Auto-IRA Programs Encourage Firms to Establish Their Own Plans

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The Pew Charitable Trusts recently reported that retirement assets in active auto-IRA programs have reached $1 billion. Auto-IRAs, which began in 2017 when Oregon launched its OregonSaves program, now are up and running in six other states: Illinois Secure Choice (2018), CalSavers (2019), MyCT Savings (2022), Maryland Saves (2022), Colorado SecureSavings (2023) and RetirePath Virginia (2023).

Auto-IRAs are a response to the problem that only about half of private sector workers in the United States are covered by an employer-sponsored retirement plan at any given time, and few workers save without one. Under the new programs, employers not offering a retirement plan must facilitate payroll deductions from their employees’ paychecks to state-sponsored IRAs. While the employee payroll deductions occur by default, employees have the option of opting out.

Many financial services firms have not been big supporters of Auto-IRAs – presumably because they feared that the state-sponsored initiatives would eat into their business. That concern never seemed quite right. Most of the uncovered workers are with small employers and are at the lower end of the earnings scale. That’s not really the target market for the financial services industry. Nor does it seem likely that many firms with plans would drop them in favor of auto-enrolling their employees in a state program – with no employer match.

More importantly, an argument could be made that even the relatively small administrative costs and hassle associated with participating in the state auto-IRA programs could encourage firms – particularly those close to the line between offering and not offering a plan – to establish their own plans. And, all the controversy surrounding the establishment of these state retirement programs could make retirement saving more salient. Indeed, the results of two recent studies, as well as earlier research, support the notion that this tendency might dominate.

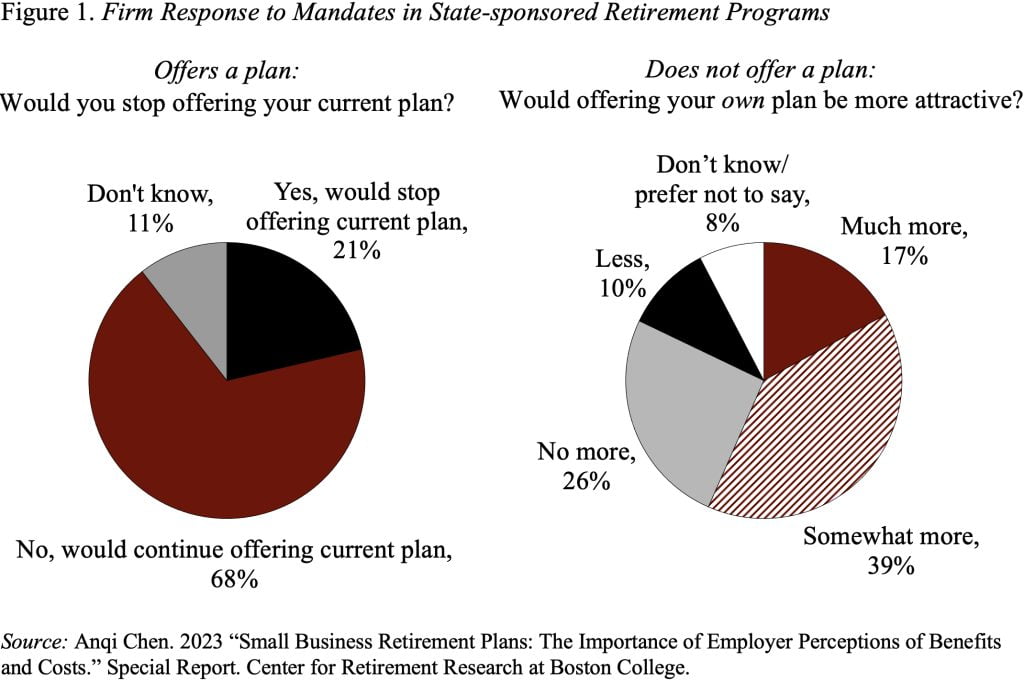

The first piece of evidence comes from a survey we recently undertook to determine why small employers do not offer retirement plans, which included a direct question about how small employers would react to a state auto-IRA. The responses show that the presence of state-sponsored programs does not seem to make firms less likely to offer their own retirement plan (see Figure 1). Among firms that already offer a plan, about 70 percent say they would continue to offer their own if their state introduced a mandate. Among firms that did not offer a plan, almost 60 percent said a mandate would actually make offering their own retirement plan more attractive. These results are consistent with a 2017 survey by Pew.

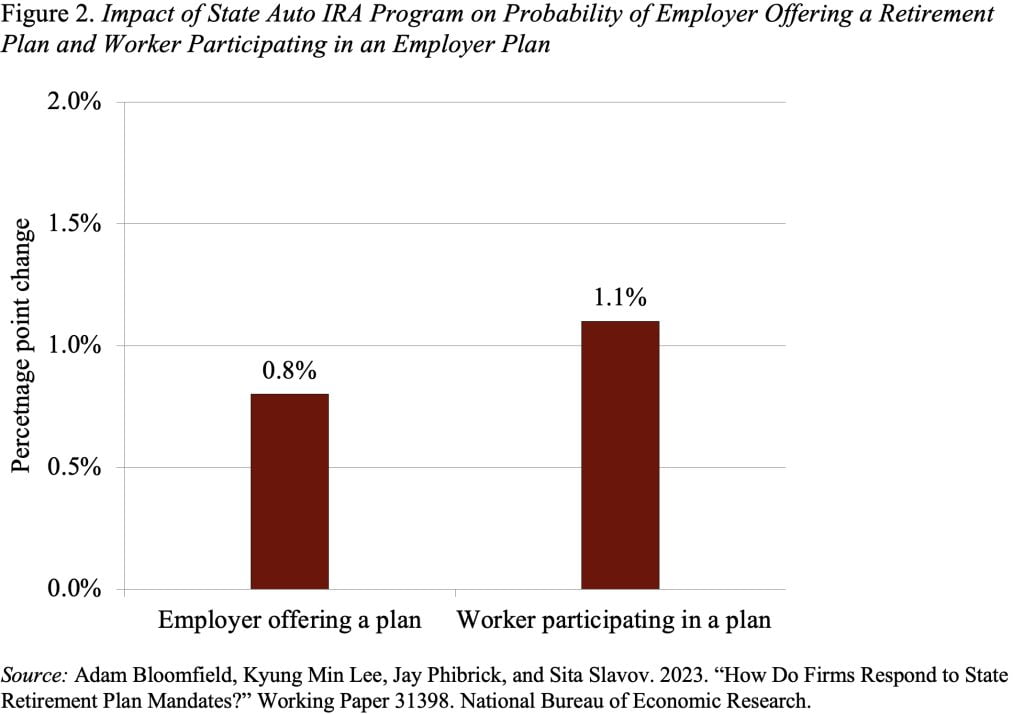

In addition to survey responses, a recent study, based on Form 5500 data and individual-level Census data, found that auto-IRA mandates increase the probability of firms offering a retirement plan by 0.8 percentage points and the probability that a worker participates in an employer plan by 1.1 percentage points (see Figure 2). These statistically significant results confirm earlier studies that state auto-IRAs complement – rather than crowd out – the private market for retirement plans.

It would be great if the financial services industry could get behind these auto-IRA initiatives.