Forensic Analysis of Pension Funding: A Tool for Policymakers

The brief’s key findings are:

- State and local policymakers face a growing pension cost burden, but often lack understanding of the root causes.

- One underappreciated cause is “legacy debt” – unfunded liabilities accumulated long ago, before plans adopted modern funding practices.

- Legacy debt still exists today because historical unfunded liabilities were ultimately paid in full using some of the money intended to fund later benefits.

- In a sample of plans with particularly low funded ratios, legacy debt averaged more than 40 percent of unfunded liabilities.

- A failure to recognize the legacy debt has provided misleading information about benefit generosity, hindering progress toward effective solutions.

Introduction

State and local policymakers face increasing pressure to manage pension costs, as unfunded liabilities continue to grow relative to budgets. However, policymakers often lack a historical perspective on the root causes of pension underfunding, which is an obstacle to developing effective solutions.

In 2015, the Center for Retirement Research (CRR) performed its first forensic analysis of pension funding for the Connecticut State Employees Retirement System (CT SERS) and Teachers Retirement System (CT TRS).1Aubry and Munnell (2015). This analysis uncovered two major contributors to underfunding. The first was a legacy debt from the period before SERS and TRS were actuarially funded – retirement benefits had been promised since the 1930s, but were not actuarially pre-funded until the 1980s. The second was inadequate contributions made by the State once it decided to pre-fund, perhaps partly motivated by the sheer size of the legacy burden and its associated amortization payments. After the CRR released its forensic study, Connecticut adopted a new method that increased the cash flow to its plans. And the State began debating options for managing the system’s legacy debt. In short, the CRR study provided actionable insights to Connecticut policymakers.

The analysis for Connecticut highlighted factors that likely play a role elsewhere as well. Therefore, to support the policy debate in more locations with poorly funded plans, the CRR performed forensic analyses for retirement systems in five other states: Illinois, Massachusetts, Ohio, Pennsylvania, and Rhode Island.

This brief – the first of two – summarizes the results of these forensic analyses. The discussion proceeds as follows. The first section untangles the roots of unfunded pension liabilities and explains why the legacy debt from many decades ago continues to impact the finances of plans today. The second section quantifies the size of the legacy burden. The third section discusses how this burden may have encouraged questionable policies for managing later liabilities. The final section concludes that the lack of understanding of legacy debt is hindering progress on pension funding and that moving forward requires a new framework for managing these unfunded liabilities, which will be the topic of a second brief.

Key Takeaways from the Forensic Analyses

The forensic analyses were conducted for the 13 major state-administered retirement systems in Connecticut, Illinois, Massachusetts, Ohio, Pennsylvania, and Rhode Island. Each analysis began with the earliest financial report available for the retirement system – generally from the 1940s – and then used subsequent reports to build a timeline of key events in the system’s funding history.

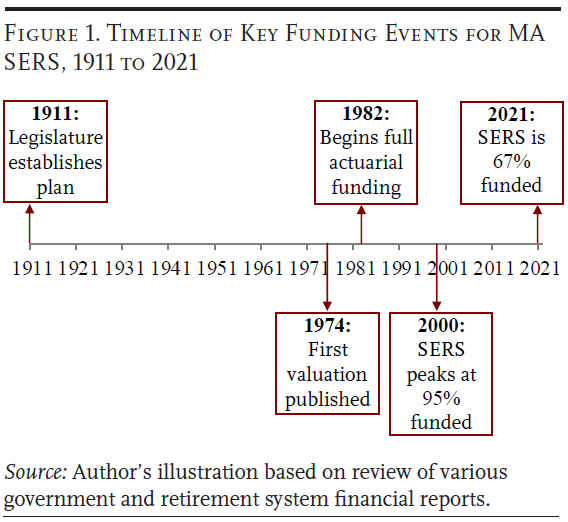

A key overall finding is that many of the retirement systems have been providing benefits since the early 1900s, but the benefits were not funded using modern actuarial practices until much later. The timeline for Massachusetts’ State Employees Retirement System (MA SERS) is typical (see Figure 1). The system was established in 1911, but did not start actuarially pre-funding until 1982 – saddling it with decades of unfunded benefit accruals.

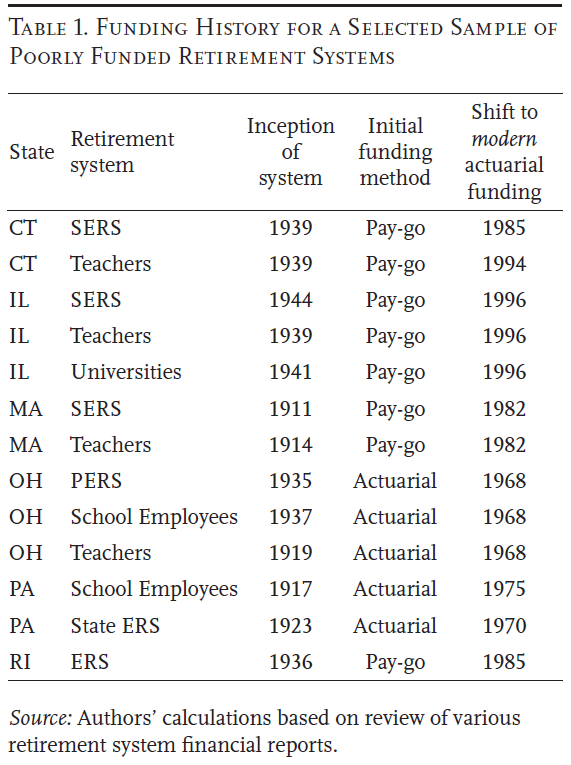

For many systems, benefits were initially funded under a pay-go approach, in which annual payments to retired workers were simply paid out of current government revenues (see Table 1). Other systems adopted some form of actuarial funding, but these early norms were much more lax than later methods, also resulting in unfunded liabilities.2For the retirement systems that have used actuarial funding practices from inception, the shift to modern actuarial funding was defined as the first year that normal cost and amortization of unfunded liabilities were explicitly referenced and/or changes to the accrued and unfunded liabilities were closely tracked. In either case, these retirement systems were saddled with unfunded liabilities when they moved to the modern actuarial approach.

A second key finding of the forensic analysis is that unfunded liabilities for these retirement systems have grown significantly even after their shift to modern actuarial funding. The primary reasons for this increase were insufficient contributions; poor investment returns relative to expectations; changes to actuarial assumptions, such as the expected mortality of retirees; the actual experience of plan members relative to those expectations; and – to a lesser extent – benefit increases in the 1980s and 1990s. 3Please see CRR reports on the funding history and growth in unfunded liabilities for specific state-administered retirement systems in Connecticut, Illinois, Massachusetts, Ohio, Pennsylvania, and Rhode Island. For more on the basic methodology for the forensic analyses, see Munnell and Aubry (2015) or Munnell, Aubry, and Cafarelli (2015).

Even though legacy pension debt represents unfunded liabilities from a bygone era, the impact is still felt today. Why? Because the initial unfunded benefits were paid in full with some of the money that was intended to fund later benefits – thus underfunding the next cohort. So, while the promised benefit payouts that made up the initial liabilities may no longer be on the system’s books, their payment simply created new unfunded liabilities, and the shortfall kept getting passed forward.4Generally, actuaries assume that pension fund assets and contributions go towards the oldest liabilities first – showing the liabilities of existing retirees to be fully funded and pushing any funding shortfall to the liabilities of active workers. This approach makes sense if one considers how a pension fund works: assets accumulated through the contributions of all members are pooled in the pension fund, invested, and then paid out to retirees on a first-come, first-served basis. However, in actuality, it is impossible to assign the assets and contributions of a pension trust fund to any specific future promised benefit payouts that underlie accrued liabilities. And, even though the amortization payments built into modern funding practices were supposed to incrementally reduce the legacy liabilities being passed forward each period, they were often insufficient.5Amortization payments have been historically insufficient in two ways. First, the calculated payments often fell short of what was needed to keep the unfunded liability from growing in dollar terms each year. Second, governments often paid less than the calculated amount.

How Large is the Legacy Debt Now?

Determining the portion of today’s unfunded liabilities that is due to the initial legacy debt depends on how one allocates the historical contributions and assets of the retirement system. The simplest approach is to conceptually split each retirement system into two systems at the point when modern actuarial funding begins – one system for the legacy liability and the other for ongoing liabilities.

Under a two-system framework, all normal cost contributions made after the split are fully allocated to the ongoing system because normal costs are the value of additional benefits accruing each year and are wholly unrelated to the legacy liabilities. The annual amortization payments, however, are split proportionally between the unfunded legacy liability and any unfunded liabilities that occur in the new system.6The amortization payments are split proportionally to reflect the fact that each future promised benefit payout that makes up the retirement system’s accrued liability has equal claim to being fully funded. Importantly, the legacy system is assumed to be the first payer of annual benefits (a result of the fact that benefits being paid right after the split would be mostly related to the legacy debt), with any remaining amount paid by the ongoing system. Because annual benefit payments from the legacy system exceed the amortization payments coming in, the legacy system accumulates no assets – all the assets (and, consequently, all the investment gains and losses) accumulate in the ongoing system.7In general, this two-system approach results in legacy liabilities growing similarly to total unfunded liabilities over time (minus the impact of investment performance). Technically, the legacy debt analysis is done as follows. First, the initial debt in the legacy system is rolled forward each year using a standard formula for tracking growth in unfunded liabilities: legacy liability (t) = legacy liability(t-1) + interest on legacy liability(t-1) – apportioned amortization payment (t) + apportioned actuarial gains and losses on the accrued liability (t). Then, the annual accrued liability for the ongoing system equals the retirement system’s reported accrued liability in the year minus the estimated legacy liability. The amortization payment apportioned to legacy debt in each year is based on the relative sizes of the prior year’s: 1) legacy liability; and 2) the additional unfunded accrued liability in the ongoing system. The gains and losses apportioned to the legacy debt each year are based on the relative sizes of the prior year’s: 1) legacy liability; and 2) the additional accrued liability in the ongoing system.

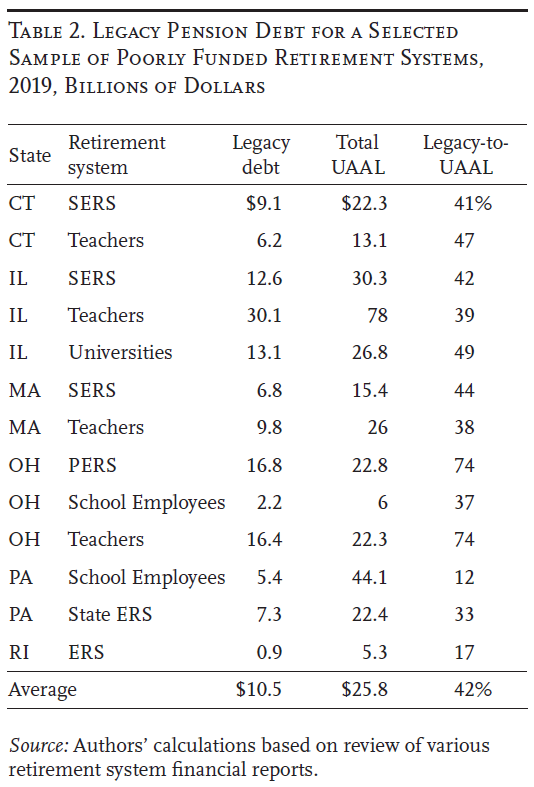

Using this approach to estimate legacy debt for each system in our sample, the results show that legacy debt represents over 40 percent, on average, of today’s unfunded liabilities for the sample plans (see Table 2).

How Legacy Debt Can Undermine Current Funding Practices

Ignoring the unique aspects of legacy debt can lead policymakers astray. Legacy debt has never fit well within the modern framework because it stems from a much earlier era and its burden cannot be reasonably allocated to those who should have borne the costs.8Each year, government workers earn a higher promised retirement benefit because both their salary (on which their benefit payout is based) and their years of tenure in government (which determines the percentage of their salary they receive as a benefit payout) increase. Each year’s normal cost represents the current value of that increase in promised future benefits to workers. In theory, paying the normal cost would result in each generation paying for promised benefits as they are earned. In practice, however, the value of future benefits is impossible to determine precisely and additional contributions are required in later periods to ensure that the cost of benefits earned in prior periods does not stretch too far into future periods. Instead, it reflects the long-term transition costs from an older way of doing things. Managing these liabilities within the modern actuarial system burdens the current generation – who, at this point, is no more responsible for the legacy debt than any other – with the full cost of that transition.

Importantly, forcing legacy liabilities into the modern framework may have also encouraged the use of questionable policies for managing later liabilities – such as using long open amortization periods and using the assumed investment return to value liabilities. When these retirement systems initially shifted to modern actuarial funding, they were faced with the high cost of paying down legacy liabilities, in addition to the basic cost of pre-funding ongoing benefits. It is not difficult to imagine policymakers seeking ways to mitigate the legacy cost by: 1) paying down the legacy debt over a long horizon; and 2) taking greater advantage of equity markets to achieve higher returns.

While long pay-down periods may seem reasonable for managing a costly initial legacy debt accumulated over decades in a prior funding regime, it translates into questionable pension policy when also applied to the more manageable unfunded liabilities that accumulated afterward. In the same vein, the shift away from primarily bond portfolios to more modern investment approaches that include more equities was reasonable and would have driven down costs over time as the higher investment returns were realized. But, using the allocation shift to immediately lower required contributions – before the returns materialized – was questionable policy.9While the shift in the asset allocation and discount rates of public plans ostensibly aligned them with those of private sector plans at the time, the underlying mechanics were much different. First, the higher equity allocations observed in private pension trust funds did not capture the significant proportion of private pension assets deposited with life insurance companies and presumably invested in corporate bonds. Second, the higher discount rate used by private plans reflected the prevailing corporate bond interest rates at the time – not their expected return.

More recently, rising unfunded liability costs following the Global Financial Crisis resulted in retirement systems taking even more risk in their investment portfolios and increasing their assumed real return to limit further increases in expected pension costs.10See Aubry and Wandrei (2019) for details on how, for many retirement systems, a decline in their assumed return masks an increase in the assumed real (i.e., net of inflation) return, which lowers costs. And keeping legacy debt within the modern actuarial framework, all else equal, makes currently promised benefits look more expensive than they are – a misperception that encouraged many policymakers to focus on benefits cuts as a primary solution.

This history suggests that continuing to manage legacy liabilities – a relatively intractable transition cost from an earlier era – within the modern actuarial framework may continue to encourage misguided approaches to managing pension liabilities generally.

Conclusion

Policymakers face growing pressure from the rising burden of pension costs. A key finding of this analysis is that the legacy debt, which was built up before modern actuarial funding methods were adopted, accounts for over 40 percent of the sample plans’ current aggregate unfunded liability. Policymakers often do not understand the role and meaning of legacy debt, which makes adopting effective funding solutions difficult.

Legacy debt poses a different policy challenge than other sources of unfunded liability. Because these legacy liabilities stem from a much earlier era of pension financing, they reflect the long-term transition costs from an older way of doing things. Continuing to manage legacy debt within the current framework burdens the current generation – who, at this point, is no more responsible for the legacy debt than any other – with the full cost of that transition. And, it may be encouraging misguided approaches to managing more recent unfunded liabilities.

To help inform state policy discourse on unfunded liabilities, the second brief in this series will lay out a new framework that could be used to manage legacy debt and other pension liabilities.

References

Aubry, Jean-Pierre and Kevin Wandrei. 2019. “How Has the Decline in Assumed Returns Affected Plan Costs?” State and Local Plans Issue in Brief 66. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Aubry, Jean-Pierre and Alicia H. Munnell. 2015. “Forensics and the Future of a Connecticut Pension Plan.” State and Local Plans Issue in Brief 46. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Munnell, Alicia H., Jean-Pierre Aubry, and Mark Cafarelli. 2015. “How Did State/Local Plans Become Underfunded?” State and Local Plans Issue in Brief 42. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Endnotes

- 1Aubry and Munnell (2015).

- 2For the retirement systems that have used actuarial funding practices from inception, the shift to modern actuarial funding was defined as the first year that normal cost and amortization of unfunded liabilities were explicitly referenced and/or changes to the accrued and unfunded liabilities were closely tracked.

- 3Please see CRR reports on the funding history and growth in unfunded liabilities for specific state-administered retirement systems in Connecticut, Illinois, Massachusetts, Ohio, Pennsylvania, and Rhode Island. For more on the basic methodology for the forensic analyses, see Munnell and Aubry (2015) or Munnell, Aubry, and Cafarelli (2015).

- 4Generally, actuaries assume that pension fund assets and contributions go towards the oldest liabilities first – showing the liabilities of existing retirees to be fully funded and pushing any funding shortfall to the liabilities of active workers. This approach makes sense if one considers how a pension fund works: assets accumulated through the contributions of all members are pooled in the pension fund, invested, and then paid out to retirees on a first-come, first-served basis. However, in actuality, it is impossible to assign the assets and contributions of a pension trust fund to any specific future promised benefit payouts that underlie accrued liabilities.

- 5Amortization payments have been historically insufficient in two ways. First, the calculated payments often fell short of what was needed to keep the unfunded liability from growing in dollar terms each year. Second, governments often paid less than the calculated amount.

- 6The amortization payments are split proportionally to reflect the fact that each future promised benefit payout that makes up the retirement system’s accrued liability has equal claim to being fully funded.

- 7In general, this two-system approach results in legacy liabilities growing similarly to total unfunded liabilities over time (minus the impact of investment performance). Technically, the legacy debt analysis is done as follows. First, the initial debt in the legacy system is rolled forward each year using a standard formula for tracking growth in unfunded liabilities: legacy liability (t) = legacy liability(t-1) + interest on legacy liability(t-1) – apportioned amortization payment (t) + apportioned actuarial gains and losses on the accrued liability (t). Then, the annual accrued liability for the ongoing system equals the retirement system’s reported accrued liability in the year minus the estimated legacy liability. The amortization payment apportioned to legacy debt in each year is based on the relative sizes of the prior year’s: 1) legacy liability; and 2) the additional unfunded accrued liability in the ongoing system. The gains and losses apportioned to the legacy debt each year are based on the relative sizes of the prior year’s: 1) legacy liability; and 2) the additional accrued liability in the ongoing system.

- 8Each year, government workers earn a higher promised retirement benefit because both their salary (on which their benefit payout is based) and their years of tenure in government (which determines the percentage of their salary they receive as a benefit payout) increase. Each year’s normal cost represents the current value of that increase in promised future benefits to workers. In theory, paying the normal cost would result in each generation paying for promised benefits as they are earned. In practice, however, the value of future benefits is impossible to determine precisely and additional contributions are required in later periods to ensure that the cost of benefits earned in prior periods does not stretch too far into future periods.

- 9While the shift in the asset allocation and discount rates of public plans ostensibly aligned them with those of private sector plans at the time, the underlying mechanics were much different. First, the higher equity allocations observed in private pension trust funds did not capture the significant proportion of private pension assets deposited with life insurance companies and presumably invested in corporate bonds. Second, the higher discount rate used by private plans reflected the prevailing corporate bond interest rates at the time – not their expected return.

- 10See Aubry and Wandrei (2019) for details on how, for many retirement systems, a decline in their assumed return masks an increase in the assumed real (i.e., net of inflation) return, which lowers costs.