Best Way to Protect Social Security and Medicare is to Balance the Budget

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New book argues that balance requires the wealthiest top 1 percent to start paying taxes again

Some observers point to the sorry condition of our federal finances as a rationale for cutting Social Security and Medicare – not to mention programs for the most vulnerable, such as Medicaid and SNAP. Indeed, federal spending in 2025 is set at $7.0 trillion and tax revenue at only $5.2 trillion, leaving a $1.8 trillion deficit for as far as the eye can see. How did we get here and how do we get out? A wonderful new book by Ray Madoff at Boston College’s law school – The Second Estate: How the Tax Code Made an American Aristocracy – lays out a clear answer for both. We got here because many of the top 1 percent, who hold $52 trillion in wealth, no longer pay taxes, and we can solve the problem by restructuring the income tax to make sure they do.

The wealthy have avoided taxes by adopting three strategies: 1) avoiding earned income; 2) investing in high-return assets and enjoying the favorable treatment of capital gains under the income tax (especially the ability to avoid taxes by avoiding sales); and 3) best of all, inheriting money.

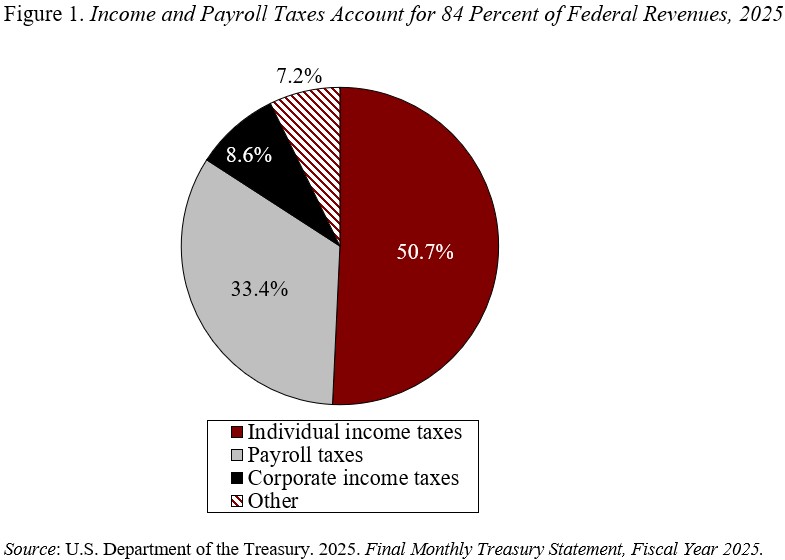

Avoiding earned income is an effective strategy because federal revenues come primarily from taxing wages and salaries: the income tax and the payroll tax account for 84 percent of federal revenues (see Figure 1). Even if the wealthy got their income from earnings, they can escape most of the payroll taxes because the Social Security payroll tax applies only to the first $176,100. The income tax has no cap and imposes a maximum rate of 37 percent to the earnings. But IRS tax returns leaked to Pro Publica in 2021 showed that many of the richest Americans had largely avoided income taxes by avoiding taxable income. As a result, today the money to pay for government programs and the interest on the massive debt must come from the nation’s wage earners.

Instead of earning salaries, wealthy people acquire investment assets that often provide higher rates of return. If they have to sell them, the income tax rates on long-term capital gains generally max out at 20 percent. But no taxes are levied until the assets are sold, allowing wealth to grown uninterrupted for decades. Meanwhile, holders of this growing wealth can support their lifestyles by simply using the assets as collateral for tax-free loans. In addition, for those who hold their investments until death, the tax code erases the gains accumulated during the deceased’s lifetime – so-called step up in basis. As a result, the heirs can immediately sell the inherited asset tax-free.

Inheritance is clearly the best way to receive money. The fact that we have an estate and gift tax makes it sound like these intergenerational transfers are taxed at the donor level. But the estate tax has eroded as the deduction (now roughly $14 million for an individual and $28 million for a couple) has increased and clever tax lawyers have created many ways to avoid it. As a result, while the concentration of wealth has increased dramatically, the estate and gift tax now accounts for less than 1 percent of federal revenues. In fact, retaining the estate tax is actually harmful given it sends the message that the wealthy are heavily taxed – when they are not. Moreover, while virtually no tax is levied on the estate of the deceased, an individual who receives a $10 million or $100 million inheritance is not taxed at all on this amount.

So, what does Ray Madoff suggest we should do? First, we should repeal the estate tax. It no longer brings in meaningful revenues, and it makes ordinary Americans believe that the wealthy are contributing to the operations of the federal government. Second, we should tax inheritances under the income tax. Individuals could receive $1 million in lifetime inheritances tax-free, but all receipts in excess of this amount would be included in income. Third, she would tax capital gains when assets are transferred either as a gift or at death. Such a proposal has been around for decades – both President Nixon and President Obama proposed such a change, and such a provision has been enacted in Canada.

Why is all this relevant to retirement? The main reason is that the well-being of Social Security and Medicare is at risk as long as our federal finances are in chaos. We can’t start to eliminate the deficit by raising the regressive payroll tax on the back of already overtaxed wage earners. It makes no sense to raise income tax rates on high earners who already pay over 50 percent of their salaries through state and local as well as federal income taxes. And, a wealth tax on the rich would be impossible to administer. The only way out of our financial mess is to bring the wealthy back in the game, by taxing inheritances under the income tax and eliminating the step up in basis for assets transferred as gifts or at death.