Before Retiring, Do this Homework

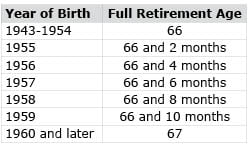

If you don’t know this chart on the Social Security website, you should:

The chart shows the so-called Full Retirement Age (FRA), which is the age at which you’re entitled to your full monthly Social Security benefit, a pension based on your earnings history.

Many boomers see their FRA as the time they ought to retire. But the question they should be asking themselves is: will the monthly benefit I’ll get at my FRA be enough?

At a time when many Americans are in danger of not having enough money for retirement, the answer is frequently no.

In 1983, Congress increased the FRA incrementally over time to save money for the program: it was 65 for anyone born in or before 1937 and will increase to 67 for anyone born in 1960 or later. The rise in the FRA saves the government money. The upshot of a later FRA is that your monthly benefit is less – and costs the government less – because you receive a smaller monthly check at any given age that you decide to start up your benefits.

Putting off Social Security is the most effective way to improve your financial outlook for retirement. If your FRA is 66, claiming at 70 increases your monthly benefit by a third. If your FRA is 67, it increases your monthly benefit by a quarter.

In figuring out when to retire, the FRA is a distraction, not a help.

To make the numbers real for you, review Social Security’s estimates of your benefit, based on your earnings today, on the program’s website. Compare your benefits at your FRA and at age 70 by creating an online account.

Before retiring, do the homework.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

In Your Social Security Statement, the phrasing is “…if you continue working until age 70…” I’m afraid this suggests to many people that, if they don’t continue working until age 70, there’s little point in delaying their claim for the SS benefit until then. Perhaps the misperception could be addressed by including “based on the same work history” to sentences such as “If your FRA is 66, claiming at 70 increases your monthly benefit by a third.”

Good point, well taken.

Extremely over-simplified advice. Taking Social Security at age 62 means the individual is ahead until around age 78. One must considered current health, family longevity as well as other sources of income.

Rarely during an analysis of when to take Social Security is there a discussion of the potential ROI of money received early. In other words, someone taking Social Security at age 62 vs. at age 70 has accumulated over $100,000 in net income while the 70 year old has receive $0. Invest that sum with only a 5% ROI and the break even point moves out to age 84 or more…

I (and my CFP) have exactly the same thoughts as pointed out by Terry.

I agree with the financial analysis of Terry and Mike, but still, I waited until age 70 to begin taking Social Security.

Social Security is both guaranteed and inflation-protected. Thus it is an insurance policy against problems with other retirement resources (pensions are only partially guaranteed and often inadequately funded, 401(k)s and IRAs are subject to the risks of the markets, state guarantee funds for annuities are limited, etc.). This guarantee is worth more to me than are the financial issues Terry and Mike discuss.

That was our experience regarding retiring early and claiming much later.

My wife and I both retired 7 years ago at age 55y/o. (We have significant investment, pension, and qualified retirement assets to live off of.)

Then, just as now, we had difficulties finding any detailed reporting on “what if we completely retire now, and don’t claim Social Security until 62yo, FRA, or 70yo? Does our Social Security benefit continue to grow if we delay?” All the examples we read assumed delayed retirement while continuing to work until filing for Social Security.

We continue to get our Social Security earnings statement each year, and enter $0 income for this and future years. What we see in those earnings statements is that the FRA amount increases by just over 3% per year. Still trying to find an equation showing how that’s calculated.

One of my wealthy friends started her Social Security monthly benefit at age 62 despite not needing it. She based her decision on her family health history and not wanting to leave anything behind for the government. She is still kicking at age 73.

Another friend had her defined benefit pension tied to Social Security monthly benefit at age 62. Nine years later she is not very happy.

I started my benefit at my eligible age of age 66. I thought I needed it. I could have done without it for four years. Oh well, my wife has found several ways to spend it.

The article talks only about delaying benefits to FRA or age 70. But it doesn’t say anything about spousal benefits or claiming strategies for spouses. For one, spousal benefits do not get delayed claiming credits after FRA is reached. Waiting to claim those leaves money on the table. Also, you can still file a “restricted application” for spouse only benefits, despite last year’s rule change. My wife and I did this. She filed for her benefits and I filed a restricted application to get half of hers. This way, I continue to earn delayed credit on my own work record.

A restricted application limits benefits to only the spousal amount but requires your spouse to have filed for his/her own retirement benefit. You have to be careful to avoid “deeming” rules that assume you filed for your maximum benefits and lose out on delayed claiming credits.

There’s no mention of the fact that those born before January 1, 1954, may still file a restricted application for spousal benefits (on their lower-earning spouse’s record) at full retirement age, then switch to their own benefit at age 70.

Social Security has closed this option to younger claimants, but it is still open to those born before 1954.

Great comments – at least as valuable at the blog itself!

Thank you- Kim (blog writer)

Delaying the primary earners benefit until age 70 is a must for a surviving spouse. Although a non-working spouse only needs 10 years or 40 quarters to qualify for free Medicare part A. They can only receive the maximum spousal benefit at their FRA, but will receive the spouse’s full retirement benefit as a surviving spouse upon death of their partner. For most married women, this can be the difference between surviving and living in abject poverty. Love your spouse and delay taking Social Security to age 70 if you can.

People forget that by working longer, those current, higher-paid salaries will replace the lower-paid salaries in the early years under the SS-formula — which uses the highest-paid 35-years. So not only will delaying Social Security until FRA or later increase the benefit, the SS-benefit will also increase based on current higher-paid wages. Any projections are based on a “current” SS-benefit, where these increases are not factored in.