Canada Proposes to Dramatically Expand the Canadian Pension Plan

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Canada goes for a national rather than a province-by-province solution to inadequate pensions.

In Canada, like the United States, more than half the private sector workforce does not have access to a well-designed, cost-effective retirement savings plan. In Canada, the province of Ontario was in the process of responding to the coverage gap with the Ontario Retirement Pension Plan (ORPP). The initiative was announced in 2014, and ORPP legislation was enacted in 2015. This legislation would have required Ontario employers to enroll their workers in the ORPP and contribute to it unless they offered a “comparable plan.”

In the U.S., states – most notably, California, Connecticut, Illinois, Maryland and Oregon – have responded by setting up retirement programs for their uncovered workers. These programs would impose a mandate on employers without a plan to auto-enroll their employees in an Individual Retirement Account. Employees would be able to opt out.

The U.S. state initiatives are moving ahead, but the ORPP has been put on hold because, in June 2016, Canada’s Ministers of Finance reached an agreement in principle for a major expansion of its wage-related social insurance system – the Canadian Pension Plan (CPP).

Before describing the proposal, a word about the CPP. The CPP covers workers in all Canadian provinces except Québec, which has a similar provincial program. In exchange for mandatory contributions of 9.9 percent of covered earnings, split equally between employers and employees, the program pays pensions, for retirement at age 65, roughly equal to 25 percent of average indexed covered earnings. These pensions supplement the government’s Old Age Security demogrant, which provides a flat payment roughly equal to 15 percent of national average earnings to all long-term Canadian residents age 65 or over.

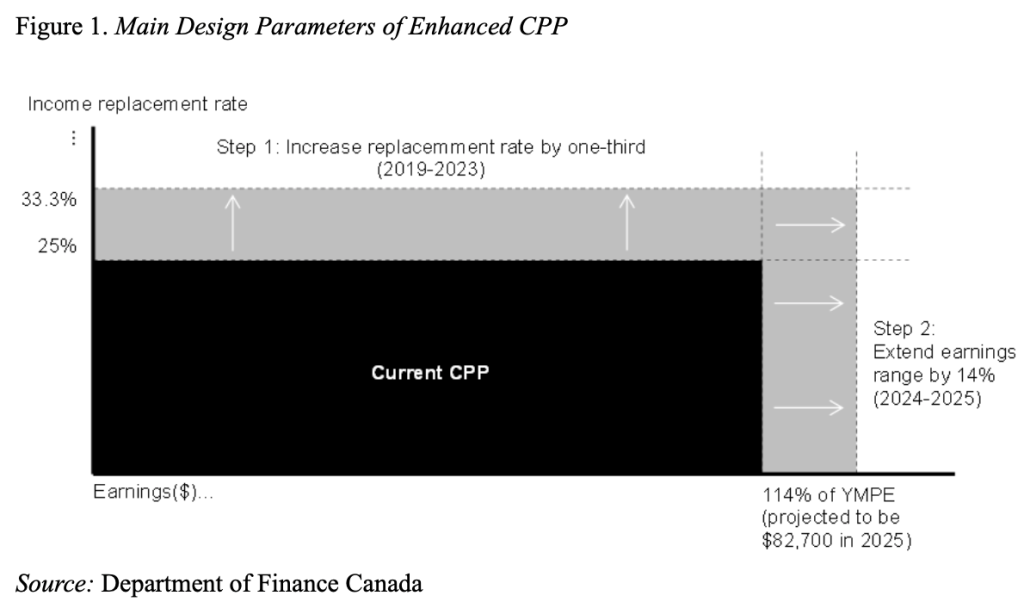

The proposed expansion of the CPP will increase its replacement rate from 25 percent to 33 percent and increase the upper earnings limit to 114 percent of the Yearly Maximum Pensionable Earnings (YMPE), or roughly $82,700 upon full implementation in 2025. The proposed expansion is shown in Figure 1.

To finance the CPP expansion below the YMPE, starting in 2019 the government would raise taxes gradually over a five-year period on earnings below the YMPE. In 2023, the contribution rate is estimated to be 1-percentage point higher for both the employer and employee. Starting in 2024, a separate contribution rate (estimated at 4 percentage points each for the employer and employee) would be imposed on earnings between 100 percent and 114 of the YMPE – that is between $72,500 and $82,700 projected for 2025.

The expansion of the CPP is truly extraordinary and appears to have occurred with little controversy. It is only one of the ways, however, to improve pension coverage. In the U.S., where the Social Security program is considerably larger than the CPP, the more sensible alternative is to require employers to enroll their employees in a retirement plan. This initiative should be undertaken at the federal level and applied uniformly across the country. Absent federal legislation, the U.S. is proceeding on a state-by-state basis. Perhaps, we could learn something from our Canadian friends!!