Can We Help People Improve Their Life Expectancy Estimates?

The brief’s key findings are:

- Understanding how long we might live can affect our retirement decisions, but many people underestimate their odds of living to older ages.

- This study tested whether providing simple information could help improve people’s estimates of reaching older ages.

- The intervention was quite effective for about a quarter of participants, specifically those who rely on experts to inform their thinking.

- But the intervention was ineffective for the many participants who rely on their parents’ experience, so more research is needed on how to help them.

Introduction

Understanding how long we might live can influence important decisions, such as how much to save or whether to buy an annuity. Yet, many people underestimate their chances of living to older ages, which may lead them to save too little and avoid annuities, potentially reducing their financial security in retirement.

This brief is a deeper dive into longevity awareness as part of a forthcoming study.1 It examines whether simple and low-cost information interventions can increase longevity awareness – people’s understanding of how long they are likely to live. To this end, the study fields an experiment with a control group and two treatment groups. The treatment groups both received educational material designed to improve their awareness of how long they might live.

The brief is structured as follows. The first section provides background on longevity awareness. The second section describes the survey and the experiment. The third section presents the results and shows that the intervention was quite effective, but only for about a quarter of the participants. The final section concludes that low-cost interventions can work for select populations and that less information can actually be better. A question for future research is how to reach others who are not receptive to these types of interventions.

Background

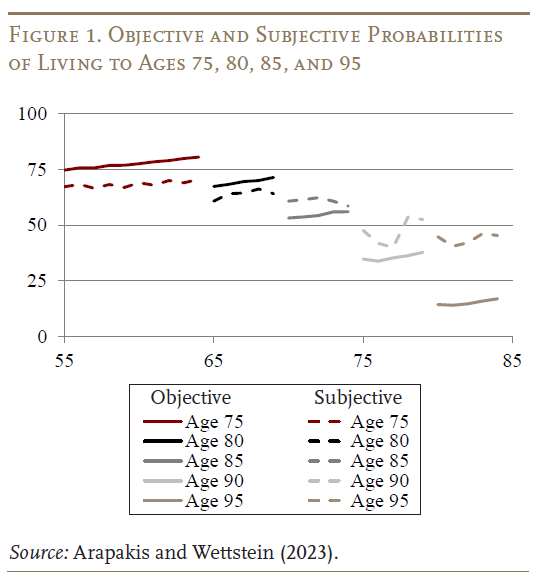

Prior research has suggested that adults ages 55-70 tend to be pessimistic about how long they will live, as their guesses about the chances of living to older ages (the dashed lines in Figure 1) are lower than the objective data (the solid lines).2 This pessimism may negatively affect decisions about savings and annuitization, since individuals will have to decide whether to buy an annuity and how to draw down their 401(k) balances at ages when they are most likely to underestimate their life expectancy.

The question is, can educational interventions help make individuals more realistic about their likelihood of living to older ages. Previous research found that presenting people with data on their probability of living to very old ages improved their longevity awareness, while simply presenting data on life expectancies did not.3 This finding suggests that people may be aware of average life expectancies but not about their likelihood of living to older ages. Furthermore, many individuals base their life expectancy on either their parents’ age of death or on media reports, but neither of these factors consider likely future improvements in lifespans.4

Survey and Randomized Control Trial

Building on these two empirical facts about the potential effectiveness of interventions and the traditional sources people rely on, our experiment tests two different informational interventions to address different biases that individuals might have about longevity. The first is “tail risk,” or not knowing the likelihood of living to very old ages. Respondents in the first treatment group are given some data from the Social Security Administration about the tail risk. The second bias is not understanding the extent to which longevity has generally improved over time. Respondents assigned to the second intervention are given the same data as those in the first treatment group, plus additional content on how much longer people tend to live than their parents. For details about the survey sample, see the Box.

Box. Survey Sample

The experiment was one part of a larger survey on longevity awareness and annuity literacy, designed in partnership with Pacific Life, and run by Greenwald Research Associates. The survey was fielded in the first quarter of 2025 and included 2,204 respondents. Participants were ages 21-70, with 1,950 individuals ages 45-70. All respondents were employed full-time and had a 401(k)-type retirement savings plan. Only participants ages 45-70 were included in the informational intervention experiment.

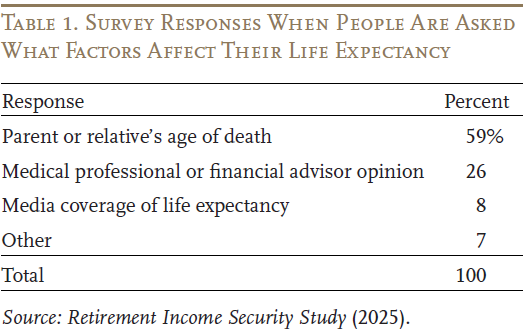

Participants were first asked to choose the most important factor they use to estimate their life expectancy. Like prior studies, our survey found that the majority of respondents based this assessment on their parents (or other relative’s) age of death, while about 10 percent based it on media coverage (see Table 1). Interestingly, about one-quarter of respondents said they relied on the opinions of health or financial professionals.

Next, to determine whether simple informational interventions could help correct lifespan misperceptions, we divided survey participants into three groups: a control group and the two intervention groups.

The control group was offered some irrelevant material unrelated to life expectancy, survival probabilities, or mortality improvements over time.5 After control group participants read this content, they were asked to estimate how long they think they might live and their probability of living to ages 75, 80, 85, …, and 100.

The first treatment group was given information about their probability of living to ages 90 and 100 from Social Security death records. As with the control group, they were then asked to estimate how long they think they might live and their probability of living to various ages between 75 and 100. As mentioned above, this approach builds on prior findings that educating individuals about the probability of living to older ages improves longevity awareness more than just life expectancy data. Identifying effective ways to improve understanding of this tail probability is particularly important in considering whether to purchase guaranteed lifetime income, since the tail risk is what the products insure.6

However, as noted, most individuals base their perceived life expectancy on their parents’ age of death. Interventions that tell people how much longer they might live relative to their parents (or grandparents for younger individuals) have not been studied before. Thus, in addition to data about the likelihood of living to older ages, the second treatment group was also given information on rising longevity across cohorts and how much longer people live compared to their parents or grandparents. Then, as with other groups, they were asked to estimate their probability of living to various ages between 75 and 100.

Results

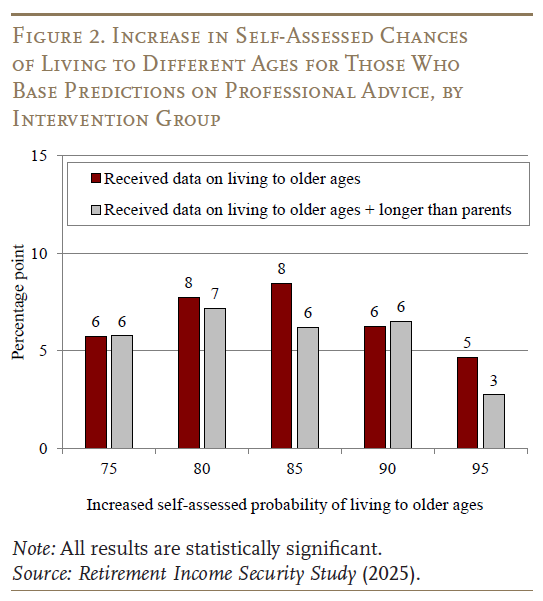

The interventions worked well, but only for one group of respondents – those who based their life expectancy predictions on advice from medical professionals or financial advisors. Respondents who trusted experts became more optimistic about living to older ages after receiving either of the informational interventions. This group represents a little over a quarter of the survey respondents who received the treatments. In contrast, the interventions had no impact on those who based their life expectancy assessments on their parents’ age of death or other factors. Figure 2 summarizes the results for those who base their life expectancy predictions on professional advice. For example, among these people, those in the first treatment group – who received only the material on living to older ages – were 8 percentage points more likely than the control group to say they will live at least until age 85. Interestingly, merely providing data about the likelihood of living to older ages is just as effective, if not more effective, as providing the additional data about living longer than parents that the second treatment group received.7

How Do Interventions Compare with Financial Advisors?

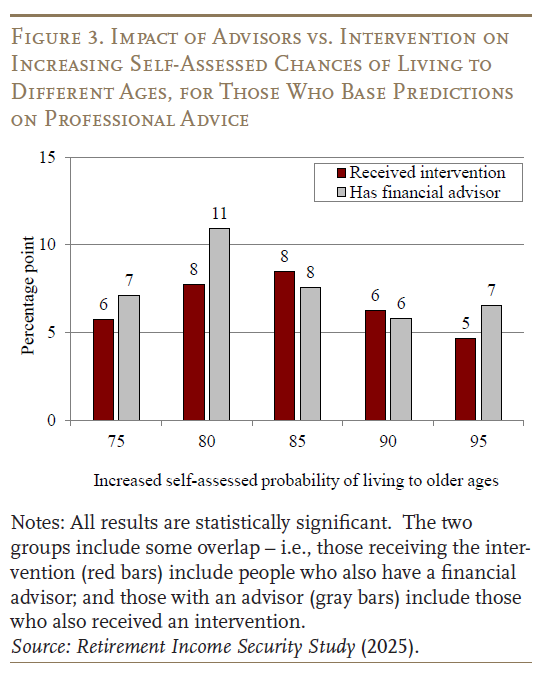

An interesting question is how does the impact of the interventions compare with the effect of having a financial advisor (again, for the one-quarter of respondents who rely on professional advice)? Not surprisingly, people who worked with financial advisors were more optimistic about living to older ages than those without advisors (see Figure 3).8

What is more interesting, however, is that if we compare the impact of the interventions with the impact of advisors, we see that the interventions had a similar impact on people’s predictions for living until older ages. Although the interventions only work for about a quarter of the population – those who trust professionals – the results are still encouraging since not everyone has access to a financial advisor. In short, these informational interventions can be a cost-effective way to improve longevity awareness.9

Can Interventions Help with Financial and Annuity Literacy?

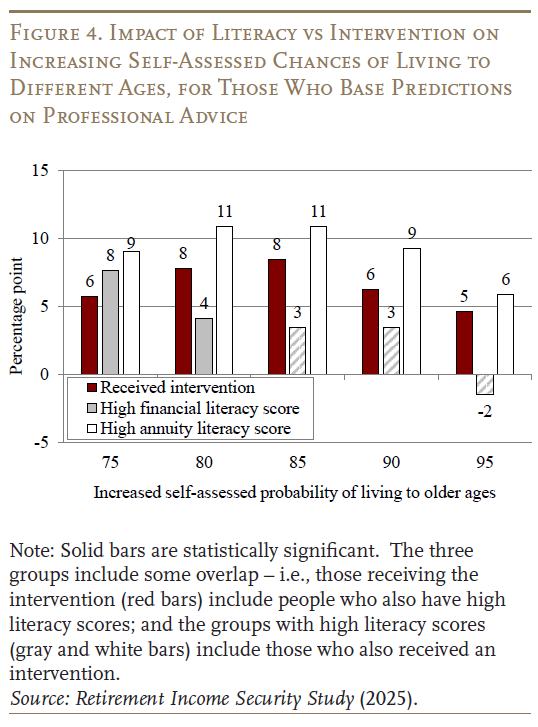

Next, we examine how the interventions compare with those who have high financial or annuity literacy. Unsurprisingly, people with higher financial or annuity literacy are more optimistic about living to older ages than those with lower literacy(see Figure 4).

Interestingly, Figure 4 shows that the intervention was more consistent at improving longevity optimism relative to higher financial literacy, although the effect is smaller than those who have higher annuity literacy.10 Since financial and annuity literacy can take years to build up, it is encouraging that the informational intervention can be impactful.

Conclusion

Understanding how long we might live can influence key decisions, such as how much to save or whether to buy an annuity. However, many people underestimate their likelihood of living to older ages. We tested whether a short informational intervention might help correct people’s misperceptions. The results from the experiment provide two important lessons. The first is that only a particular subset of individuals are receptive to interventions – intuitively, it is those who trust professionals for their information. For this group, the interventions were effective. For the other groups, more research is needed to determine how to improve longevity awareness, as such people tend not to base their assessments on expert opinion, making interventions from the experimenters less effective.

The second lesson is that providing simple material works just as well, if not better, as interventions with more detail. While neither intervention was particularly long, our results showed that merely providing some data – on the likelihood of living to specific ages – was enough to increase respondents’ perceptions of surviving to older ages, and offering more data on mortality reductions over time did not improve outcomes.

References

Arapakis, Karolos, Anqi Chen, Qi Sun, and Gal Wettstein. (forthcoming). Retirement Income Security Study. Newport Beach, CA: Pacific Life.

Arapakis, Karolos, and Gal Wettstein. 2023. “Longevity Risk: An Essay.” Special Report. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Hurwitz, Abigail, Olivia S. Mitchell, and Orly Sade. 2022. “Testing Methods to Enhance Longevity Awareness.” Journal of Economic Behavior & Organization 204: 466-475.

Hurwitz, Abigail and Olivia S. Mitchell. 2022. “Financial Regret at Older Ages and Longevity Awareness.” Working Paper No. 2022-25. Philadelphia, PA: University of Pennsylvania, Wharton Pension Research Council.

Endnotes

- Arapakis et al (forthcoming). ↩︎

- Arapakis and Wettstein (2023). ↩︎

- Hurwitz, Mitchell, and Sade (2022). ↩︎

- Arapakis and Wettstein (2023). ↩︎

- Providing the control group with irrelevant content helps ensure that any potential difference in responses between the control and treatment groups is not driven by the treatment groups being more tired due to exposure to extra information. ↩︎

- See Hurwitz and Mitchell (2022). ↩︎

- This pattern may not be surprising, since the second treatment is meant to fix misperceptions due to reliance on a parents’ age of death, and the type of person who responds to informational treatments would not have had this bias to begin with, since they rely on experts, not family history. ↩︎

- Roughly a third of survey respondents had a financial advisor and about 45 percent of those who based their longevity information on professionals had an advisor. ↩︎

- Of course, financial advisors provide guidance about many things beyond longevity awareness. ↩︎

- Roughly 40 percent of those who look to professionals for their longevity estimate have a high financial or annuity literacy score. The share of people with high scores are almost identical regardless of the source of their longevity estimates. ↩︎