At Last, Agreement on Social Security Replacement Rates

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

CBO “flap” shows SSA numbers weren’t so bad after all.

So as to not lose my few remaining readers, I would like to wind up the discussion of Social Security replacement rates. And I think that I can do that on a positive note. The Congressional Budget Office (CBO) “flap,” where the agency admitted that it had miscalculated replacement rates, suggests two pieces of good news.

First, those who are constantly arguing that Social Security benefits replace an enormous share of pre-retirement earnings embraced the concept – recently adopted by the CBO – whereby benefits are compared to the last five years of pre-retirement earnings. I, too, think benefits relative to recent earnings seems like a reasonable measure and, indeed, the 2015 Technical Panel, which I chaired, concluded that such a measure would be useful and should be included – along with others – in the annual Social Security Trustees Report. Thus, after years of wrangling, it appears we have agreement.

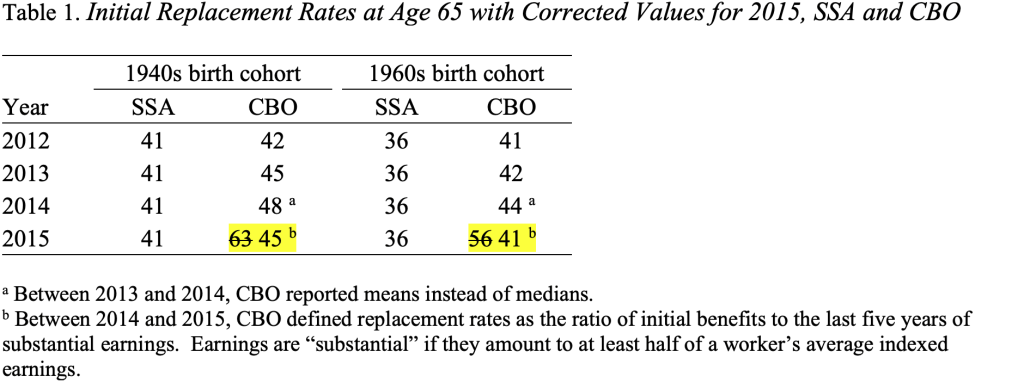

I trust that the enthusiasm for the CBO approach expressed in op-eds in the Wall Street Journal, Los Angeles Times, and Forbes centered on the concept, not on the fact that this concept produced very high numbers. As discussed last week, the CBO had a programming error that overstated replacement rates; the new, corrected replacement rates are now consistent with the agency’s previous estimates and numbers produced by the Social Security actuaries (see Table 1).

This brings me to the second positive outcome. The “CBO flap” ended up showing that the SSA numbers were not so bad after all, severely undermining the argument for deleting them from the Trustees Report in 2014. If we’re agreed that benefits relative to final earnings is a desirable measure, then the best replacement rates constructed on hypothetical lifetime earnings are those that yield results close to the final earnings measure. We no longer have to argue about price indexing versus wage indexing, but simply look at which measure brings us closer to our agreed-upon metric.

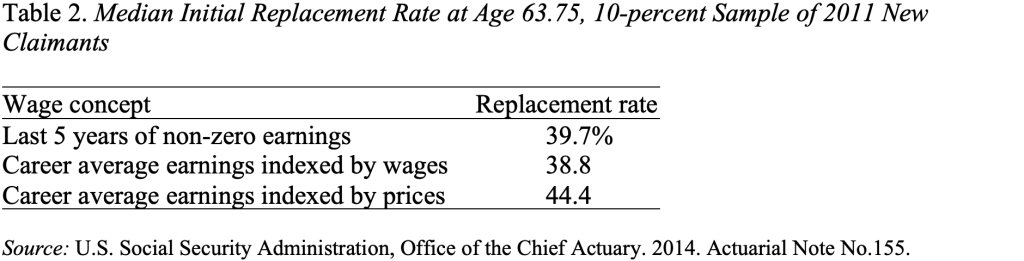

The Social Security actuaries’ analysis of a random sample of 200,000 workers claiming benefits in 2011 shows that wage-indexed earnings come much closer to the final-earnings measure than price-indexed earnings (see Table 2).

So in my view the debate is over. The old replacement-rate tables should be reinstated in the Trustees Report. They present a picture that both the “generous program” guys and I think is accurate.

Having no replacement rate numbers is a dangerous state of affairs. If policymakers only see dollar amounts rising over time – without any reference to the earnings these benefits are replacing – they may think that slowing the rate of increase would do little harm. But slowing the growth in inflation-adjusted benefits reduces the percentage of earnings replaced. If Social Security replaces less, then future workers must depend on the 401(k) system for more. But 401(k) balances, for a host of reasons, are very modest and unlikely to improve in the future.

So let’s put the replacement rate table back into the Trustees Report and move on to other topics!