Despite Medicare, 1 in 5 Retirees Have Medical Debt

Two people in my family who are independent contractors and lack employer health insurance happen to be turning 65 this year and will finally be eligible for Medicare. Hallelujah!

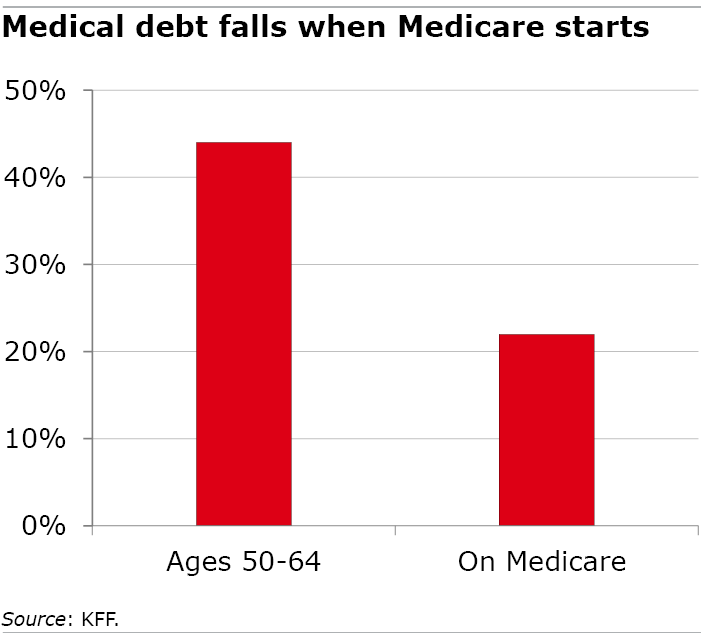

A report by KFF, the health care research and news organization, shows why Medicare eligibility is a milestone: 22 percent of people over 65 are paying off debt incurred for routine medical tests, doctors and dental care. While that’s a lot, it’s half as much as the share of older workers paying off medical debt.

Retirees are somewhat protected from piling up debt for two reasons, said Alex Cottrill, a KFF policy analyst. Medicare coverage is nearly universal, and retirees usually have an Advantage Plan, Medigap, Medicaid, or a former employer’s retiree health insurance to help with cost-sharing expenses or to pay for services that traditional Medicare doesn’t cover.

Contrast retirees’ near-universal coverage with working-age people. Roughly 10 percent go without any health insurance – including one person in my family who will turn 65 – putting themselves at risk of large out-of-pocket expenses if they become ill. My other family member turning 65 has been buying a policy on the Affordable Care Act’s (ACA) state exchange with a $7,000 deductible. The deductibles and premiums for ACA policies for a typical worker consume nearly 12 percent of their income. Even among private-sector workers with employer coverage, half are in high-deductible plans that incur large expenses before insurance starts paying.

Depending on the nature of their illness or the type of coverage, retirees can also have high out-of-pocket expenses, resulting in one in five having medical debt. That is a problem in a population in declining health with modest savings in which half have incomes below $36,000, Cottrill said. Medicare is “robust insurance but often they don’t have a lot of financial resources available to them if they’re hit with a medical bill they weren’t expecting,” he added.

When older Americans can’t afford care, they endanger their health. In KFF’s survey, 62 percent of retirees with medical debt delayed or skipped care. These retirees are making a financial decision, rather than the best decision for their health.

Medicare, which passed in 1965, remains a landmark program. But there are still too many retirees who struggle to pay for care.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

The median income for Americans 65 and older is $50,290. How can half have incomes below $36,000?

Has research been done comparing medical debt with persons with Medigap plans versus Advantage Plans? It is my understanding the medical debt in seniors has been rising as Advantage Plans have grown in popularity. I am curious if anyone has studied this correlation.

It is not just that they struggle to pay for care. It is often hard to find a doctor who participates with Medicare and if they do, they may limit how many Medicare patients they will take or one must wait months to see a physician if they do participate. A specialist can take even longer to see. As a former nurse married to a surgeon, I feel that participation by physicians should be mandatory in the Medicare system ,to keep and maintain their medical license. Dental, hearing, and eye care should also be included in the Medicare coverage. People will not see a doctor anywhere in the world ( we both lived abroad and have seen other systems that are successful and traveled extensively) if they have to pay too much. I am hopeful the system in the USA will be more inclusive. It is a shame that people are denied care due to their income.

Did you look at the debt differences for people with Medicaid, Advantage, Supplement, no insurance?