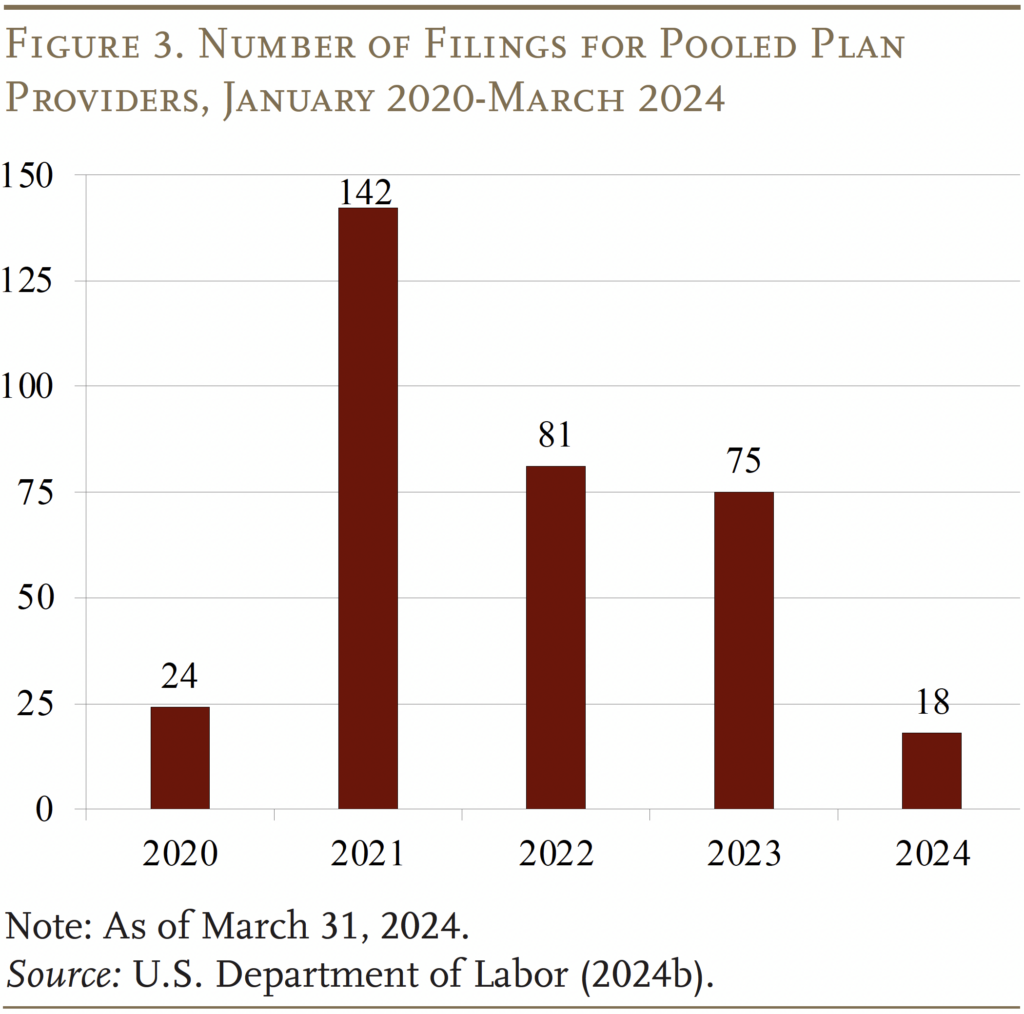

Moreover, new PPP filings suggest that interest in PEPs may be less than expected. While new filings climbed in the first year after SECURE was passed, momentum slowed in 2022 and 2023 (see Figure 3).6The SECURE Act 2.0 was passed in 2022 and extends the PEP structure to 403(b) plans, which are defined contribution plans for schools and non-profits. However, 403(b)s are unlikely to drive substantial growth as they only represent 4 percent of private sector plans. Regardless, PEPs offer the most potential for growth relative to other types of MEPs. To get a sense of the future for PEPs, it is useful to consider their advantage relative to existing options for small employers and how they could fall short of expectations.

Possible Advantages of PEPs

The selling points for MEPs is that they offer advantages over existing retirement products for small businesses and the possibility of lower costs.

PEPs versus Other Options

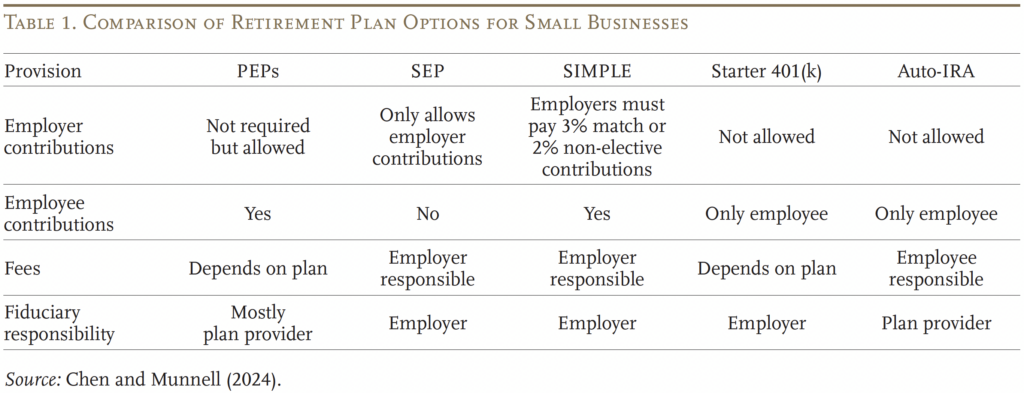

PEPs are not the first retirement plan designed for small businesses. Federal policymakers have tried for decades to expand retirement plan coverage among small employers. Major initiatives include the Simplified Employee Pension IRA (SEP) and the Savings Incentive Match Plans for Employees of Small Employers (SIMPLE). And SECURE 2.0 introduced the starter 401(k), another option aimed at reducing the costs of offering a retirement plan for small employers. Additionally, 16 states have launched or are preparing to launch programs requiring employers without a plan to automatically enroll their employees in an Individual Retirement Account (“Auto-IRAs”).

Table 1 compares the characteristics of PEPs to the provisions of existing options. Unlike SEP/SIMPLE plans, PEPs do not require employer contributions, allow the sharing of the fixed costs of establishing a plan, and outsource the selection of the fund menu to a PEP administrator. In comparison to Starter 401(k)s, PEPs allow employers to outsource most of the fiduciary and administrative burden, enjoy lower investment fees by aggregating assets across more employers, and permit employers to contribute. The main advantages of PEPs relative to Auto-IRAs is that they are available in every state, 401(k)s have higher annual contribution levels than IRAs, and employers are allowed to contribute. In short, employers might find PEPs more attractive than existing options because they limit fiduciary responsibility, while maintaining the ability to select the provider of choice and offer employer matches. The biggest push for PEPs, however, has centered on costs.

Possible Cost Savings of PEPs

PEPs advertise cost savings due to the economies of scale associated with bringing together a number of small employers. While two recent studies seem to contradict this contention, the results do not really reflect an apples-to-apples comparison. The studies, using MEPs data from before the SECURE Act, found that MEPs were at least as expensive, if not more expensive, than single-employer plans of a comparable size.7Shnitser (2020) and Mitchell and Szapiro (2020). That finding is not surprising, given that a MEP with $10 million in assets from 100 employers is inherently more complex than a single-employer plan with $10 million. The relevant question is how the average cost of a MEP with $10 million from 100 employers compares to the cost of a single-employer plan with $100,000. Those data are not currently available.

What the data do show is that most MEPs are quite small – about 50 percent hold less than $10 million and about 75 percent have under 100 participants. And small plans are more expensive than large ones.8BrightScope and Investment Company Institute (2023). One study determined that at least 30 percent of MEPs with less than $10 million in assets charge more than 1.5 percent for combined administrative and investment fees.9Mitchell and Szapiro (2020).

Going forward, it could be possible that the growth in PPPs will promote lower fees due to more competition and higher-quality investment products. It could also be, however, that employers with weak bonds to one another pay less attention to plan costs. In fact, one of the two studies cited above found that, among different types of MEPs, total expense ratios were higher for Professional Employment Organizations MEPs, which have weaker employer bonds, than for association MEPs or corporate MEPs, which have stronger bonds. If the PEP market develops like its parent MEPs, it is not clear that PEPs will be cheaper than single-employer plans – especially given the growth in low-cost 401(k) plan options for small employers.10A quick Google search yielded several 401(k) options where annual employer costs would only be about $2,500 for a firm with 10 employees and $5,000 for a firm with 50 employees. The mid-tier plan offered by Guideline costs $79 a month and $8 a month per participant. The mid-tier plans from Betterment and Human Interest cost $150 a month and $6 a month per participant. Fidelity offers a small business retirement plan that charges a $500 start-up fee and a $300 per-quarter administration fee. However, it also requires employers to match employee contributions, which can increase costs. If PEPs are not cheaper, their only main benefit will be less fiduciary responsibility.

Another cost consideration is how the fees are split between the employer and employee, particularly for small plans where fees tend to be higher. Some PEP sponsors advertise plans that have minimal fees for employers. However, retirement plans are not free. Plans that are free (or almost free) to the employer must invariably pass on costs to plan participants. If higher costs are passed on to employees, the question becomes how much higher are employee fees relative to single-employer plans? If employee costs are only slightly higher than stand-alone plans, PEPs could still be beneficial in helping workers who would otherwise not have access to a plan save for retirement. But if costs are substantially higher, PEPs could erode retirement savings for the most vulnerable workers and expose employers to excessive fee lawsuits.11Several MEPs excessive fee lawsuits have been filed. A recent high-profile lawsuit includes McLach-lan v. International Union of Elevator Constructors.

Factors that Could Limit Adoption of PEPs

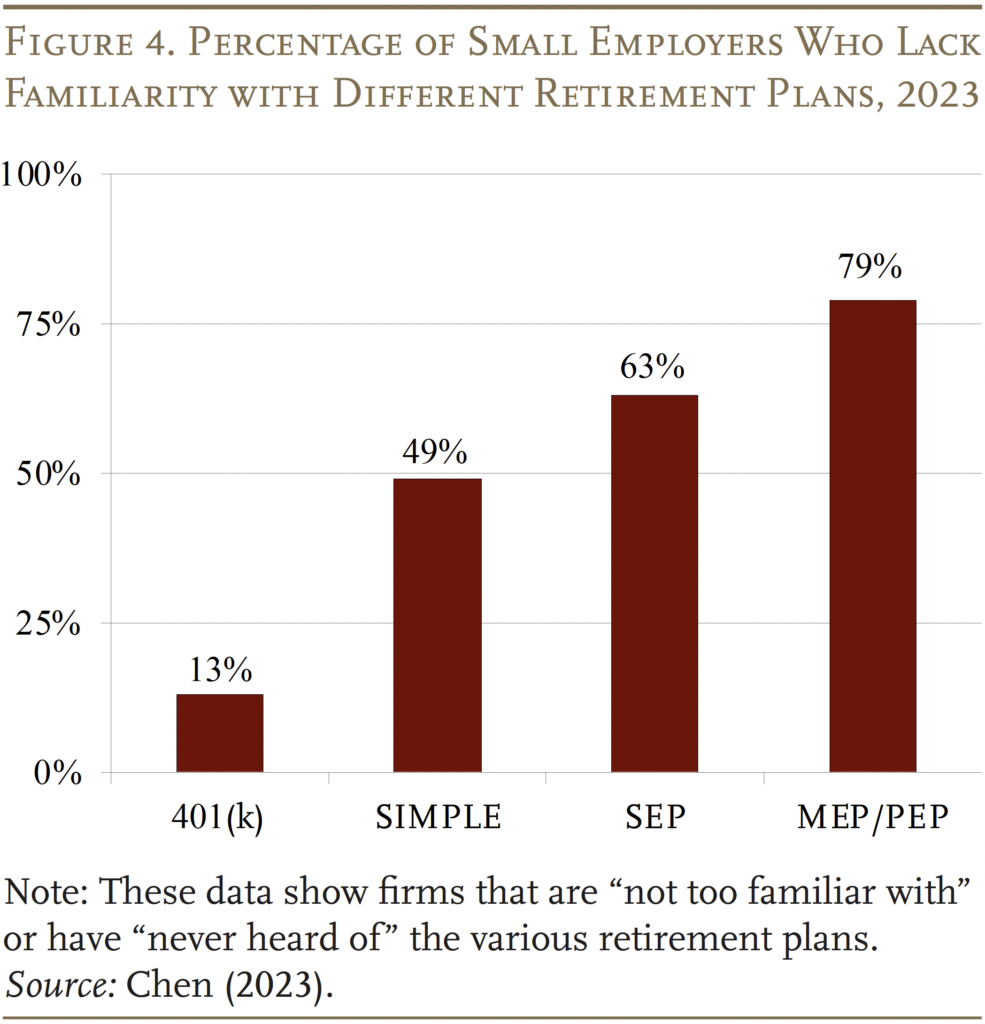

A number of factors could limit the adoption of PEPs. The biggest limitation of PEPs may be the lack of awareness. The vast majority of small employers has never heard of PEPs or their parent, MEPs (see Figure 4). PEPs, like all retirement plans, have to be “sold” to employers – i.e., employers don’t come looking for them. Providers will not only have to convince employers that offering a retirement plan is valuable, but that joining a PEP is the right option for them. This challenge might be a high hurdle to clear.

Even if providers could overcome the awareness hurdle, numerous issues remain.

- Cost advantage may not materialize. As noted above, MEPs may turn out not to have a cost advantage for two reasons. First, it may be hard to beat the cost of providing a single-employer plan, which has declined dramatically. Second, increased competition in the MEPs market could promote lower fees, but employers with weak bonds could also pay less attention to plan costs. Finally, plans that are free (or almost free) to the employers invariably pass on costs to plan participants.

- Employer retains some fiduciary responsibilities. While the PPP is the named fiduciary for a PEP, the employer is responsible for selecting the right provider, monitoring the fees, and determining whether the services offered are beneficial.

- Exiting may be difficult. An employer that gets bigger and wants to convert to a more customizable single-employer 401(k) may find it difficult and time-consuming to terminate its portion of the PEP.

- PEPs can also make mergers and acquisitions more challenging. Whether an employer wants to merge its plan with a buyer’s plan or fold an acquired employer’s plan into its own plan, the process is much easier with a single-employer plan.

Clearly widespread adoption of PEPs faces a lot of hurdles; only time will tell whether this less restrictive version of MEPs makes a dent in coverage.12Even if PEPs did begin to grow significantly, it might not help close the coverage gap. It could simply mean employers are opting to join a PEP rather than offer their own single-employer plan.

Conclusion

The lack of consistent coverage is a pressing concern for the nation’s retirement income security, and the coverage gap is driven by small employers. The original SECURE Act created PEPs, a subclass of MEPs that are less restrictive and potentially more attractive for small employers. While PEPs offer several benefits – such as potential economies of scale and limited administrative and fiduciary responsibilities – small employers may be slow to join PEPs. They are an unfamiliar product, and it is not clear that they will have a cost advantage over stand-alone plans for small employers.

References

Biggs, Andrew G., Alicia H. Munnell, and Anqi Chen. 2019. “Why Are 401(k)/IRA Balances Substantially Below Potential?” Working Paper 2019-14. Chestnut Hill, MA: Center for Retirement Research at Boston College.

BrightScope and Investment Company Institute. 2023. The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2020. San Diego, CA: BrightScope and Washington, DC: Investment Company Institute.

Chen, Anqi. 2023. “Small Business Retirement Plans: The Importance of Employer Perceptions of Benefits and Costs.” Special Report. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Chen, Anqi and Alicia H. Munnell. 2024. “A Multiple Employer Plans Primer: Exploring Their Potential to Close the Coverage Gap.” Chestnut Hill, MA: Center for Retirement Research at Boston College.

Mitchell, Lia and Aron Szapiro. 2020. “Paperwork or Panacea.” Chicago, IL: Morningstar Policy Research.

Shnitser, Natalya. 2020 “Are Two Employers Better than One? An Empirical Assessment of Multiple-Employer Retirement Plans.” Journal of Corporation Law 45: 743.

U.S. Department of Labor. 2019-2023. Private Pension Plan Bulletin. Washington, DC.

U.S. Department of Labor. 2024a. 2022 Form 5500 Datasets. Washington, DC.

U.S. Department of Labor. 2024b. Form PR Registration Filings Search. Washington, DC.

Endnotes

- 1Biggs, Munnell, and Chen (2019).

- 2Chen (2023).

- 3Chen and Munnell (2024).

- 4Borzi (2010).

- 5Data from 2022 Form 5500 filings and U.S. Department of Labor (2024a).

- 6The SECURE Act 2.0 was passed in 2022 and extends the PEP structure to 403(b) plans, which are defined contribution plans for schools and non-profits. However, 403(b)s are unlikely to drive substantial growth as they only represent 4 percent of private sector plans. Regardless, PEPs offer the most potential for growth relative to other types of MEPs.

- 7Shnitser (2020) and Mitchell and Szapiro (2020).

- 8BrightScope and Investment Company Institute (2023).

- 9Mitchell and Szapiro (2020).

- 10A quick Google search yielded several 401(k) options where annual employer costs would only be about $2,500 for a firm with 10 employees and $5,000 for a firm with 50 employees. The mid-tier plan offered by Guideline costs $79 a month and $8 a month per participant. The mid-tier plans from Betterment and Human Interest cost $150 a month and $6 a month per participant. Fidelity offers a small business retirement plan that charges a $500 start-up fee and a $300 per-quarter administration fee. However, it also requires employers to match employee contributions, which can increase costs.

- 11Several MEPs excessive fee lawsuits have been filed. A recent high-profile lawsuit includes McLach-lan v. International Union of Elevator Constructors.

- 12Even if PEPs did begin to grow significantly, it might not help close the coverage gap. It could simply mean employers are opting to join a PEP rather than offer their own single-employer plan.