Are Counties Major Players in Public Pension Plans?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Not generally, but California, Maryland, and Virginia are major exceptions.

The Center for Retirement Research at Boston College has wonderful funders in Washington, DC who kept urging us to look at the role of counties in the public pension arena. Candidly, sitting in Boston, I didn’t know what they were talking about. As far as I could see, counties did virtually nothing, and the idea that they would sponsor plans seemed highly unlikely. But I now understand that they were sitting in Washington, DC, looking out at Maryland and Virginia, where counties are major providers of services. So I have learned a lot.

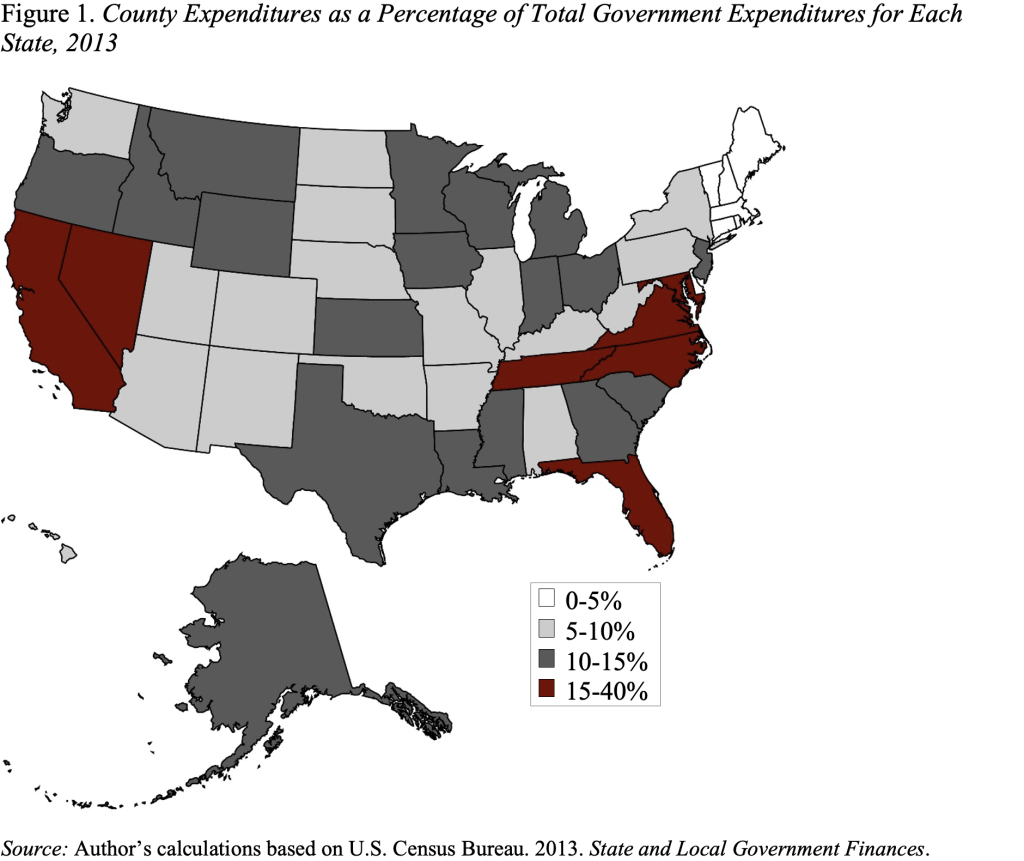

The extent of county involvement in the pension system varies widely by geographic location. Across New England, counties employ very few people and thus have little desire to construct their own pension plans. In contrast, across the mid-Atlantic region and in Tennessee, Florida, California and Nevada, counties actively provide an array of infrastructure and services.

Clearly, those states where counties play a major role employ significant numbers of workers, and pensions are part of their compensation. Generally, county employers participate in state pension plans but, in a surprisingly large number of states (22), some counties sponsor their own plans. Maryland, California, and Virginia lead the pack, with county assets amounting to 17 percent, 16 percent, and 14 percent, respectively, of total public pension assets in the state.

County pension expense involves the county’s contributions to its own plans and its contributions to state-administered plans and amounts to 4.8 percent of county revenues. But, in our sample of about 150 counties, this figure ranges from less than 2 percent of revenues to over 10 percent.

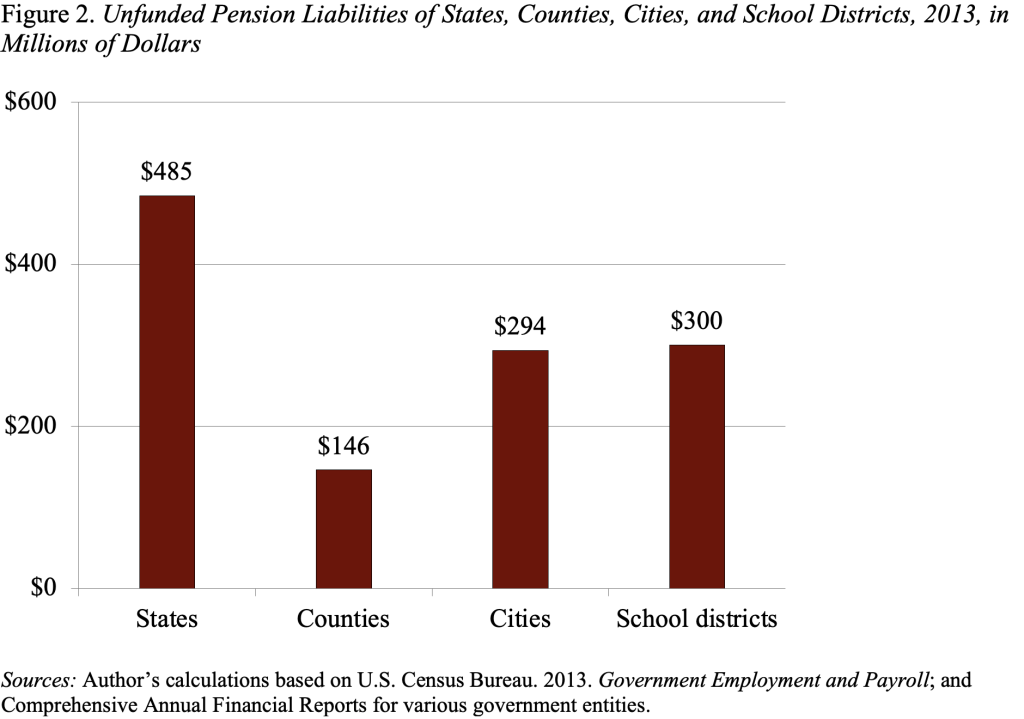

Similarly, a county’s unfunded liability consists of the unfunded liability of its own plan plus its share of the unfunded liability in any state plan in which it participates. A tally of total unfunded pension liabilities at each level of government shows that counties, on the whole, are relatively small players in the pension world. In total, counties’ unfunded pension liabilities – for their own plans and their share of state-run plans – amount to only $146 billion, roughly 12 percent of the total $1.2 trillion for all state and local governments.

But the unfunded liability of counties can be significant in states with active county governments. In California and Maryland, counties are responsible for about a quarter of the unfunded liability. In Virginia, where counties not only run the public school systems but also are responsible for funding teacher pensions, counties hold over 40 percent of the unfunded liabilities.

The bottom line: although county-sponsored pensions plans are insignificant in the majority of states, they are really important in some states and cannot be ignored when assessing the public pension landscape.