Retirees with Pensions Slower to Spend 401k

Retirees have long been reluctant to spend the money they’ve accumulated in their 401(k) savings plans. But it also used to be common for retirees to have a traditional pension to cover their regular expenses.

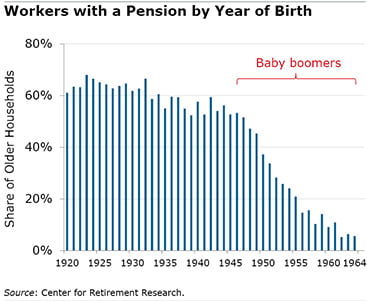

By the time the baby boomers came along, pensions were available to a dwindling minority of workers, and it isn’t entirely clear how much they’ll tap into their 401(k)s.

A new study quantifies the impact of this transformation in the U.S. retirement system, where traditional pensions are now found almost exclusively in the public sector. The conclusion, by the Center for Retirement Research, is that retired boomer households lacking a pension seem more likely to rapidly deplete the 401(k) savings they rely on, “leaving them with more risk that they will outlive their savings.”

A new study quantifies the impact of this transformation in the U.S. retirement system, where traditional pensions are now found almost exclusively in the public sector. The conclusion, by the Center for Retirement Research, is that retired boomer households lacking a pension seem more likely to rapidly deplete the 401(k) savings they rely on, “leaving them with more risk that they will outlive their savings.”

Consider a simple example of the difference a pension makes. In the past, typical households that started retirement with a pension and $200,000 in 401(k)s and other financial assets had about $28,000 more at age 70 than their counterparts with $200,000 in assets but no pension. After age 75, the difference between the haves and have-nots widened to about $86,000.

For this analysis, the researchers used data on the retirement finances provided in a survey of older Americans, specifically the heads of households born between 1924 and 1953, which includes some of the earliest boomers.

The researchers also found that the pace at which these retirees spent their savings hinged on the percentage of wealth they held in the form of annuities, whether a pension, Social Security, or an insurance company annuity. The retirees who got more of their income from annuities depleted their savings more slowly.

Based on prior generations’ behavior, the researchers roughly estimated that boomers – given their lower pension coverage – are in danger of using up their financial assets at around age 85. This would leave them with little room in their budgets for a long life, a large unexpected medical bill, or an inheritance for their children.

Boomers probably shouldn’t assume then that their parents’ retirement experiences are a reliable indication of how they will fare.

To read this study, authored by Robert Siliciano and Gal Wettstein, see “Can the Drawdown Patterns of Earlier Cohorts Help Predict Boomers’ Behavior?”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Health in the US is the most expensive in the world by a factor of 3 to 4x and 20% of GDP. It is now estimated one would need 300K alone for health in retirement, so in either case they will go bankrupt just based upon health care costs. Look up the data.

Allan Sloan: Forcing people of modest means to depend on the stock market for income to pay bills after they stop working is madness.

The other key difference is that I have investments that I accumulated during my working years that my parents couldn’t have dreamed of. Yes, my father had a traditional pension that I don’t have. At retirement, I had my 401(k) transferred to my existing IRA. So, I have significant retirement investments that more than make up for the lack of a pension. (My wife has similar financial holdings).

So, we have our retirement nest eggs to work with. Having just started receiving our social security benefits (at FRA), we rarely have to touch our IRAs. We’ll be in good shape for quite a while – the rest of our lives, we’ve projected – even without our parents’ type of pensions. The modeling we’ve done indicates that we won’t be depleting our retirement assets anytime soon (if ever), and will even leave a fairly good sum to our grandkids, something our parents couldn’t (or didn’t) do with their pensions.

What we’ve seen is that it’s almost always about personal choices and what opportunities one took advantage of during one’s working years.

If you have large traditional IRAs you will be clobbered by taxes starting at 72. Are you converting to a Roth IRA?

This study suggests another reason for the commonly recommended strategy of annuitizing a portion of your IRA/401(k) assets: not only does the annuity provide investment security, it also slows winding down the other assets.

There are various strategies for allocating payouts over retirement. A simple one is to take only your Required Minimum Distributions.

It does not take an advanced degree to see that if you have a guaranteed pension that is more money in addition to what one could save for retirement. I am a single woman, a former nurse, and not one job offered me a pension. I am relying on my savings and social security as well as the equity in my home. Meanwhile, I have a cousin who is seven years younger who will be making $3500 in pension plus his 401K plus social security. He is 60 and has worked for forty years for UPS. He just mailed in his retirement papers this week. I am 67.

Well thank you for this Captain Obvious! People with pensions will not spend down their savings as quickly as people without them. I’m shocked!

Good point Ed and Lee! Yes, that does seem obvious. I suppose the larger and more important issue is whether retired baby boomers will have enough in their 401ks to last and maintain their living standard – given that so few have pensions.

I retired in 2011 at age 67. With no mortgage and debt, we live comfortably on a pension, SS and some annuitized IRA funds. Still a good nest egg in IRA’s which I would leave alone if it weren’t for MRD. The steady monthly income lets my wife rest easy at night.

Your Social Security annuity is a great guaranteed pension. How many employees would volunteer to pay more into Social Security because they only have a 401(k) and Social Security?